Global stocks stumbled early in the session in the aftermath of the dismal Netflix earnings which saw the first drop in US subs following the company’s price hike (suggesting US consumers are far less price inelastic than many had suspected), and following a bevy of European earnings misses, but then staged a sharp rebound after a Bloomberg report that the ECB was seeking to imitate the Fed and was potential revamp of their inflation goal.

The news, which suggested that the ECB was set to ease even more than the market had priced in, slammed the EUR, sending the EURUSD to session lows just above 1.12…

… while Europe’s Stoxx 600 erased a drop of as much as 0.7%, trading little changed, with defensive sectors including health-care and utility shares among the best performers and tech shares remain biggest losers. The rebound was strongest in the export-heavy DAX, which sharply pared losses, narrowing its loss to 0.5% from as much as 1.4%.

According to Bloomberg, similar to the Fed’s own “symmetric” approach to inflation, the ECB was studying a potential revamp of its inflation goal, in a move that could “embolden policy makers to pursue monetary stimulus for longer. ” As the report noted, the staff are informally analyzing the institution’s policy approach, including the question of whether the current target of consumer-price growth “below, but close to, 2%” is still appropriate for the post-crisis era, which is ironic: after all, the ECB has been unable to hit 2% for years, and now the implication hopes to hit 3%

President Mario Draghi favors a “symmetrical” approach, meaning flexibility to be either above or below a specific 2% goal, the officials said, asking not to be identified as the work so far is confidential and preliminary. That would allow the ECB to keep inflation elevated for a while after a period of weakness to ensure price growth is entrenched.

Governing Council members were given a presentation last week on symmetrical approaches to the current target. Changing the goal itself would probably require a formal review, the officials said. An ECB spokesman declined to comment.

The ECB “trial balloon” promptly papered over several big earnings misses in Europe, most notably after SAP, Europe’s most valuable tech stock by market cap, reported poor results, with U.K. fashion retailer Asos and Nordea Bank also reporting poor earnings.

“We’re in a trade war, you’re seeing the impact on corporate earnings, you’re seeing the central banks forced to scramble to react to that,” Bob Michele, CIO of JPMorgan Asset Management told Bloomberg TV.

The weak start to the Q2 earnings season may spill over into the outlook for the remainder of the year, threatening equity markets’ stellar rally this year. “We are probably in the middle of analysts downgrading Q3 company earnings expectations,” said Sunil Krishnan, head of multi-asset funds at Aviva Investors.

Europe’s latest monetary boost – which is certain to infuriate Trump as it is another indication of just how the ECB manipulate the common currency by jawboning also helped push US futures off session lows and back to unchanged, despite yesterday’s shock report from Netflix which slammed the Nasdaq and pushed tech stocks sharply lower at least until Draghi’s verbal intervention.

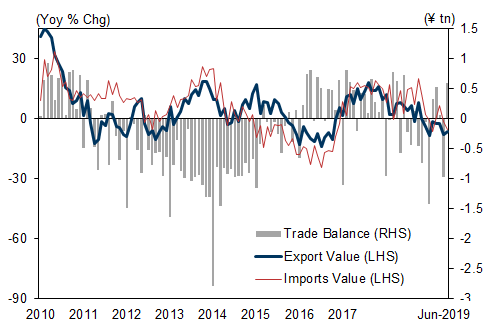

Earlier in the session, Asian stocks dropped for a third day, led by industrial and energy firms, as investors assessed trade tensions and the increasingly gloomy Q2 earnings season. Most markets in the region were down, with Japan and China leading declines. The Topix closed 2.1% lower, dragged by electronics makers and chemical firms, as Japanese exports fell for a seventh month, slumping 6.7% in June, while manufacturers’ confidence fell to a three-year low in July on the back of the trade tensions and slowing China growth.

Canon dropped 4% following a Nikkei report that the company may cut its profit outlook. The Shanghai Composite Index fell 1%, with Kweichow Moutai and PetroChina among the biggest drags. The liquor giant declined 1.7% after reporting its slowest first-half revenue growth since 2016. India’s Sensex retreated 0.4%, driven by Reliance Industries and Tata Consultancy Services. Yes Bank tumbled as much as 20% after the lender’s profit missed estimates amid rising bad loans.

In global macro, with less than two weeks before the Fed’s policy meeting at which investors expect an interest-rate cut, the central bank’s anecdotal Beige Book report yesterday suggested the outlook was far better than it was in April and the labor market remains tight, even as companies are still struggling to pass on higher wages and tariff-related costs to customers, keeping inflation subdued, and the start of earnings season hasn’t improved sentiment.

