Earnings season always features more than a couple of surprises, and on Wednesday morning, the most shocking numbers were released by two of America’s iconic industrial giants: Boeing and Caterpillar.

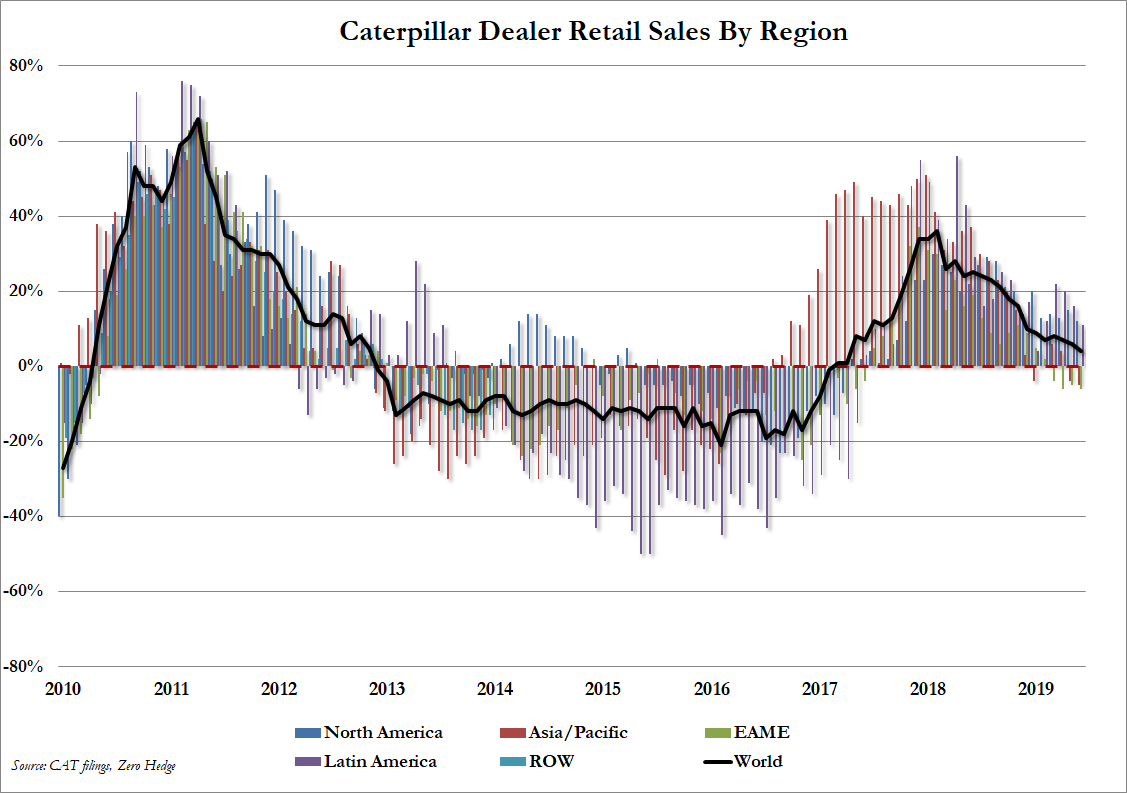

But while Boeing shares swiftly recovered from their initial earnings inspired selloff as analysts and algos found some redeeming information in the company’s services and defense business, for shares of CAT, it was mostly a one-way move, as the company, which constitutes 3.4% of the Dow, missed on both the top and bottom line – though the company’s warning that it now sees full-year EPS coming in at the lower end of its range, citing rising costs and falling sales in Asia, is what grabbed investors’ attention.

It’s the latest sign that the blowback from President Trump’s trade war might be even more severe than many had anticipated. And after the IMF’s dismal economic projections (released yesterday), the results from the global belwether are the second significant sign this week that global economic growth and trade are slowing.

“The increase in manufacturing costs was primarily due to higher material costs, including tariffs, variable labor and burden and warranty expense,” the company said in a statement Wednesday.

Analysts highlighted the whiplash created by CAT’s earnings outlook after several quarters of raising guidance.

“Cracks are showing,” said BI’s Karen Ubelhart. “Outlook unchanged, but Caterpillar emphasized lower end of forecast after a string of quarters of raising guidance.”

Here are the highlights:

- Adj EPS: $2.83 (est $3.12)

- Rev: $14.43B (est $14.45B)

- Still Sees FY Adj EPS: $12.06-$13.06 (est $13.29)

- Expects To Be At Lower End Of FY Adj EPS Range

CAT also reported its weakest sales since 2017.

Twitter wits were quick to crack a few jokes.

Headline should be: Boeing and Cat earnings so bad it pushed ES and nasdaq up https://t.co/jRQn9VvW8S

— Tom (@TradingThomas3) July 24, 2019

But while earnings this season have been broadly better than anticipated, will CAT’s struggles factor into the FOMC’s rate-hike thinking next week?

via ZeroHedge News https://ift.tt/2Z8y5RW Tyler Durden