The good news: Morgan Stanley does not have the balance sheet to engage in net interest income, unlike its big bank peers, so it could not report a decline in Net Interest Margin, which was enough to hit the stocks of Citi JPM and BofA.

The bad news: Morgan Stanley is very much reliant on institutional flow and trading, and it was here that the bank report sharp revenue declines, similar to Goldman, although unlike Goldman, Morgan Stanley did not have a hyperactive prop trading (investing and lending) group to offset the decline in flow.

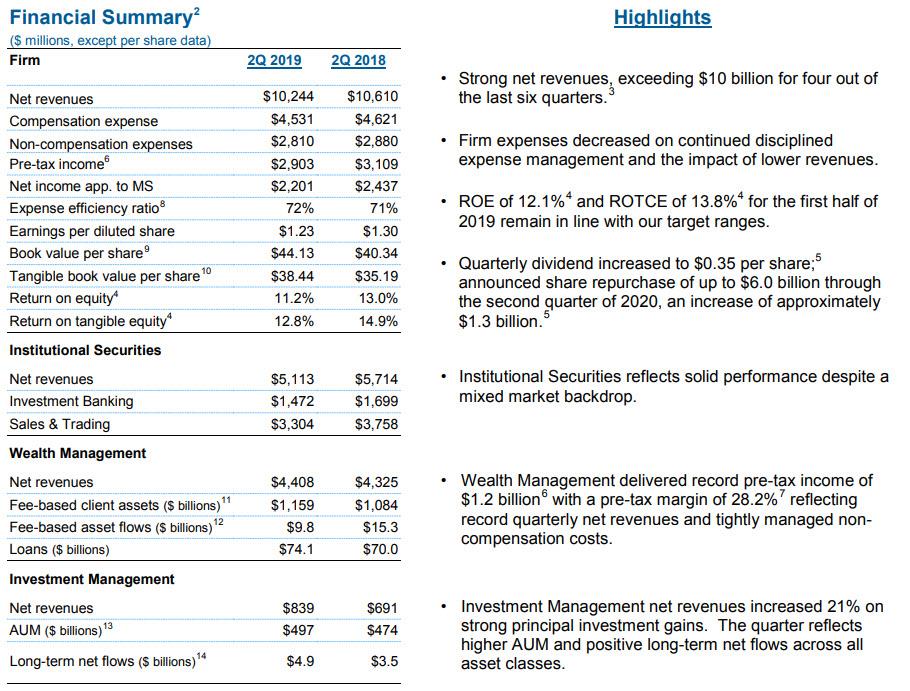

So what did Morgan Stanley, the last of the big US banks to disclose Q2 earnings, report this morning? Like most other banks, MS also beat on the top and bottom line, reporting revenues of $10.244BN, below the $10.61BN from a year ago but above the $10.09BN expected and the 6th consecutive quarter of revenue rising above $10BN. EPS of $1.23 also beat expectations of $1.16, but declined from $1.30 in Q2 2018. As revenue dipped, so did expenses, with compensation expense dropping by $90 million to $4.531BN in Q2.

The company also increased its quarterly dividend to $0.35 per share;and announced share repurchase of up to $6.0 billion through the second quarter of 2020, an increase of approximately $1.3 billion.