Additionally, after Korea’s recent GDP shock…

… investors betting on rate cuts by the BOK were proven right on Thursday, as central banks in South Korea and Indonesia lowered benchmarks. Ironically, both countries’ currencies strengthened modestly and the Kospi slumped, suggesting the move was seen as a “policy error” by the market. That’s after similar moves by central banks in Malaysia, India and the Philippines.

Meanwhile, trade war sentiment worsened overnight after a WSJ report that progress toward a U.S.-China trade deal has stalled as the Trump administration works out how to address Beijing’s demands that it ease restrictions on Huawei Technologies.

“It’s still about the U.S. and China dispute,” Christophe Barraud, chief economist and strategist at Market Securities. “The trade war is creating uncertainty, weighed on capex, and clearly on trade flows. There are also problems with guidance, especially in the transportation sector. The fact is that one of the key stories of this year is global trade flows contraction,” he said.

In rates, Eurozone government bond yields slipped back toward record lows on Thursday as economic indicators and corporate earnings deepened gloom on the global economy and increased bets on interest-rate cuts by major central banks. 10Y Treasury yields moved within 1bp of 2.045%.

In FX, the euro was the big mover, sliding sharply lower just after 6am when the ECB inflation revamp report hit; the yen initially strengthened amid reports of fresh trade tensions between Japan and South Korea however it later gave up all gains thanks to the plunge in the Euro; Sterling was a shade higher at $1.244, off its lowest since April 2017 touched on Wednesday amid growing risks of Britain leaving the European Union in a no-deal Brexit. After trading lower, the dollar also spiked thanks to the plunge in the euro.

Oil prices were mixed, with WTI modestly lower after data showed U.S. stockpiles of gasoline and other products rising sharply last week, suggesting weak demand. Brent futures were up 6 cents, or 0.1%, at $63.71 a barrel.

Expected data include jobless claims and the Leading Index. Blackstone, Danaher, Honeywell, Morgan Stanley, Philip Morris, and Microsoft are among companies reporting earnings.

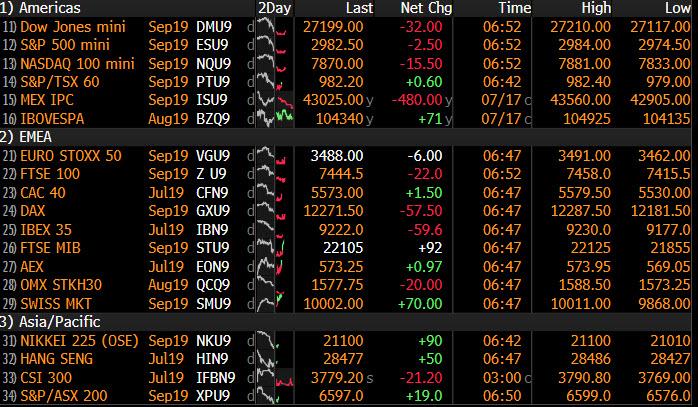

Market Snapshot

- S&P 500 futures down 0.1% to 2,981.75

- STOXX Europe 600 down 0.5% to 385.64

- MXAP down 0.8% to 159.11

- MXAPJ down 0.3% to 526.13

- Nikkei down 2% to 21,046.24

- Topix down 2.1% to 1,534.27

- Hang Seng Index down 0.5% to 28,461.66

- Shanghai Composite down 1% to 2,901.18

- Sensex down 0.4% to 39,042.90

- Australia S&P/ASX 200 down 0.4% to 6,649.12

- Kospi down 0.3% to 2,066.55

- German 10Y yield fell 1.2 bps to -0.302%

- Euro up 0.1% to $1.1238

- Italian 10Y yield fell 1.7 bps to 1.242%

- Spanish 10Y yield fell 1.8 bps to 0.429%

- Brent futures up 0.4% to $63.91/bbl

- Gold spot down 0.4% to $1,420.66

- U.S. Dollar Index down 0.2% to 97.08

Top Headline News

- Slow progress on key initial demands from Presidents Donald Trump and Xi Jinping is raising doubts about whether the U.S. and China will actually return to the negotiating table to overcome their much deeper differences. Reaching a comprehensive trade deal as Trump gears up for re-election next year increasingly seems like a remote possibility, according to people familiar with the matter, who spoke on the condition of anonymity

