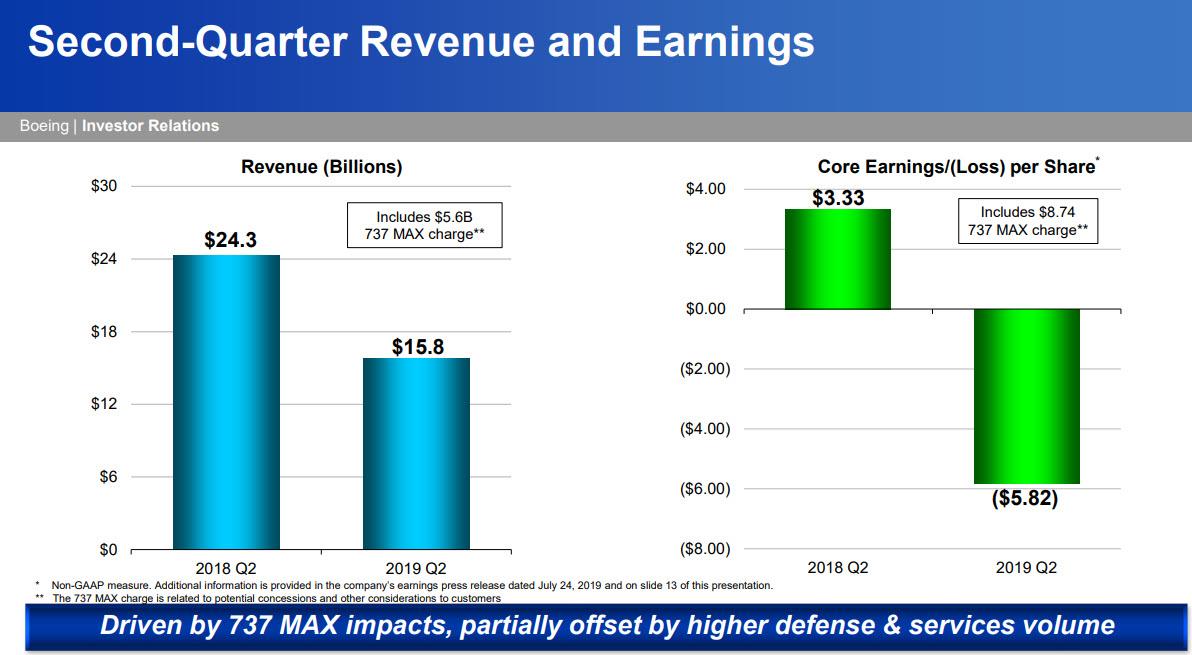

With the storm clouds over the grounded 737 MAX gathering patiently for the past 5 months, it was only a matter of time before the torrential downpour arrived, which it did just before 730am, when Boeing reported shocking numbers, with Q2 EPS printing at a stunning loss of $5.82, far below the expected profit of $1.98 per share and last year’s profit of $3.33 with revenue plunging 35% Y/Y to $15.75BN, some $5 billion below the expected $20.45 billion.

The company listed the following reasons for this surprising loss:

- Recorded lower BCA revenue and operating earnings due to fewer 737 deliveries

- Booked $4.9B after-tax charge related to estimated potential concessions and other considerations

- Included $1.7B increased costs to produce aircraft in the 737 program accounting quantity

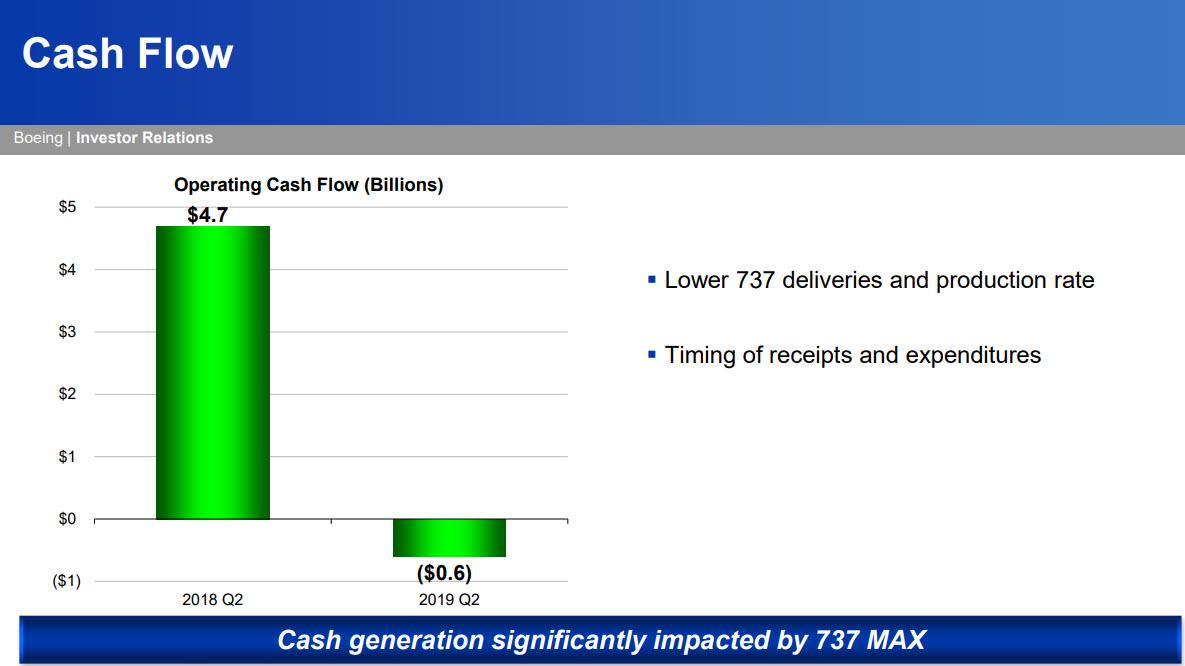

The 737 MAX fiasco meant that Boeing actually tipped into cash flow negative, reporting $600 million in cash burn, a far cry from the $4.68BN a year ago, while the company’s backlog dropped 2.9% to $474 billion.

