US corporate profits hit an all time high in the first quarter of 2019, but contrary to conventional wisdom, this did not inspire American companies with confidence; on the contrary, business sentiment has been steadily declining over the past year according to business activity surveys and the ISMs.

In an attempt to figure out what has changed, Goldman analysts constructed an measure of business sentiment using public communications from S&P 500 companies by poring over 4,000 earnings and conference calls transcripts in the past year.

This is how the call sentiment index was constructed according to Goldman:

By combining lists of negative and positive words designed specifically for working with financial, political, and economic texts, the bank created a sentiment dictionary that assigns a semantic orientation to a word — that is, whether it is typically positive, neutral, or negative. To extract the tone from 4,000 earnings and conference call transcripts, we first evaluate the orientation of each word in a document. Next, we give each transcript a sentiment score by calculating the difference between the share of positive words and negative words. We finally average the sentiment scores across each month to create an aggregate index.

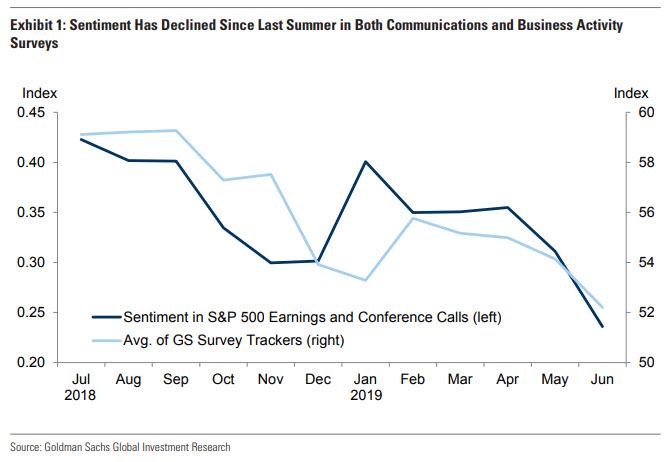

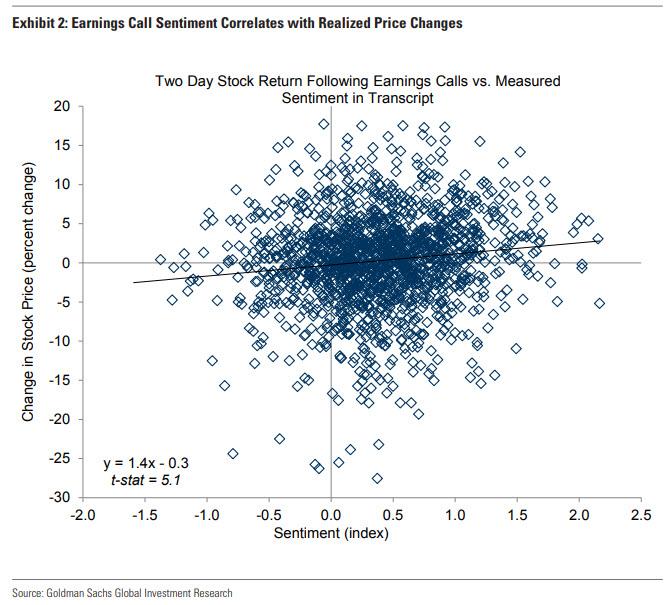

This new conference call derived sentiment index has been tracking the path of business activity surveys well over the sample period; additionally, in testament to the predictive power of conference call “tone” and sentiment, Goldman also found a significant relationship between the sentiment scores of individual transcripts and the corresponding company’s stock returns following earnings calls.

Three quality checks conducted on the ad hoc sentiment measure provided encouraging quality metrics according to Goldman.

- First, the sentiment index tracks the path of business activity surveys well. Similar to the path of manufacturing and non-manufacturing survey trackers, the sentiment index declined over 2018H2, and then rebounded slightly in 2019Q1 before declining to its lowest value in the past year in June.

