Authored by Marc Orsley of PrismFP

- Better data recently begs the question if this is a temporary bounce or a trend change to reflation

- Potential for China stimulus and the dovish global CB pivot to slow the data deterioration

- Despite the better data, FOMC voting members are still talking extremely dovish

- FF/IOER spread widening indicative of why the Fed will cut even if the data firms (don’t fight the Fed)

Since the July 5th Payroll day, the US has seen a mini run of better data. Therefore, the question du jour has become: is this another temporary blip up in the data (like we saw in January and May) inside the larger downtrend of data deterioration, or is there truly a real turn in the data developing?

The first thing to note is that after more than a year of the US data disappointing; economic surprise indices have entered the zone where the index tends to mean revert.

That’s not to say the data can’t still be weak. It’s just economist, who tend to be overly optimistic and playing from behind, catch up to the narrative that the data trend is lower and thus they downgrade all their forecast and voilà; surprise indices bounce.

In order to identify if the better data is a blip or a reversal, there needs to be a catalyst. Let’s identify a few major potential catalyst to a data pivot and assess if it can drive a reversal:

1) US/China Trade Wars – since the G20 “truce” that in reality yielded no progress, the news flow has worsened. To name a few…

- The Chinese insertion of Zhong Shan (considered a hawk) into the negotiating team suggests China is taking a harder line

- China now denying making any explicit commitment to buy more US agricultural products as the administration has previously said China would

- US officials pushing for sanctions on China over oil purchases from Iran

- AFL-CIO labor union threatening to end their support for Trump if he takes a softer stance

Bottom line – there is no progress to speak of and the two sides seem to be digging in. Therefore, considering trade wars have been a major cause of the data deterioration, this is will only lead to continued weakness not a reversal. Throw trade wars out as a catalyst for a data reversal for now.

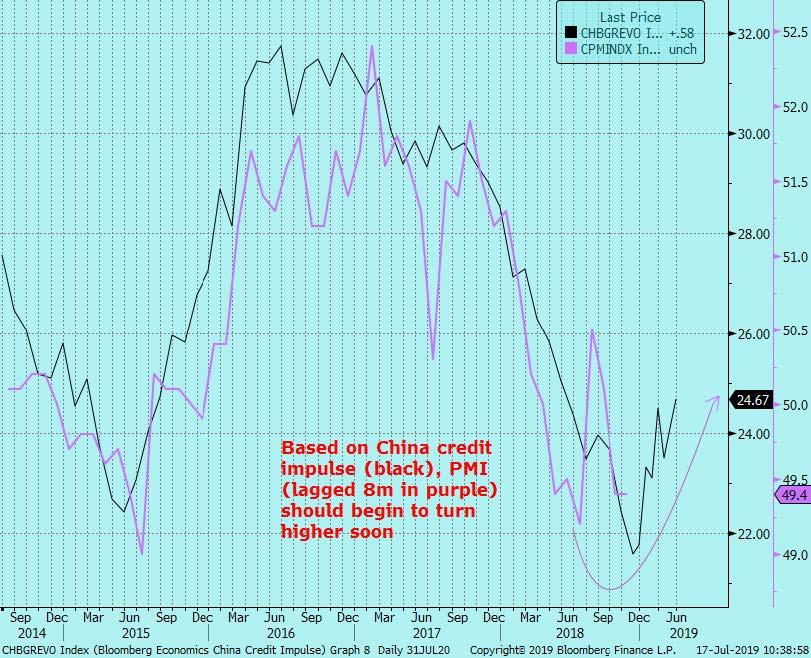

2) China stimulus – since Q4 2018, China has instituted something like 88 incremental stimulus measures and there is always a multi month lag between the stimulus and the economic data. Here is an easy way to show the effects of stimulus to the data….

Additionally, on the liquidity front, the PBoC yesterday began injecting liquidity via 7-day reverse repos for the first time in 16 sessions. Over the past two days, the PBoC has injected CNY260b. That is a trend change.

Bottom line – it is entirely possible the 88 incremental stimulus measures is beginning to feed into the economic data and the renewed liquidity injections will also aid the economy. This bears watching.

