Oil prices held on to gains overnight after the huge API-reported crude draw (but large ghasoline build) and more confidence in a possible US-China trade deal.

A confirmation of the API report in official government figures scheduled to be released Wednesday would “help us confirm an oil-price bottom,” said Phil Flynn, senior market analyst at Price Futures Group Inc., in a note to clients.

“If we hold the recent lows and build off of it, it is very possible that crude oil has set a low that won’t be tested for the rest of this year.”

Bloomberg Intelligence’s Senior Energy Analyst Vince Piazza warns:

“Energy investors seem to be paying attention to the wrong things. Escalating tensions in the Persian Gulf are supporting benchmarks, though the modest price boost relative to the risk of bottlenecks is surprising. Weaker petroleum demand should be the larger long-term concern, along with trade issues and resilient U.S. production. Modest aftereffects of storm system Barry still skew industry data.”

API

-

Crude -10.961mm

-

Cushing -448k

-

Gasoline +4.436mm – biggest build since Jan

-

Distillates +1.42mm

DOE

-

Crude -10.835mm

-

Cushing -429k

-

Gasoline -226k

-

Distillates +613k

Confirming API’s data, DOE reported a massive 10.8mm barrel inventory draw last week (and only marginal product inventory shifts). This is the 6th weekly crude draw in a row

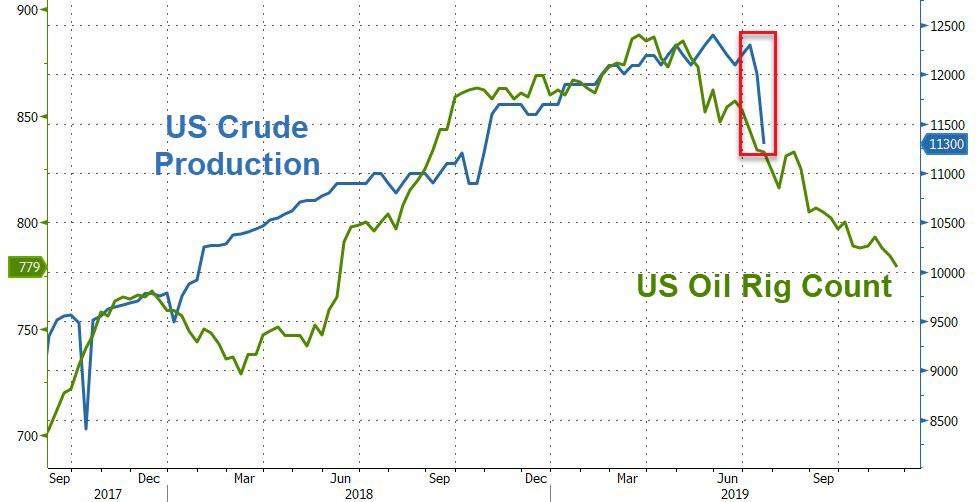

US Crude production crashed down 700k last week but largely due to Gulf stoppages due to storm Barry…

WTI pushed up to the high of the day – above API print levels – ahead of the official DOE data, then spiked above yesterday’s highs after the data confirmed API’s big draw.

However, as Bloomberg notes, there are still signs of deteriorating global economic conditions. Prompt front-month Brent futures — the international benchmark for crude — traded at a discount to the second month for the first time since March.

The price structure, known as contango, typically indicates supplies are exceeding demand.

via ZeroHedge News https://ift.tt/2YrvyF6 Tyler Durden