With Bank of America reporting Q2 earnings this morning, the results of the big-4 are now all out, and the emerging picture is one where declining interest rates and future rate cuts threaten to gut the core revenue stream of the largest US banks to the point where US banks are in danger of being Europeanized.

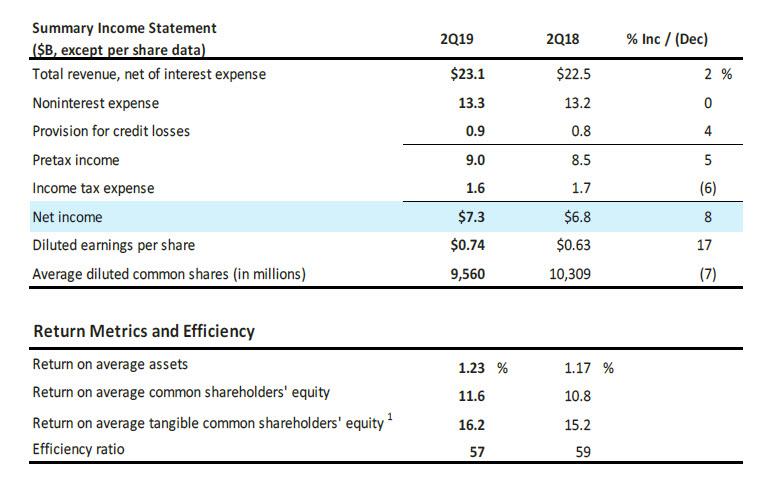

To wit: for Q2, Bank of America reported an 8% increase in net income, which rose to $7.3BN from a year ago, resulting in EPS of $0.74, better than the $0.71 expected even as revenue of $23.1BN, up 2% on the year, came just short of the $23.25 expected. The 8% jump in net income was largely the result of cost-cutting with noninterest expense of $13.3 billion flat on the year, while interest tax expense actually declined by 6% to $1.6 billion, resulting in the net income jump.

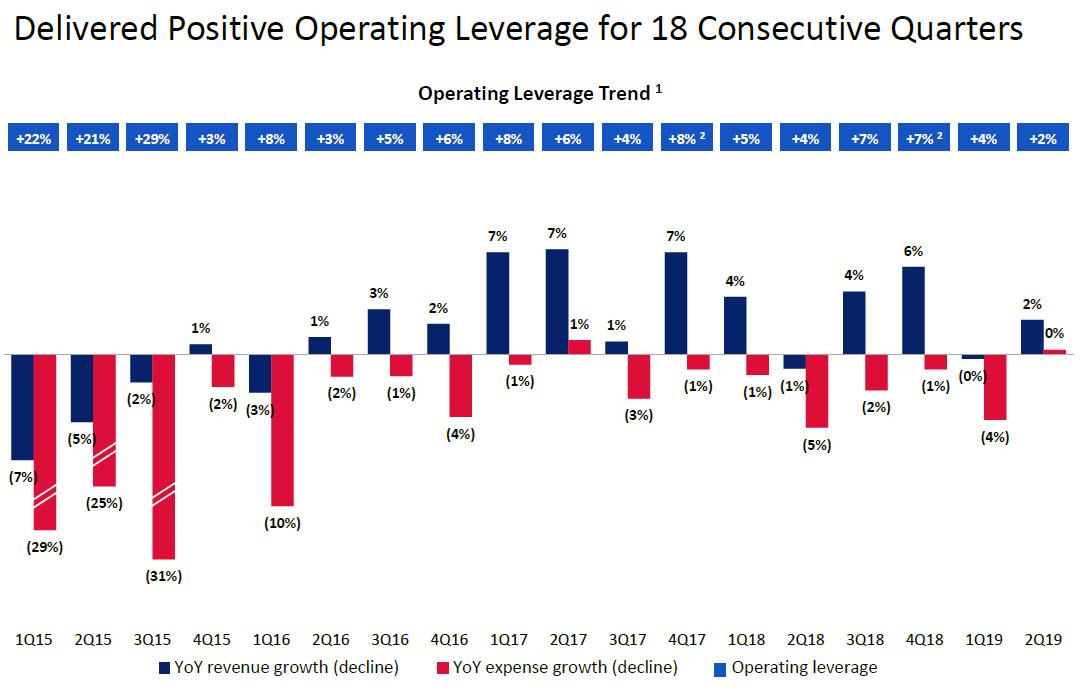

As a result of modest revenue growth and flat or declining expense growth, BofA reported positive operating leverage for the 18th consecutive quarter.