3) The global Central Bank dovish pivot – We already know the PBoC, Fed, ECB, and BOJ have turned dovish out of the major central banks, and after last week we can add the BoC to the list as Poloz indicated the markets “aren’t factoring in the complexity of trade wars.” While not moving to an easing bias quite yet, the BoC has moved away from its tightening bias.

Only the Norges bank remains the lone G10 stand out towards hiking but even they could pivot shortly given the CPI “miss” last week.

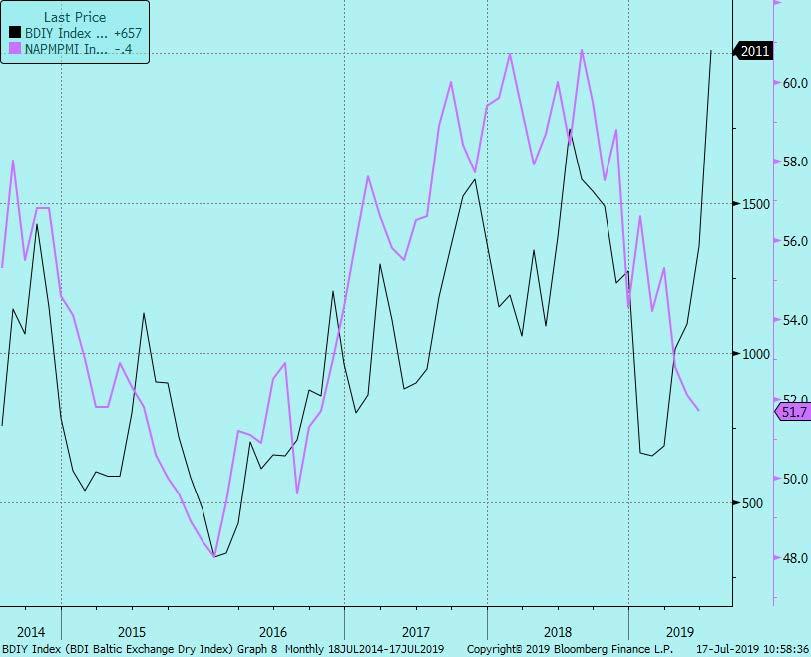

The Baltic Dry has long been thought of as a read through to global growth (note: I have never been able to validate this but the market talks about it so let’s highlight it). Perhaps the global dovish pivot has started to feed through into better activity that could lead to a bounce in the sagging PMI’s.

Bottom line – with almost all CB’s moving to a dovish bias it will, at the very least, help stabilize the economic data/slow the rate of change of the deterioration.

Putting all that together, there is some scope for China stimulus and dovish central banks to slow the data deterioration theme we have spoken about for months now. However as long as trade wars languish, it will be very difficult to see a major reflationary turn.

* * *

The better data does not mean the Fed will not still cut rates. With good data in hand, we have received that confirmation from voting members of the FOMC in the past few days:

1) Chair Powell – continuing his staggering dovish comments:

“Sees June Core PCE running 1.7% YTD” (so still below their mandate and talking down the stronger CPI data last week)

- “Factors holding down the neutral rate is likely to persist” (this suggest more than an insurance cut)

- “We must continue to assess additional policy strategies (so AIT and YCC?)

2) Evans – along with Bullard signals there is at least 50bps of cuts coming:

- “Says he forecasts 50bps of accommodation to lift inflation”

- “Fed may need more than 50bps of cuts in cumulative easing” (that doesn’t sound like a one-time insurance cut)

3) The other FOMC voting members’ comments I showed in Friday’s note from Williams, Clarida, Brainard, and the FOMC minutes that all showed they will cut despite better payroll and CPI data.

- Please note the Fed’s preferred inflation gauge is Core PCE not the headline CPI data (Powell confirmed this yesterday)

- NFP was likely overstated by the rising number of people who are taking on two jobs – that gets double counted in NFP and is overall not a bullish read on the economy

As you can see above, the FOMC is highly likely to deliver 50bps before the year is out and there is scope for more.