- Group of Seven finance officials meeting near Paris confronted an outlook of slowing growth that has already prompted monetary authorities to shift stance and prepare for stimulus

- Iran is capable of shutting the Strait of Hormuz — a crucial choke-point for oil flows — but doesn’t want to do it, the country’s foreign minister said

- U.K. lawmakers are gearing up for a knife-edge vote on a measure to prevent the next prime minister suspending Parliament to pursue a no-deal Brexit. As pro-EU ministers weigh up how they will vote, the government’s fiscal watchdog published new forecasts of the economic damage a chaotic exit would bring

- Boris Johnson, the favorite to succeed Theresa May as British prime minister, said a trade deal won’t be reached with the U.S. soon after Brexit, predicting discussions will be “tough” and “robust”

Asian equity markets traded negatively as the risk-averse tone rolled over from Wall St where all major indices declined for a 2nd consecutive day amid mixed earnings, in which the S&P 500 gave back the 3k level and with futures pressured after-market following disappointing Netflix results which missed on revenue, as well as global subscriber growth and posted its first ever decline in net US subscribers. ASX 200 (-0.4%) and Nikkei 225 (-2.0%) were lower in which the energy sector led the declines in Australia after further pressure in oil prices and reduced quarterly revenue from Santos and Woodside Petroleum, while the Japanese benchmark underperformed from a double whammy of a stronger currency and wider than expected decline in Exports. Hang Seng (-0.5%) and Shanghai Comp. (-1.0%) were dragged lower by weakness in the blue-chip oil names and amid ongoing trade uncertainty with US-China talks said to have stalled as the Trump administration determines how to respond to Beijing’s demands of easing restrictions on Huawei. Finally, 10yr JGBs were higher as they tracked the upside in T-notes with prices underpinned by safe-haven demand and following a continued decline in exports.

Top Asian News

- Japan LNG Imports Hit Post-Fukushima Low as Reactors Restart

- China Investor Beating 98% of Peers Bets on Hong Kong Stocks

- SoftBank’s Son Shines a Spotlight on His Vision Fund Proteges

- Indonesia Pledges More Rate Cuts as It Moves to Spur Growth

Major European bourses are now mixed after the region pared opening losses [Eurostoxx 50 -0.2%] amid reports ECB staff are looking at a revision to the inflation target.. Sectors are mixed with heavy underperformance in the IT sector (-1.4%) as EU’s largest tech stock SAP (-6.0%) posted disappointing earnings in which all major metrics, including cloud revenue, fell short of estimates. Furthermore, the IT sector could also be feeling some pressure amid comments from TSMC post-earnings as the chip-giant expects a global semiconductor contraction this year. On the flip side, healthcare names (+1.5%) outperform as pharma heavyweight Novartis (+5.0%) rose to the top of the Stoxx 600 amid guidance upgrades in which FY 19 operating guidance was raised to “double digits to mid-teens” from “high single digits” and net sales guidance is now expected to be in the “mid to high single digits” compared to a prior view of “mid-single digits”. Subsequently, shares in Roche (+1.3%) moved higher in tandem and thus Switzerland’s SMI (+0.9%) outperforms vs. its EU peers. In terms of individual movers, Germany’s Hochtief (-9.8%) fell to the foot of the pan-European index as its Asia-Pac division reported a decline in revenues, whilst easyJet (+4.8%) and Ubisoft shares are supported on the back of earnings. Looking ahead, British American Tobacco (+3.9%) and Imperial Brands (+1.2%) are awaiting numbers from US competitor Philip Morris.

Top European News

- U.K. Retail Sales Unexpectedly Jump, Reversing Two-Month Drop

- Nordea Sinks After Signaling It Will Cut Shareholder Rewards

- Vodafone Wins Conditional EU Approval for Liberty Global Deal

- Deutsche Bank Considers Subletting Zig Zag Offices in London

In FX, the Pound had already extended its rebound from midweek lows (and a fresh sub-1.2400 ytd trough vs the Usd) on a combination of positive sounding EU remarks about the Irish backstop, technical buying and short covering, but got an additional boost via UK retail sales data that confounded expectations for a 3rd consecutive monthly decline in consumption. For the record, the ONS reported a 1% rise in sales vs consensus for a 0.3% fall on the back of non-food items and 2nd hand goods, and Cable climbed towards 1.2500 in response, while Eur/Gbp retreated further from circa 0.9050 at one stage on Wednesday to 0.9000 before Sterling momentum waned somewhat ahead of a vote in Parliament on a bill to prevent its suspension and force through no Brexit deal.

