Submitted by Alexey Yeremenko, PhD, head of Investments and Trading Department in a Luxembourg-based bank

Austrian bonds with maturity in 2017 were placed at sub 1.2% yield to maturity at the time when European swaps market started assigning a significant probability of further rate cuts by the ECB after Mario Draghi’s dovish comments at the ECB forum in Sintra. Dr. Draghi’s main argument was an absence of inflation in Eurozone.

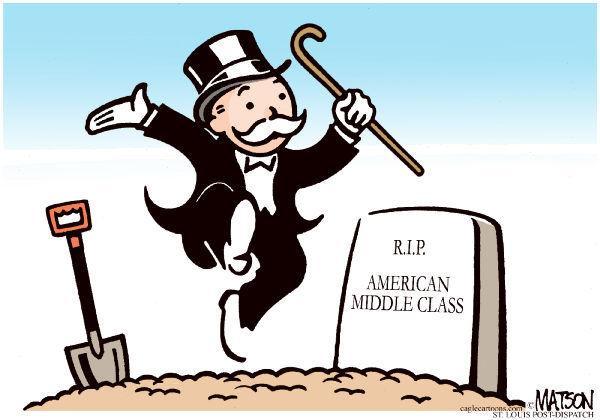

As a consumer living in a Eurozone country, I don’t feel like that inflation is hovering around an official 1% estimate. Fair enough, my consumption basket might be different from the one, which is considered to be an average. Still, there are plenty of people living in the Eurozone that share exactly the same sentiments. Either we are all wrong, or alternatively, the Harmonized Index of Consumer Prices (HICP) reported by the ECB is not an accurate measure of inflation for consumers living in the EU. The biases in estimation of HICP have been well known for a long time. If consumer inflation is indeed not accurately estimated, that might well explain observed social phenomena in some of the larger European economies such as: the yellow vest movement in France, the five star movement in Italy , the rise of German nationalist sentiment, and the conundrum that is Brexit. These actions, which can be ascribed to a feeling of disenchantment of the European middle class, may be indicators of inaccurately estimated consumer inflation.

Why does this happen?

The social tensions are arguably on the rise when living standards are in decline. This situation is not unique to Europe. In America, recently elected congresswoman, Alexandria Ocasio-Cortez, refers to herself as a “Democratic Socialist”, and she enjoys widespread support among Millennials. More than any other generation before them, Millennials are OK with Socialism. Could this be due to the exploding cost of higher education and subsequent indebtedness?

The policy of financial repression employed by the Central Banks has had an effect on Eurozone savers for over a decade. Now, with 20Y German bunds paying 0% and the USD13trillion-bond market at negative yields, we have gone from bad to worse. Pension funds, insurance companies, and banks are being forced to buy negative or zero-yielding assets. Who is going to pay for that? The middle class, obviously. There is a huge redistribution of wealth due to Central Bank policies. Does it come as a big surprise that the 26 richest people on earth in 2018 had the same combined net worth as the poorest half of the world’s population, some 3.8 billion people?

The latest discussions about the virtues of Modern Monetary Policy do not lay the groundwork for much optimism either. I would not argue with the fact that government debt is comparatively easier to manage than private debt given the set of monetary tools at the Central Banks’ disposal. But the whole idea of fiscal policy and Central Bank sovereign debt management as the primary means of achieving full employment sound dubious, albeit theoretically curious, given the reality on the ground.

The very last thing Europe needs is a monetary policy experiment or continuation of an existing policy of financial repression, which lead to an erosion of purchasing power, income inequality, and the rise of populism. It occurred 100 years ago, and people remember how it all ended up. We should do whatever it takes not to end up there again.

via ZeroHedge News https://ift.tt/2XqVVXp Tyler Durden