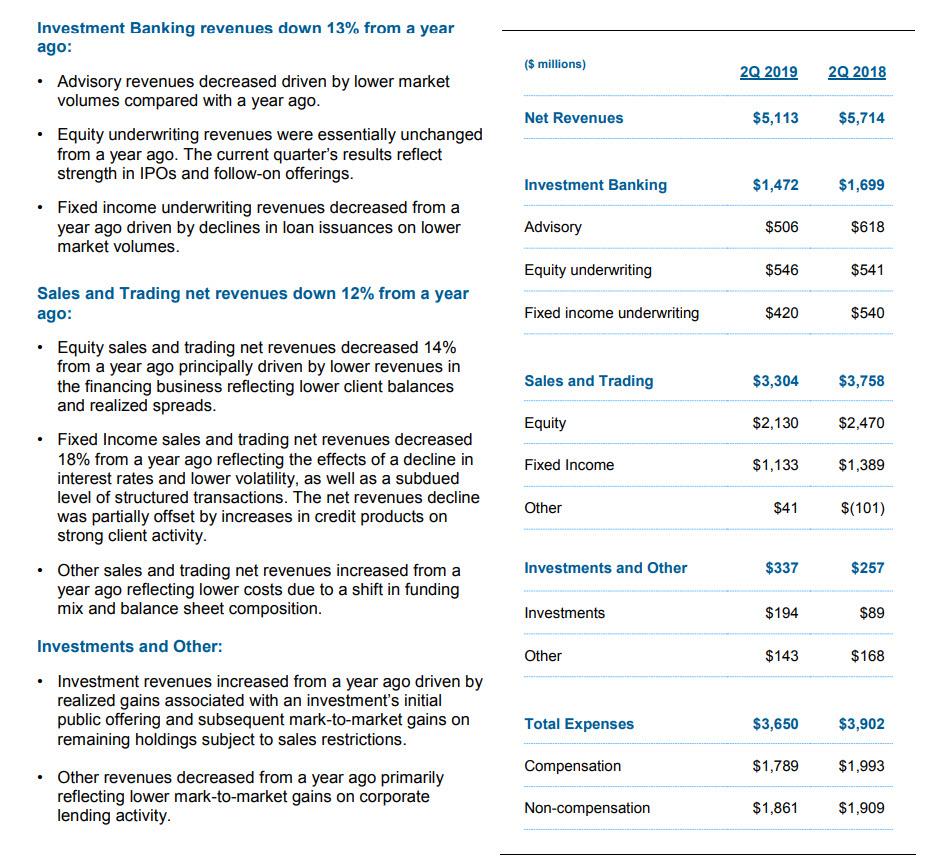

That was the good news. The bad news emerges when looking at the bank’s all important trading desk, the biggest on Wall Street. The overall “Institutional Securities” group reported net revenues for Q2 of $5.1 billion compared with $5.7 billion a year ago, as every single trading division saw revenue decline in Q2.

Of note, the bank posted a sharp 15% drop in equities-trading revenue, the biggest decline among major U.S. banks, which was driven by “lower revenues in the financing business reflecting lower client balances and realized spreads.”

Here is a summary of the key segment revenues:

- Equity Sales and Trading: $2.13BN, down -15% from $2.470BN, Exp. $2.27BN

- FICC Sales and Trading: $1.13BN, down -19% from $1.389BN, Exp. $1.29BN

- Investment Banking: $1.472BN, down -13% from $1.699, Exp. $1.44BN

The bank’s fixed-income trading also dropped more than rivals in the second quarter, slipping 18%, compared with analysts’ estimates of a 7% drop, and was blamed “on a decline in interest rates and lower volatility, as well as a subdued level of structured transactions. The net revenues decline was partially offset by increases in credit products on strong client activity.”

Investment banking had a drop across deals and underwriting for debt that was worse than expected, while equity underwriting surpassed estimates. Specifically, fees from underwriting bond and loan deals, meanwhile, tumbled 22% to $420 million, below analysts’ estimates for $452 million.

Other, less market reliant, results from MS were generally better than expected, to wit:

- 2Q net interest income $1.03 billion, +14% y/y, estimate $991.6 million

- 2Q wealth management net revenue $4.41 billion, +1.9% y/y, estimate $4.28 billion (MODL)

Commenting on the results, CEO Jim Gorman said “We reported solid quarterly results across all our businesses. Firmwide revenues were over $10 billion and we produced an ROE within our target range, demonstrating the stability of our franchise. We remain focused on serving our clients and pursuing growth opportunities while diligently managing expenses.”

Others were less sanguine, with Bloomberg analysts stating that “the outlook for trading revenue is relatively soft, in our view, based on global peer reports so far. Morgan Stanley’s equities trading result faces a higher hurdle after a beat and gain at Goldman Sachs amid misses and declines for other peers, with the market-share opportunity critical. A 36% jump in BofA equity fees is a highlight among broadly better results.”

Overall, this was a poor quarter for Morgan Stanley on the banking and trading front, because as Bloomberg notes, “analysts had been pricing in some weakness here but not as much as this.”

The stock, however, took it all well, and has barely moved since the report.

via ZeroHedge News https://ift.tt/32y36Rc Tyler Durden