There are other reasons besides weakening data why the Fed will cut. To repeat what I said in Friday’s note:

“You may disagree with my data deterioration theme which gives the Fed reasons to cut, but do not miss this important point why the Fed will cut:

- Rising deficits which causes increase treasury supply at a time when foreigners are losing their appetite to fund the US govt (as noted above in the bond auction) means the Fed needs to talk dovish/cut rates/provide accommodation/inject liquidity in order to keep yields from rising. We saw what happens when front end yields like 1y1y rise above 3% as it did in Q3 2018; the system breaks.”

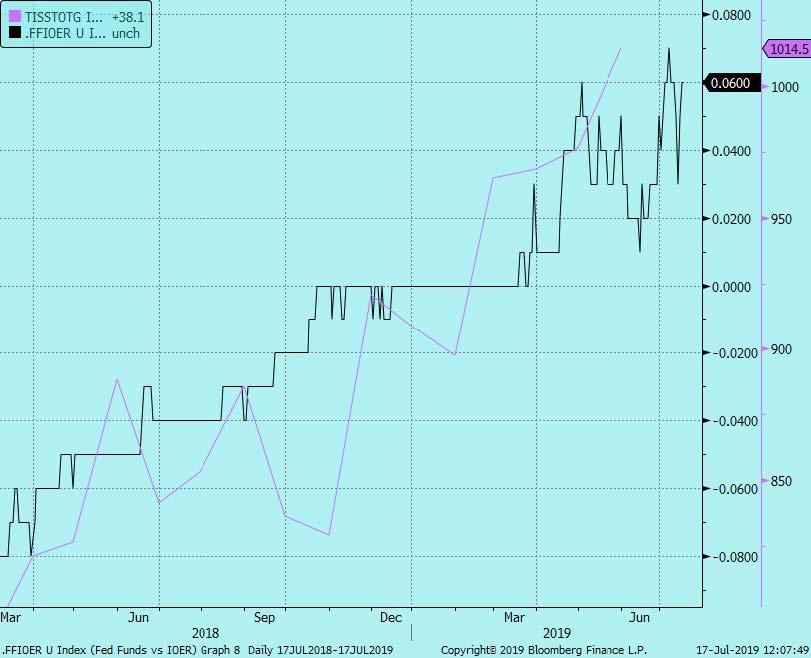

The Fed Fund (FF)/Interest on Excess Reserve (IOER) spread is the clearest indication that the Fed will have to cut even if the data is turning better. It is the symbolic representation that debt levels are too high to have rising rates.

To recap what is pushing FF over IOER:

1) Deficits are increasing and projected to increase more

2) Increased deficits mean increased Treasury supply to fund the deficit (see chart in point #4)

3) Decreasing foreign demand in UST’s means domestic demand is needed to take down the supply

4) That need for domestic demand is causing repo rates to increase and reserves to shrink. Rising repo rates are taking FF higher it and above IOER:

Therefore, there are only a few ways to stop Fed Funds from rising (since cutting IOER did not help):

- To my point above, the Fed will cut the Fed Fund rate (to the chagrin of those that think the data is strong)

- The government will have to cut the deficit (as Powell stated in his testimony to Congress last week, but unlikely any time soon)

- The Fed will have to institute a standing repo facility (as stated in the Minutes, it is being considered but it is complicated)

Therefore, even if you think the data is not weak enough to warrant Fed cuts, the Fed has to cut to control Fed Effective. You simply cannot have rising yields any more.

What do I mean by you can’t have rising yields? Just look at how S&P’s traded yesterday after the US received its strong retail sales report and fixed income sold off. The 5yr note future made its lows at 9am EST and by 11am, S&P’s were breaking down.

As we saw in December, you can’t have S&P’s falling off a cliff or the whole economy goes with it and that puts the massive credit market also at risk. Therefore……the Fed has to act to compress yields which means whether this is a reversal of the data or not, the Fed will cut rates.

via ZeroHedge News https://ift.tt/2xUMMfe Tyler Durden