After countless weeks of equity outflows, last week, when the S&P hit a new all time high above 3,000, skeptical investors capitulated and decided to buy stocks at the highest possible level ever, injecting $6.2bn into equities this week, alongside the now traditional fixed income tide, which last week amounted to $12.1 billion into bonds. As a result, the constant hemorrhaging at equity funds – which have seen $151BN in redemptions in H1’19 – finally stopped, and in the past 6 weeks there has been $11bn in inflows (although it is worth noting that inflows are exclusively to US equity funds, to the tune of $22bn past 6 weeks).

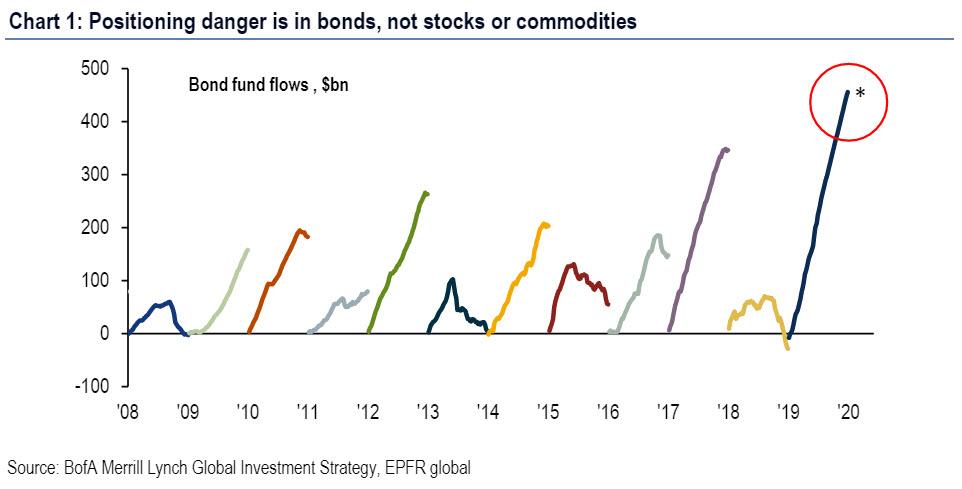

Still, when it comes to flows, it is all about bonds, and as BofA’s Michael Hartnett writes, the most important flow to know is that of annualized inflows to bond funds, where there now is a staggering record $455 BN in 2019…

… which compares with $1.7tn inflows past 10-years, leading Hartnett to concludes that the “positioning danger is in bonds, not stocks or commodities.”

A more grandular look reveals frothy inflows to virtually every asset class, including government bond, IG, HY, and EM debt funds, all coinciding with…

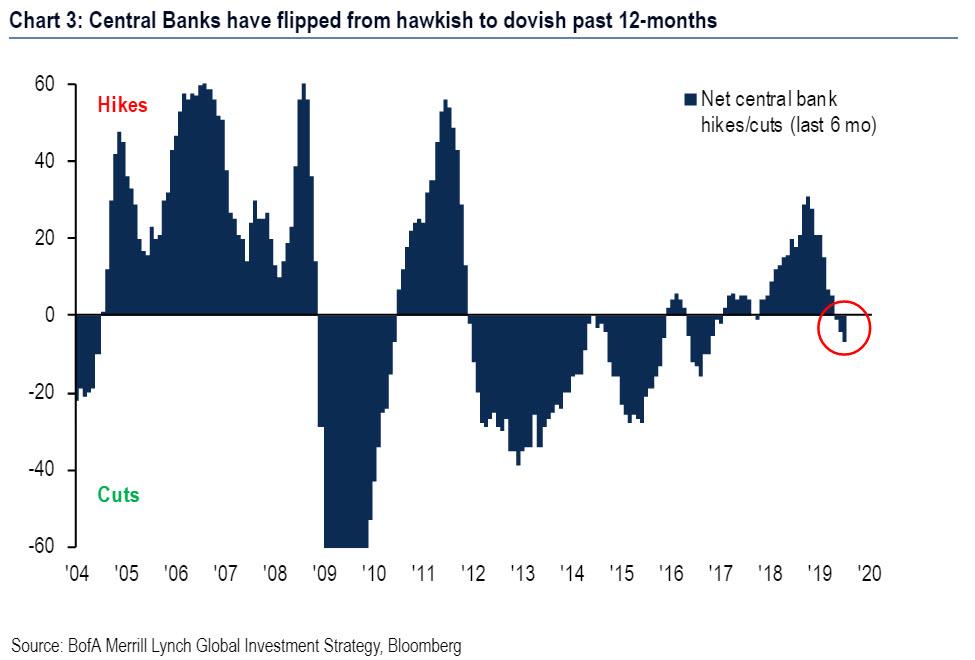

- renewed global monetary ease (18 rate cuts past 6-mths & 720 cuts since Lehman);

- record $12.9tn of bonds in developed markets with negative yield (25% of total);

- record 26% of Euro IG corporate bonds with negative yield;

- record 56% share of global equity market cap from tech-heavy US stock market;

-

extreme relative valuation of “growth” stocks versus “value” stocks, e.g. US growth & EAFE value have price-to-book ratios of 7.7x & 1.1x, and dividend yields of 0.9% & 4.8% respectively.