Trying to put some lipstick on the pig, Boeing said it delivered 90 airplanes, including 42 787s, and noted that it had received a letter of intent from IAG for 200 737 MAX planes.

Commenting on the ongoing 737 MAX troubles, Boeing said that “disciplined development and testing is underway and we will submit the final software package to the FAA once we have satisfied all of their certification requirements.” Boeing also remains “focused on 737 MAX safe return to service; results significantly impacted.”

For now, and until there is clarity on the future of the 737 MAX, Boeing pulled all forecasts, saying that the previously issued 2019 financial guidance does not reflect 737 MAX impacts, and that due to uncertainty of timing and conditions on 737 MAX return to service, new guidance will be issued at future date. This is what the company said:

“Due to the uncertainty of the timing and conditions surrounding return to service of the 737 MAX fleet, new guidance will be issued at a future date. Boeing is working very closely with the FAA on the process they have laid out to certify the 737 MAX software update and safely return the MAX to service. Disciplined development and testing is underway and we will submit the final software package to the FAA once we have satisfied all of their certification requirements. Regulatory authorities will determine the process for certifying the MAX software and training updates as well as the timing for lifting the grounding order.”

The silver lining, of course, is that Boeing is also a bullish bet on war, and at least in that regard it did not disappoint, as sales in the offense “defense” unit rose 8% to $6.6 billion. As Bloomberg notes, no surprise that that would be up if you’ve been paying attention to other earnings this week, as Pentagon contractors Lockheed Martin, United Technologies and Northrop Grumman all beat expectations.

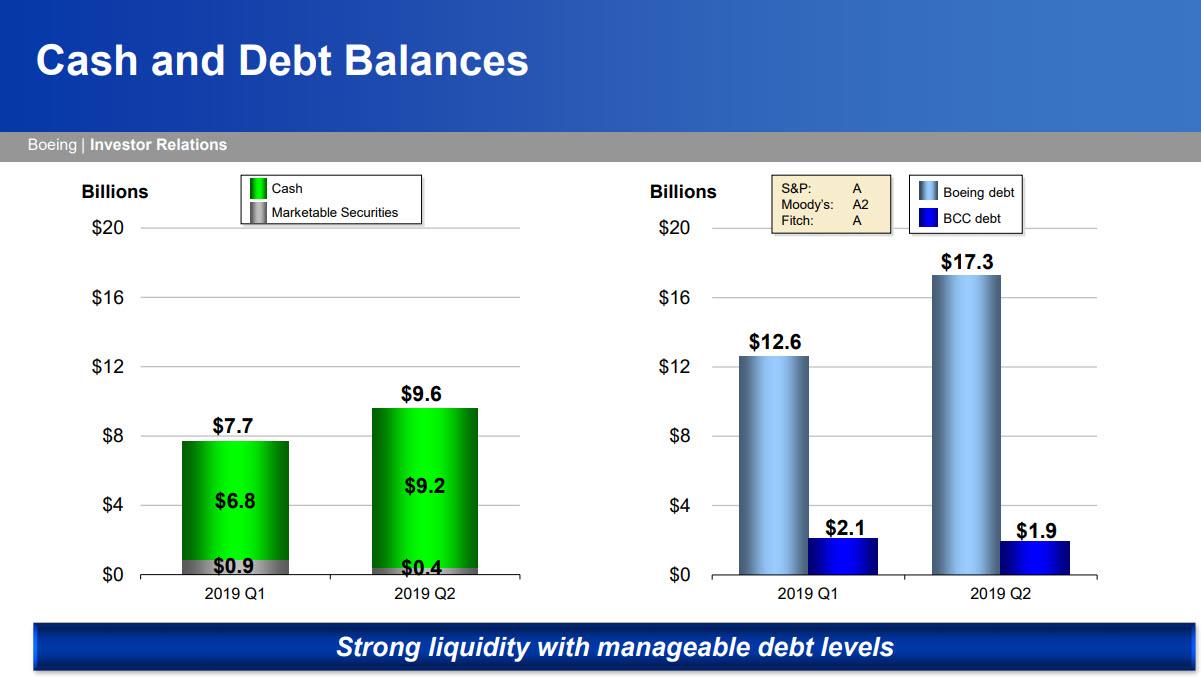

Meanwhile, even as Boeing’s net cash balance prudently rose by $2 billion, its debt increased by a far more ominous $4.7 billion, which will be a problem now that Fitch, and soon other rating agencies, are preparing to cut Boeing from single A and push it into the triple Bs.

In kneejerk reaction, Boeing shares – which have the highest weighing in the Dow Jones – tumbled as much as 1.8% before regaining much of their early losses.

Boeing’s full Q2 invester presentation is below

via ZeroHedge News https://ift.tt/2GpbYPW Tyler Durden