Over a year in, the trade war between the US and China has claimed its first corporate casualty: a large Indonesian textile maker which missed a dollar loan payment last week is putting a fresh spotlight on how the stress from the geopolitical conflict is roiling global credit markets.

On Monday, S&P slashed its rating of dollar bonds sold by a subsidiary of Indonesia’s Duniatex Group (also known as Delta Merlin Dunia Textile) by six notches to CCC-, citing “significant liquidity challenges” after another group company missed a payment on a syndicated dollar loan that had matured on July 10.

The ongoing U.S.-China trade tensions are “significantly hurting” the Indonesian textile market, and Duniatex’s liquidity was affected by plummeting prices due to the oversupply of imported cheap fabric from China, S&P also said. The ratings agency pointed to ripple effects from the U.S.-China trade war in part for Duniatex’s worsened liquidity.

“The ongoing U.S.-China trade tensions are significantly hurting the Indonesian textile market,” S&P explained in the note. “Following the U.S.-imposed tariffs of 25% on Chinese imports, Chinese producers have started redirecting their products to more hospitable destinations, including Indonesia, from May onwards.”

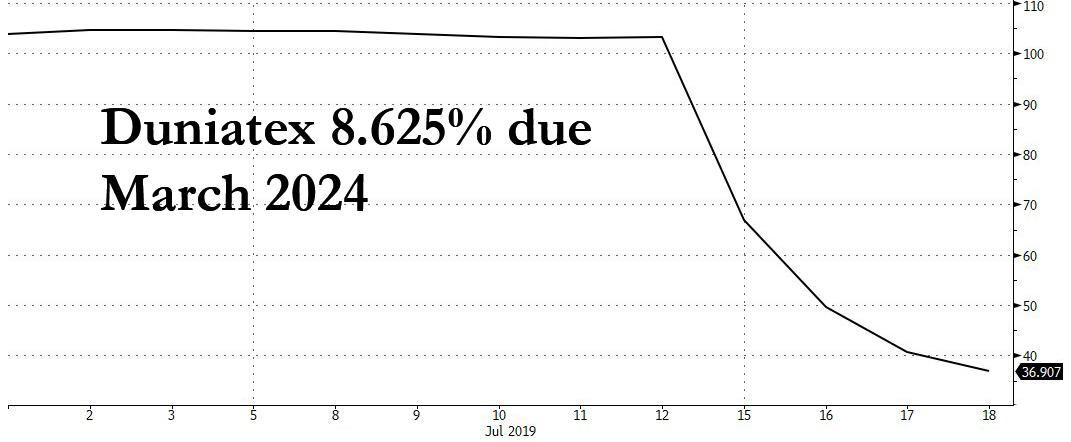

While the Duniatex sub should be able to make a bond payment on a $300 million note it priced just 4 months ago back on March 5, bond investors aren’t so sure, and the note have plunged to a low as 34 cents on the dollar, after trading above par just this past Friday. If the company defaults in the coming months, this could be the first new bond issuance since Blockbuster that has defaulted before even paying a single coupon.

The stunning fall in Duniatex bonds has shocked bond investors, many of whom have scrambled to allocate money to emerging markets – such as Indonesia.

The Indonesian firm’s implosion also highlights the risks faced by investors as they buy into the region’s junk bond market, which has returned 11% so far this year, the most in three years. Recent bond defaults out of China have raised concerns about the quality of financial reports. One defaulter, Chinese firm Kangde Xin Composite Material, was found to have faked billions of yuan in profit.

Yet while US corporations can easily issue new debt and loans at ridiculously, some emerging market corporations are finding themsleve locked out; as a result more stress is emerging in Indonesia. Fitch Ratings on Wednesday cut its credit score on notes sold by Agung Podomoro Land’s subsidiary, citing delays in raising funds for refinancing. The company’s $300 million 2024 bond fell 11 cents on the dollar to 70.2 on Thursday, according to data compiled by Bloomberg.

“This event reminds us of potential problems outside of China as well, with a lack of disclosure for private companies,” said Raymond Chia, head of credit research for Asia excluding Japan at Schroder Investment Management Ltd.

Meanwhile, Bloomberg highlights that the communication between Delta Merlin Dunia Tekstil and investors also highlights the difficulties bond buyers can face when things go sour.

There have been concerns about disclosure in recent defaults of unlisted companies including dollar bonds sold by CEFC Shanghai International Group and Reward Science and Technology Industry Group. Neither Duniatex nor its subsidiary that sold the bond or the loan are listed.

An email sent from a Duniatex executive to an investor that was seen by Bloomberg News, said “We will try to ring fenced DMDT as the bond issuer” from a missed payment on a loan.

“We will update later, please dont call or email at this time, as my Inbox flooded with emails,” the email also said.

So with the issuer refusing to speak to anyone, attention turns to the underwriters: BNP Paribas and Standard Chartered arranged the bond sold in March. A spokeswoman for Standard Chartered declined to comment, while a spokesman for BNP Paribas also declined to comment when Bloomberg asked them how they could underwrite a bond that is set to default without having made a single payment.

via ZeroHedge News https://ift.tt/2YZ2IJx Tyler Durden