It’s a story of “activist” versus activist.

The publicly traded arm of Pershing Square, Bill Ackman’s Pershing Square Holdings Ltd. in London, is now facing pressure from an activist investor of its own, according to Bloomberg.

Asset Value Investors owns a 3% stake in the London firm and is pushing back against Pershing’s decision to issue $400 million of 20 year debt without consulting its shareholders. A letter sent by AVI calls the move an “outrageous decision”:

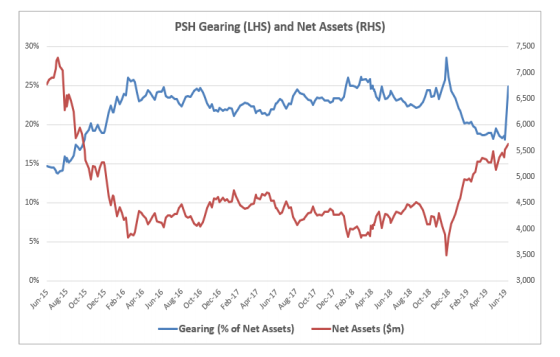

We are writing this open letter to you following the outrageous decision by the Board to sanction the issuance of $400m of twenty-year debt without, as far as we are aware, any consultation with shareholders unconnected to the Investment Manager. The issue of such long-dated debt materially constrains the Board’s ability to manage PSH’s persistently wide discount to NAV, at a time when doing so should be their primary focus. We are staggered that the Board has decided to further tie its hands in this way.

The letter continues, saying that it hopes “sunlight will be the best disinfectant” against the firm’s decision:

At AVI, we pride ourselves on being an engaged shareholder in all our investee companies, and our first preference is always to resolve contentious issues behind closed doors. Indeed, we did so with you in January 2018 when the ill-conceived proposed tender by Bill Ackman was rightly abandoned in favour of a company-led tender following representations from ourselves and other shareholders. With the debt issue being announced as a “fully committed” fait accompli, we see no choice other than to write to you in this public forum in the hope that sunlight is the best disinfectant for the company’s corporate governance failings.

“Shareholders have suffered from a persistently wide and growing discount to NAV, which is even more remarkable given the company’s investment portfolio is comprised of large-cap, liquid, listed securities,” the letter continues.

The letter also admits that AVI is hedging some of their position:

“In the spirit of full disclosure, please note that a portion of our position (44% of our total 6.7m shares held) is hedged for risk management purposes.”

Fitch Ratings downgraded Pershing Square Holdings’ rating to two levels above junk on Monday and warned that taking on more debt would increase the firm’s leverage ratio.

We hope AVI has more luck with activism than Ackman had on his last activist endeavour. You can read AVI’s full letter here:

via ZeroHedge News https://ift.tt/2YdcgU1 Tyler Durden