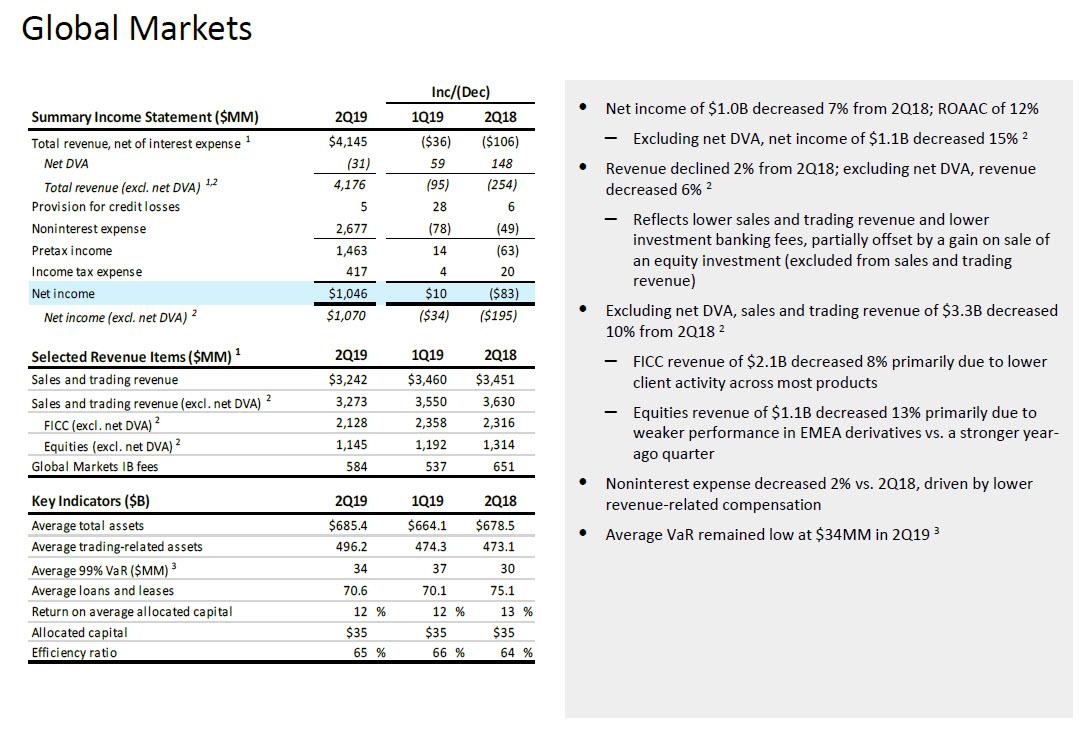

Of course, with investors focused first and foremost on bank trading results, BofA came largely as expected, with 2Q trading revenue excluding DVA $3.27 billion, just above the estimated $3.26 billion, but 10% below last year’s $3.63 billion. The decline “reflects lower sales and trading revenue and lower investment banking fees, partially offset by a gain on sale of an equity investment (excluded from sales and trading revenue).”

Looking at the trading segments, FICC was a small beat while equities were a miss to expectations:

- 2Q FICC trading revenue excluding DVA $2.13 billion vs estimate $2.08 billion, and -7.1% y/y primarily due to lower client activity across most products.

- 2Q equities trading revenue excluding DVA $1.15 billion vs estimate $1.18 billion, and -12% y/y primarily due to weaker performance in EMEA derivatives vs. a stronger year-ago quarter.

At the same time, non-interest expense decreased 2% vs. 2Q18, driven by lower revenue-related compensation, while VaR remained subdued, at just $34 in Q2, down from 37 in Q1.

