Freight brokers continue to paint an ugly picture for the industry ahead. According to FreightWaves, despite higher rates at the end of June, brokers are saying that conditions have “eased” again and pressure is coming on gross margins from customers.

J.B. Hunt called out “flattish” rates for its trucking business in its Q2 call as a reason for optimism and, on July 17, Morgan Stanley saied that “commentary stayed mixed this update as carriers continue to be notably more positive than peers as they see signs of an ‘adjustment’ to capacity in the coming months.” Late June data was also being used to peddle a stabilization narrative about the freight market where rates may have reached their bottom.

But new channel checks tell a starkly different tale.

Management at Trident Transport in Chattanooga called June’s market as an extended “hangover” from Roadcheck week. They said margins will compress because capacity made a sluggish return to the market and drove rates higher.

William Kerr, president of Chicago-based Edge Logistics said:

“It was very difficult to cover loads and make margin, worse than it usually is, and no one knows why. The market was a little shaky for a while and it was pretty hard to make money for the rest of June.”

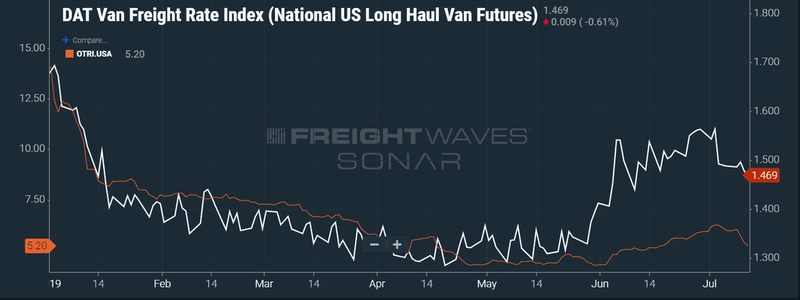

Data and color from brokerage executives now say that the market is loosening once again. This chart shows the tightening in June and subsequent freeing up of capacity heading into July.

Jason Roberts, vice president of sales at Chattanooga-based Avenger Logistics said:

“Most customers are realizing now they have a lot of the power back in their hands, and they’re putting pressure on us to get their rates down or they’ll give it to someone else. We’ve had to cut some rates to keep the business. We had customers who had been sitting at higher margins, and we reduced the margins by 5 percent [i.e., 500 basis points] in some cases.”

Kerr says his business continues to see good volume, despite being down about 2% on a national basis: “I’m very food and beverage focused — that’s insulated us a little bit from the volume volatility. We like to work with America’s largest shippers.”

Roberts continued, commenting on capacity:

“As far as capacity goes, it’s loose as a goose. The competition for spot freight between brokers has heated up, and customers are being offered such ‘wildly aggressive’ rates that they have almost no choice but to take them.”

He believes that “larger and mid-sized brokerages are bidding down lanes” and that large brokerages may be trying to buy market share while the mid-sized brokers could be trying to make a splash with a major customer.

He continued: “In some cases they’ve gotten too aggressive and bit off more than they can chew. I believe that capacity is going to stay loose for the entirety of the summer and rates will continue to fall. Volume is going to be there, but I think rates are going to plummet and people are going to be cutthroat about how they try to gain a piece of that market share.”

Kerr says there’s no indication that capacity is going to leave the market: “I think we might see some serious volatility in the second half of 2019, based on how crazy the weather’s been. We’re not hoping for that, but it might contribute to some market fluctuations for the rest of the year.”

via ZeroHedge News https://ift.tt/2JMQ8YJ Tyler Durden