You know it’s bad when… even Wall Street’s biggest tech analysts are getting nervous about the market’s lofty levels.

“Risk is increasing in tech, especially with high priced stocks,” warned Toni Sacconaghi, AB Bernstein’s senior technology research analyst, in a note this week, pointing out that tech companies are getting way too expensive as the earnings picture continues to deteriorate.

The tech sector is now trading at 12 year highs, dramatically above the broader market.

As CNBC reports, this rapid multiple expansion, which is the most pronounced this year, has reached a worrisome degree given earnings are expected to have a “startling” decline over the next 12 months, according to Sacconaghi.

“Part of tech’s challenge is that it is comping against a tough 2018. Tech’s earnings lagged the broader market last year, as tax reform more favorably impacted other sectors and expectations for 2020 don’t improve dramatically.”

Earnings for the tech sector are expected to drop by 9.9 percentage points on an equal-weighted basis in the next 12 months, compared with the broad market’s 1.3 percentage points decline, according to Bernstein. The revenue picture is also not uplifting with the group expected to grow just 0.5% while the overall market is set to gain 4.7% in sales, Sacconaghi said.

Additionally, as safe-haven flows surge, U.S. companies are regaining their dominance in the world’s stock markets. As Bloomberg notes, they accounted for about 56% of the total market value of the MSCI All-Country World Index at the end of last week. Their weight in the index, consisting of companies in developed and emerging markets, was the highest since August 2003.

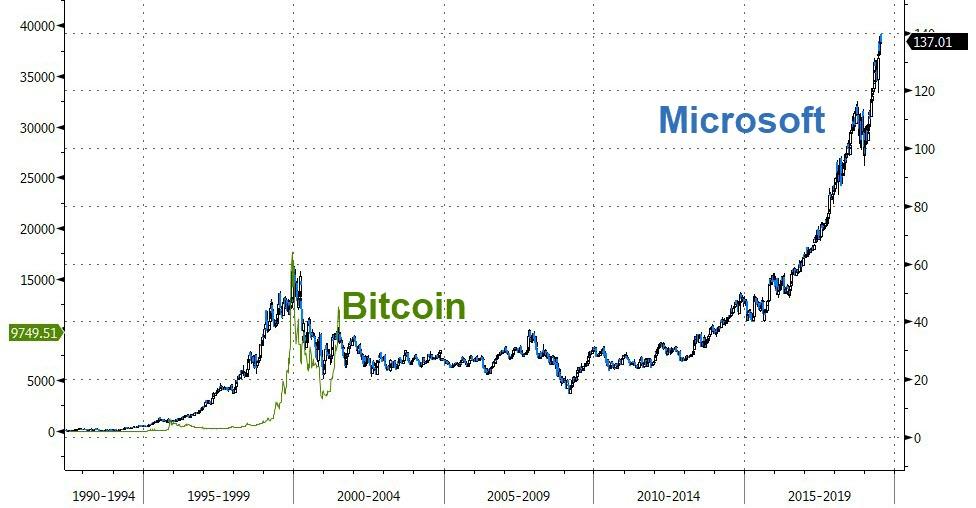

Finally, a reminder, this is not a bubble…

via ZeroHedge News https://ift.tt/30Dm0og Tyler Durden