- AUD/NZD – The Aussie is the current G10 outperformer, and also partly due to bullish macro news, albeit not quite so apparent from the headline Aussie payrolls tally released overnight. However, internals were encouraging as permanent placements rose 21.1k (vs +10k forecast for full and part-time jobs combined) and underemployment eased. Aud/Usd subsequently reclaimed the 0.7000 handle and is back above the 100 DMA (0.7018) eyeing this week’s prior high just shy of 0.7050, but still below 1.0450 against the Kiwi that is benefiting from ongoing Greenback weakness. Indeed, Nzd/Usd is holding firm within a 0.6730-46 range as the DXY only just keeps its head above 97.000 following yesterday’s US housing data misses.

- JPY/CHF/EUR – The Yen and Franc are back in demand on safe-haven grounds as US-China trade angst intensifies after the latest stall in negotiations on Huawei concessions, with Usd/Jpy down through 108.00 and seemingly capped ahead of more decent option expiries at or above the big figure (1.5 bn up to 108.15 and 1 bn from 108.30 to 108.50). Similarly, Usd/Chf has pulled back from around 0.9900 and Eur/Chf is under 1.1100 even though the single currency remains heavy on attempts to clear 1.1250 vs the Dollar and embroiled in tightly stacked expiries. Indeed, some 7 bn roll off between 1.1190 and 1.1275, as Eur/Usd breaks below a tight range to retest 1.1200 amidst reports that the ECB staff are looking at a revision to the inflation target.

- EM – The Rand is also in a bind vs the Buck, with Usd/Zar straddling 14.0000 ahead of the SARB policy verdict that is expected to deliver a 25 bp cut in line with BoK and BI moves in the run up.

In commodities, WTI and Brent futures are marginally firmer following yesterday’s decline in the complex with prices currently above 57/bbl and 64/bbl respectively. Comments from Iranian Revolutionary Guard aided the benchmarks climb over the round figures, which stated they have stopped a foreign oil tanker in Lark Island in the Gulf. On the OPEC+ front, Russia’s Energy Minister acknowledged that Russian production will be increased to levels agreed in the accord. Meanwhile, gold prices are marginally softer and little influenced by the declining Buck as investors lock in profits following the yellow metal’s recent surge. Elsewhere, copper prices are little changed above the 2.7/lb whilst Dalian iron ore continued to decline as market participants reassess the base metal’s outlook given the rising shipments to China from Australia coupled with the Dalian Commodity Exchange’s higher transaction fees in all iron ore futures contracts.

US Event Calendar

- 8:30am: Philadelphia Fed Business Outlook, est. 5, prior 0.3

- 8:30am: Initial Jobless Claims, est. 215,500, prior 209,000; Continuing Claims, est. 1.7m, prior 1.72m

- 9:30am: Fed’s Bostic Speaks to Clarksville Chamber in Tennessee

- 9:45am: Bloomberg Consumer Comfort, prior 63.8;

- 10am: Leading Index, est. 0.1%, prior 0.0%

- 2:15pm: Fed’s Williams Speaks on Monetary Policy

DB’s Jim Reid concludes the overnight wrap

Whether it’s investors waiting on the sidelines for the FOMC meeting in under two weeks, a reluctance to break past recent record highs, or just a general lack of newsflow to get excited about, risk assets are certainly lacking a bit of inspiration at the moment. The S&P 500 closed down -0.65% last night and below the 3k level again while there were similar declines for the DOW (-0.42%) and NASDAQ (-0.46%).

Earnings were the main focus with a big slide for freight transport operator CSX (-10.27%) front and centre. That was the biggest decline since 2008 after the company forecast weaker sales for 2019 with the company CEO calling the present economic backdrop “one of the most puzzling I have experienced in my career”. On aggregate yesterday though earnings were still better than expected and the same can be said for Bank of America which gained +0.93% on the back of gains in the retail division. That offset declines in trading revenue – a similar trend to the other US banks that have reported so far.

Late last night we also got results from some of the high profile tech names, with IBM and eBay both beating estimates. However the big move came for Netflix which dropped as much as -13% in late trading after its report revealed that the company had lost 130k US-based subscribers, most likely as a result of recent price hikes. Competition in the streaming sector is heating up, with Disney and Apple set to launch their own services later this year, followed by Comcast and AT&T next year. S&P 500 and NASDAQ futures are down -0.23% and -0.46%, respectively, this morning.