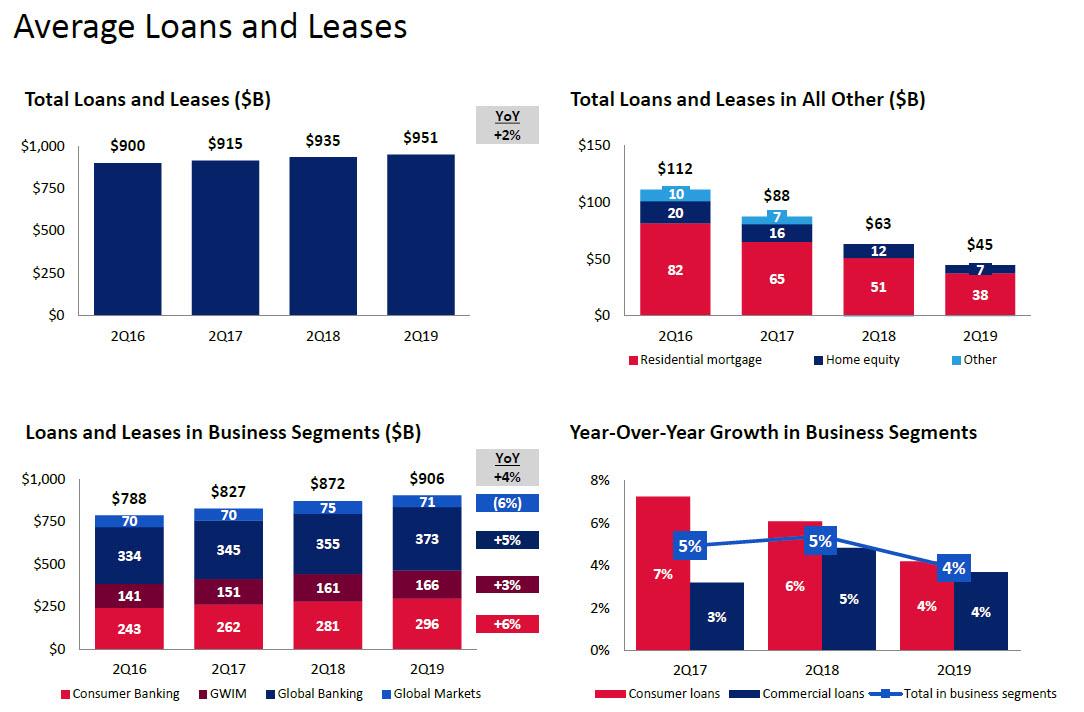

Yet while BofA’s trading division was lackluster for another quarter, similar to most of its peers, it was BofA’s consumer banking group that stood out, and extended its winning streak for another three months. Profits in the retail division helped drive overall profit to a record in the second quarter as loans…

