Is the Netflix juggernaut finally dead?

Back in April, when Netflix reported strong Q1 earnings, what surprised most investors was the company’s unexpectedly weak outflook, predicting a sharp slowdown in subscriber growth, and expecting 5.00 paid subscriber.

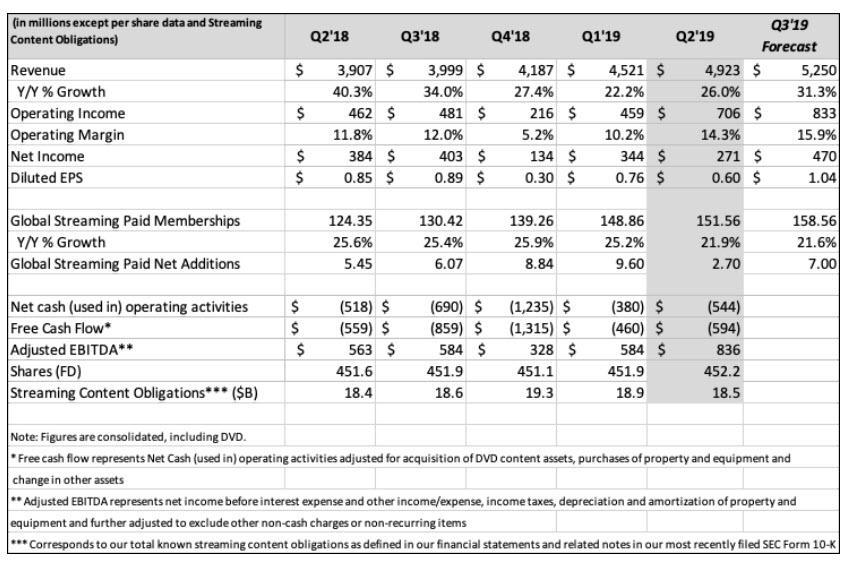

In retrospect, nobody was prepared for just how bad the final number would be, because moments ago while Netflix reported strong top and bottom line results, it was the collapse in Q2 subscriber growth that is the reason why the stock is plunging over 10% after hours, specifically Netflix reported that in Q2 it added a tiny 2.7 million subs, far below the company’s 5.0 million forecast, and well below the Wall Street consensus estimate of 5.06 million.

First the good news: EPS of 60 cents was above the 56 cents expected, with revenue of $4.92 right on top of the expected $4.93 billion. Additionally, the company reported a rather impressive Q1 EBITDA of $836 million, well above the $584MM in Q1. Of course, if that was the extent of it, NFLX stock would be surging. Looking ahead, Netflix reported that Q3 forecast revenue would be $5.250 8BN, a 31.3% increase Y/Y, which is also above the estimate of $5.2BN, a number which would generate EPS of $1.04.

However, the reason why Netflix is tumbling after hours is because just like one and two quarters ago, the growth story is once again in jeopardy as a result of the company’s surprisingly weak subscriber print: to wit, whereas Wall Street expected Q2 subscribers to rise by 5.06 million, Netflix reported just half this number, or 2.70 million, which in addition to a far weaker than expected 2.825mm intl subs, domestic subs actually declined by 126K in Q2 to 60.1 million, a sharp slowdown from the 9.6 million paid net subscribers added in Q1.

Developing

via ZeroHedge News https://ift.tt/2JDdhwH Tyler Durden