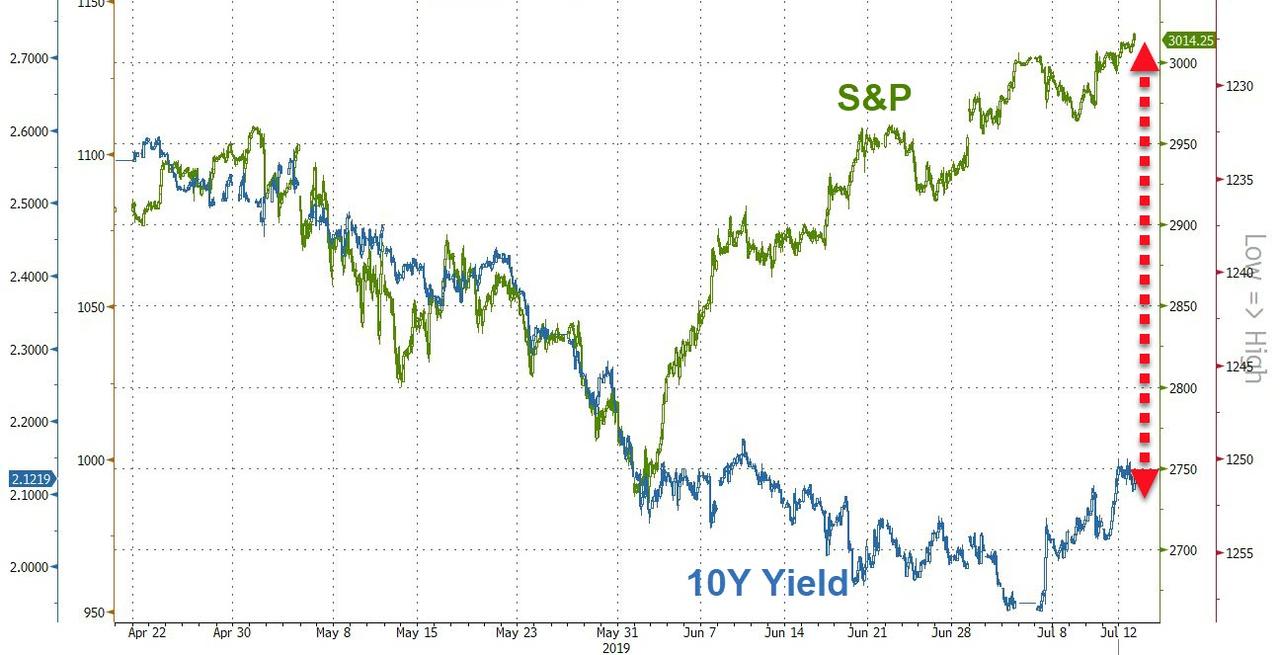

Meanwhile as a result of schizophrenic investor sentiment, the relative bull trend in assets which promise “yield” and “growth” has become more and more extreme as central bank capitulation to Wall Street deepens in 2019.

Of course, this won’t be a happy ending as it is impossible for both to be right, and while stocks will eventually be in a world of pain, for now Bank of America remains tactically bullish equities as the BofAML Bull & Bear Indicator is 3, as consensus remains more bearish than bullish; Furthermore, the Fed wants to steepen yield curve and weaken the US dollar, which will require 50bps cut July 31st although as the Fed made clear on Friday, that is not happening, no matter what SF Fed president John Williams says; Additionally, BofA is bullish as it now expects Chinese monetary and UK/European fiscal easing (especially with BREXIT in Oct) likely H2; while credit spreads continue to indicate that recession and/or policy impotence is not an immediate threats to Wall St & corporates.

Which brings us to three specific contrarian trades that BofA CIO Michael Hartnett recommends to clients, which are as follows:

1. The contrarian positioning trade: With $254bn into bonds YTD and $144bn out of equities, the contrarian trade is long stocks, short bonds via long EM stocks, short HY bonds (Chart 5 shows great entry level over past 20 years)…yields in equity market looking more and more attractive relative to yields in fixed income…2363/2847 MSCI ACWI stocks have DY>0.56% (Chart 4, avg yield for US, UK, Japan, Swiss, German, Aussie, Canadian govt bonds)…US DY 50bp above 10-year Treasury yield, in Europe 400bp above 10-year bunds.