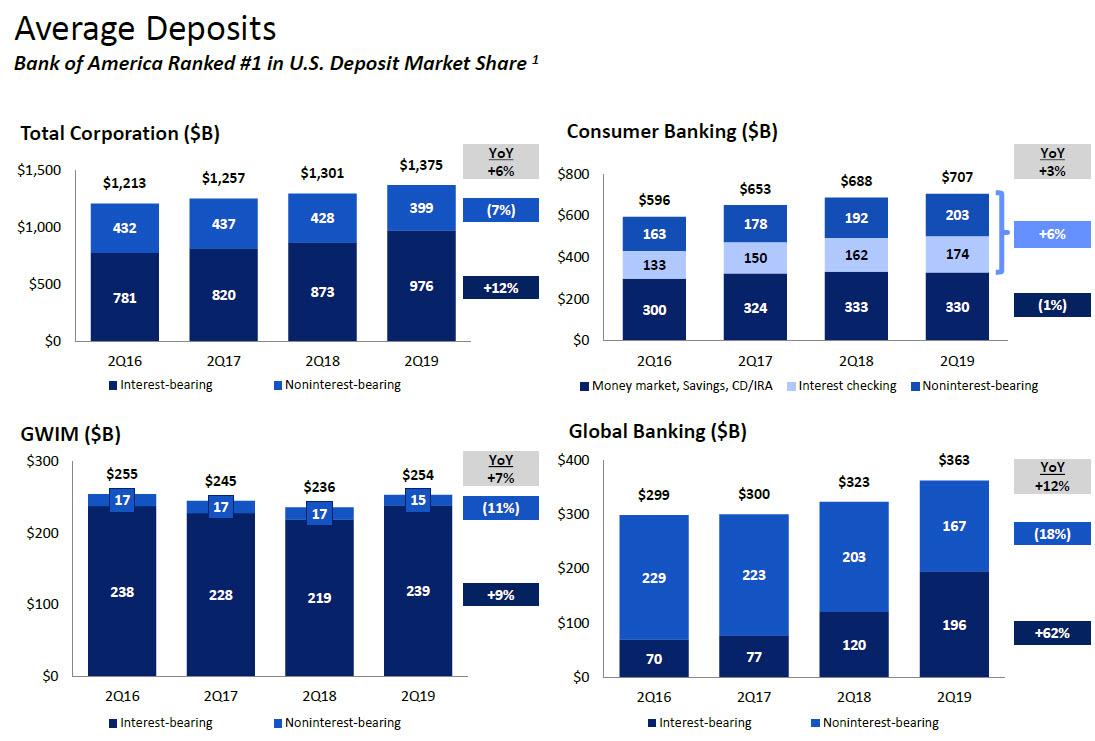

… and deposits grew…

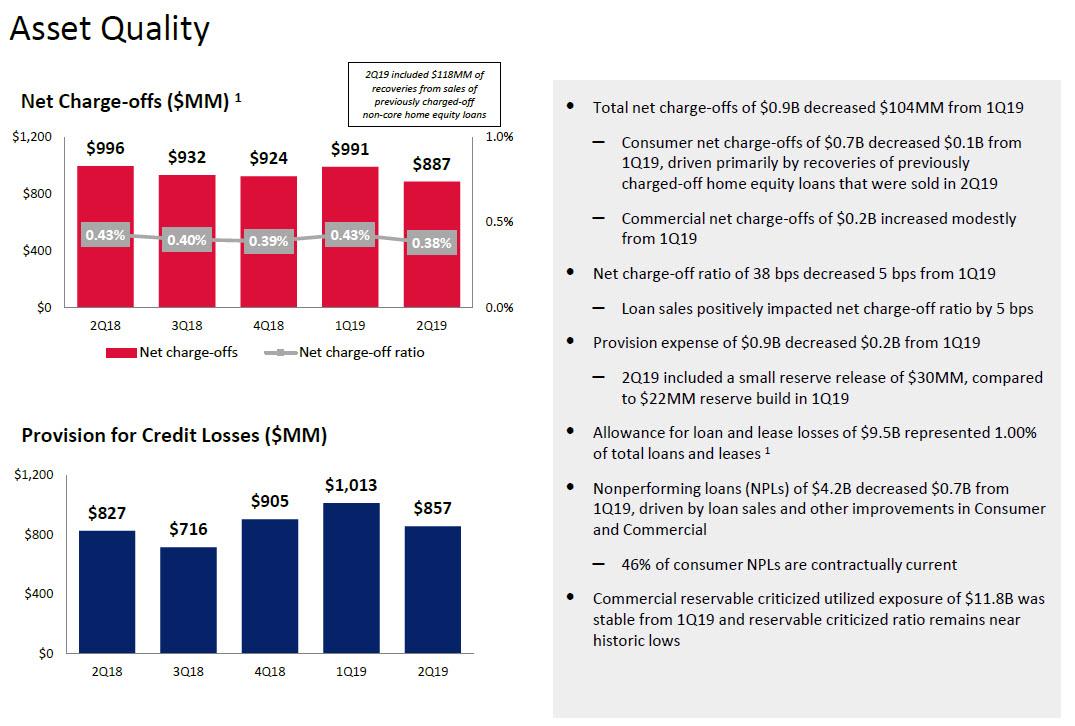

… while mortgage activity jumped even as provisions for bad loans posted a surprise drop from the first quarter as Total net charge-offs of $0.9B decreased $104MM from 1Q19, while the credit loss provision expense of $0.9B decreased $0.2B from 1Q19, and was well below the $1+ billion expected.