- Second, the sentiment measure appears to produce sensible results for individual transcripts. In an earnings call transcript with a particularly negative score, the company noted that it “had a disappointing fourth quarter with results negatively affected by higher than expected … losses … and severe declines in the stock market” and that “earnings this quarter [were] pretty ugly.” On the positive side, a particularly positively scored transcript noted that “customer response has been overwhelmingly positive,” and that the outlook was “very, very encouraging.

- Third, Goldman found a significant positive relationship between an individual transcript’s sentiment score and the corresponding company’s stock price return following earnings calls (Exhibit 2).

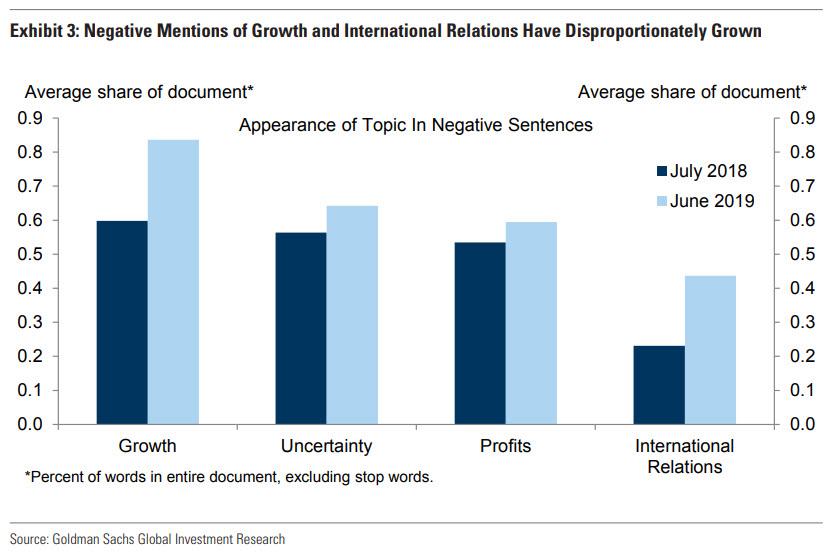

So what, according to Goldman’s new index, prompted the observed decline in business sentiment? To answer this question, Goldman identified topics that occur in sentences that also contain identified negative words (Exhibit 3). Specifically, there has been a sharp increase in negative mentions of the “growth” topic, which is consistent with slower domestic growth. And while the topic of international relations — which contains references to foreign countries and trade — is somewhat less prominent than other topics, its co-occurrence with negative words has increased notably, and appeared responsive to the slowdown in global growth and continued escalation of trade tensions. The pick-up in negative uncertainty associations is somewhat more muted, consistent with the limited increases in the other measures of business uncertainty.

Nuance aside, what does poring over 4,000 conference call transcripts reveal? Simply, that while both business surveys and Goldman’s sentiment measure declined further in June, the first two manufacturing surveys of July have offered “an encouraging preliminary signal that sentiment may turn a corner. Under our projection for growth to accelerate slightly over the next year as the impulse from financial conditions improves, we’d expect some of the growth fears to abate.”

And while Goldman also expects global growth to stabilize and some form of a trade agreement with China, it seems somewhat less likely that the international relations bucket will return to its previous level, as analyst commentary signals a more persistent rise in broad trade war risk which could continue to weigh on sentiment.

In the end, however, all of this is creating work for the sake of work because when it comes to the only thing that matters vis-a-vis changes in the direction and momentum of economic data, i.e. the Federal Reserve and how it responds to changes in data, as we noted last week, the Fed is no longer data dependent, but pre-data dependent as it attempts to quietly change its mandate, and grant itself the ability to react not only to changes in data but to what it believes will be a change in data, which in turn explains why with the US economy now firing on all cylindes, the big debate is whether the Fed will cut by 25bps or 50bps on July 31.

via ZeroHedge News https://ift.tt/2Gk75HE Tyler Durden