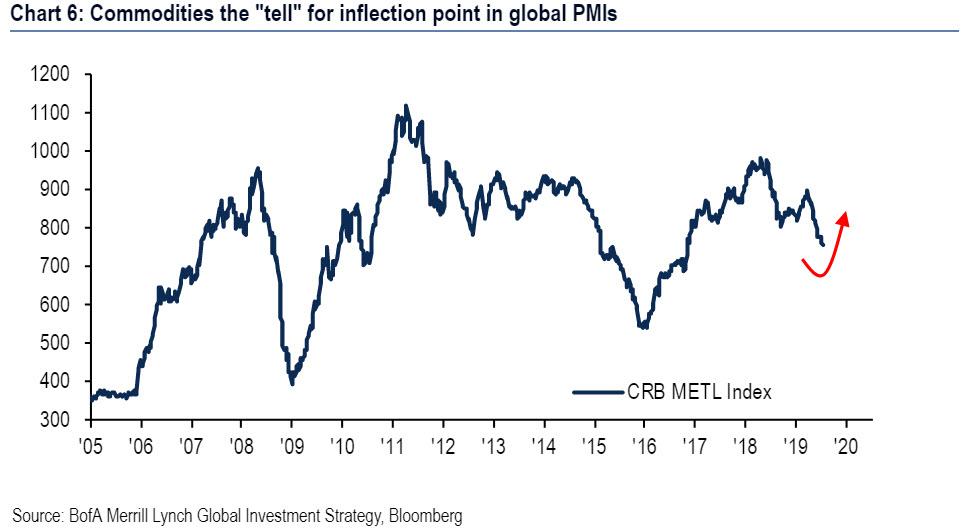

2. The contrarian profit trade: with global manufacturing unambiguously in recession (global PMIs have contracted for 2 consecutive months, US yield curve has inverted, 12-month consensus global EPS forecasts now negative) the contrarian trade is long cyclical value, short defensive growth via long TRAN, short UTIL or long EU large cap value, short US mid-cap growth to play “soft landing” in Q3… The key drivers are either bold policy moves (Fed cuts 50bps, China cuts 50bps, European fiscal easing) which steepen yield curves & weaken US dollar, or commodity markets indicating an inflection point in the global manufacturing cycle (e.g. CRB METL index moves above 850-900 – Chart 6).

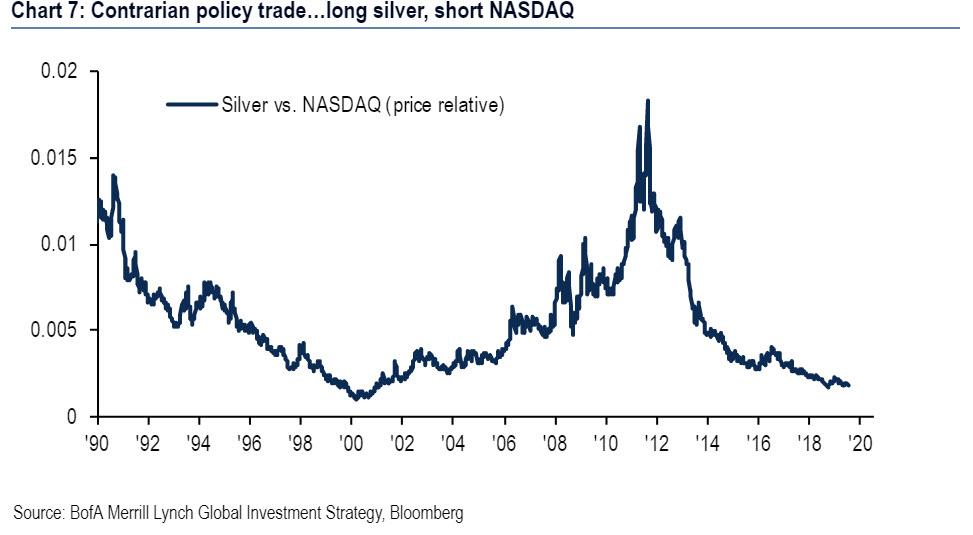

3. The contrarian policy trade: long silver, long US banks, short US$, short EU bonds & credit…

- if Fed cuts 50bps + July payroll >300k…Fed dovish policy mistake which will provoke either disorderly rise in government bond yields (1994 analog) or melt-up in stocks; and…

- if Fed cuts + July payroll -150k…signals onset of recession & policy impotence… sparks disorderly rise in corporate bond spreads & decline in US dollar.

Bottom line from Hartnett: slowly but surely the credibility and independence of central banks is in retreat; volatility continually surprised to the downside this decade; but… in the next decade inflation-targeting, MMT, debt forgiveness and acceleration of populism is likely to coincide with higher volatility and lower returns on Wall St.

Enjoy it while it lasts.

via ZeroHedge News https://ift.tt/30TPTkn Tyler Durden