Overall consumer banking revenue of $9.7B increased $0.5B, or 5%, from 2Q18, driven primarily by NII, while noninterest expense increased 1% from 2Q18, driven by investments for business growth, including marketing, and higher compensation and benefits expense, largely offset by improved productivity and lower FDIC expense. On the deposit side, average deposits of $707B grew $19B, or 3%, from 2Q18 (53% of deposits in checking accounts; 92% primary accounts) while the average cost of deposits was 1.52%. Meanwhile, average loans and leases of $296B increased $16B, or 6%, from 2Q18, driven by growth in residential mortgages and small business.

“We see solid consumer activity across the board, with spending by Bank of America consumers up 5% this quarter over the second quarter of last year,” Chief Executive Officer Brian Moynihan said Wednesday in a statement.

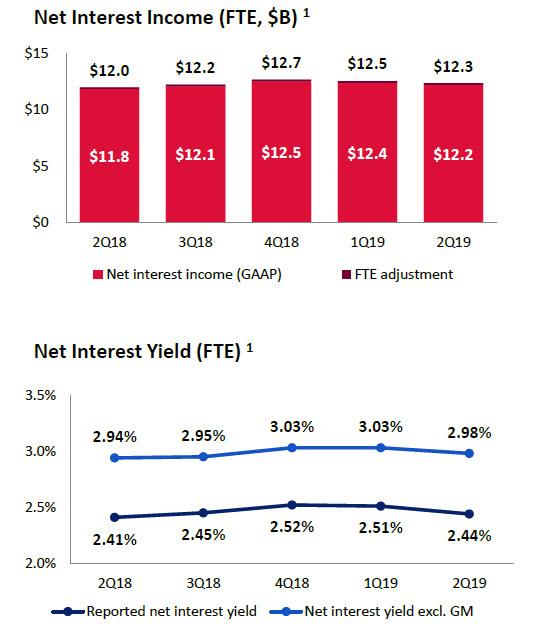

But while investors glossed over both the 10% drop in trading revenue and the record jump in consumer banking revenue, where they punished the bank was for the same reason Wells was hammered yesterday as described in “Wells’ Interest Income Tumbles In Urgent Warning How Fed Will Cripple US Banks” – the bank’s Net Interest Income slumped to $12.2 BN from $12.4 BN in Q1, missing estimates of $12.3 billion as a result of “lower short-term rates (impacting variable-rate assets and improving long-term debt costs), higher bond premium amortization expense driven by lower long-term rates and higher funding costs in Global Markets.”

Demonstrating just how vulnerable big banks are to lower long-term rates, BofA’s Net Interest Maring slumped to 2.44% from 2.51%, missing the lowest sellside estimate

Bank of America’s net interest income – revenue from customers’ loan payments minus what the bank pays depositors — rose 3% to $12.2 billion, compared with the $12.3 billion average estimate in a Bloomberg MODL survey. The bank joined rival lenders including JPMorgan, Wells Fargo & Co. and Citigroup Inc. in reporting sliding net interest margins compared with the previous quarter, with BofA explaining that “asset sensitivity position increased, primarily driven by lower

long-term rates.“

In short, with the Fed set to cut rates, expect much more pain from banks.

Despite the NIM slump, CEO Moynihan remained optimistic on the economy:

“Our view of the economy reflects the activity by the one-in-two American households we serve, which points to a steadily growing economy. We see solid consumer activity across the board, with spending by Bank of America consumers up five percent this quarter over the second quarter of last year.”

Investors were less excited, with the kneejerk reaction to the net interest income miss lower, although the gap is slowly being filled as the BTFDers jump in.

via ZeroHedge News https://ift.tt/2xUcSyU Tyler Durden