On a related note, yesterday we published a US credit strategy note looking ahead to earnings season and highlighting the USD BBB- potential fallen angels names to look out for. A couple of stats that stood out include there being $768bn of BBB- bonds which are 1-3 downgrade notches away from HY and of that, $144bn of bonds where the number of notches of downgrade required is less than or equal to the number of rating agencies that have a negative watch or outlook. That’s 19% of the BBB- universe. See the link here for the full report .

Back to markets, where the risk off moves led to a decent bid for bond markets with 10y Treasuries finishing -5.7bps lower in yield and the 2s10s curve flattening -2.1bps. The Fed released its beige book of anecdotal economic commentary, which showed broadly steady growth over the last several weeks. The labour market continued to improve, albeit at a slower pace, and price inflation moderated. Separately, Kansas City Fed President George, considered the most hawkish member of the committee, gave a somewhat surprisingly dovish speech. She emphasized demographic trends and noted that the natural rate of unemployment may be lower than thought, which would make rate cuts less risky from an inflation standpoint. Treasuries continued their rally throughout the Fedspeak. Speaking of safe havens doing well, Gold (+1.45%) tested the recent highs again yesterday while Silver jumped +2.63% for the biggest daily gain since January.

This morning in Asia equity markets are trading lower, with the Nikkei (-1.60%) leading the declines as data overnight showed Japanese exports fell -6.7% yoy (vs. -5.4% expected), the seventh consecutive monthly fall. A report in the Nikkei suggesting that Canon is expected to profit warn next week is also doing some damage. In Korea the equity moves are smaller however, with the Kospi down -0.33% after the central bank unexpectedly cut interest rates by 25bps overnight to 1.5%, the first rate cut since 2016. The Bank of Korea also cut their growth forecast for the country to +2.2% this year, down from +2.5% previously. Following the decision, the Korean won has actually strengthened against other major currencies this morning, and is currently +0.31% against the US dollar. Elsewhere, the Hang Seng (-0.46%) and the Shanghai Comp (-0.65%) are also lower.

Also worth flagging are a couple of trade stories out overnight in the WSJ and SCMP which are perhaps adding to the slightly damper mood in markets. The suggestion from both are that US-China trade talks have stalled or are stalling and that China appears less willing to compromise. The WSJ story in particular suggests that China is waiting to see what the US does on Huawei before making any commitments.

Moving on. In Europe yesterday it was also a decent for bond markets where 10y Bunds rallied -4.5bps to close at -0.294% despite euro area core inflation getting revised 7bps higher to 1.12% yoy and the headline index revised up 0.1pp to 1.3%. Elsewhere, the STOXX 600 faded to close -0.37% after the US session kicked into gear, with the auto sector (-1.45%) lagging. Euro area new car registrations fell -7.8% yoy, for the worst June since 2015. Other cyclical sectors fared poorly as well, including a -1.74% drop for European Banks and -2.07% fall by the oil and gas sector. The latter was catching up to Tuesday evening’s descent in oil prices. That was compounded by a further -1.07% decline in crude yesterday, after US data showed a smaller-than-expected drawdown in stockpiles.

Before turning to the remainder of yesterday’s economic data, it’s worth highlighting updated forecasts from our US econ team. They still expect the Fed to cut rates three times this year, by 25bps each, and the see core PCE inflation staying below-target at 1.8% by the end of the year. The only major change to the forecast is slightly higher growth due to the recent firming in consumer spending, as our team now sees Q2 growth 0.3pp higher at 1.8%, taking the full year forecast up 0.1pp to 2.0% Q4/Q4.

Finally, yesterday’s economic data in the US including the latest housing numbers and which were fairly underwhelming. Housing starts fell -0.9% mom in June (vs. -0.7% expected) while permits plummeted -6.1% mom (vs. +0.1% expected), although the latter does tend to be quite volatile. In the UK there were no surprises in the June inflation numbers. Core CPI rose one-tenth to +1.8% yoy as expected while headline CPI was unchanged at +2.0% yoy, also as expected.

To the day ahead now, which this morning includes the June retail sales report in the UK, before US data releases include jobless claims, July Philly Fed business outlook and June leading index. Away from that it’s the turn of the Fed’s Bostic and Williams to speak this afternoon and this evening, respectively, while the last of the big US banks in Morgan Stanley is due to report earnings. Microsoft is the other notable company reporting.

via ZeroHedge News https://ift.tt/30CxcBj Tyler Durden