It was a week of Treasury auctions to forget.

Starting with a medicore 2Y auction, progressing through one of the ugliest 5Y auctions in years, and concluding with today’s lackluster 7Y, this week’s treasury auctions – coming at a time when the Fed is about to push interest rates even lower – were unexpectedly weak.

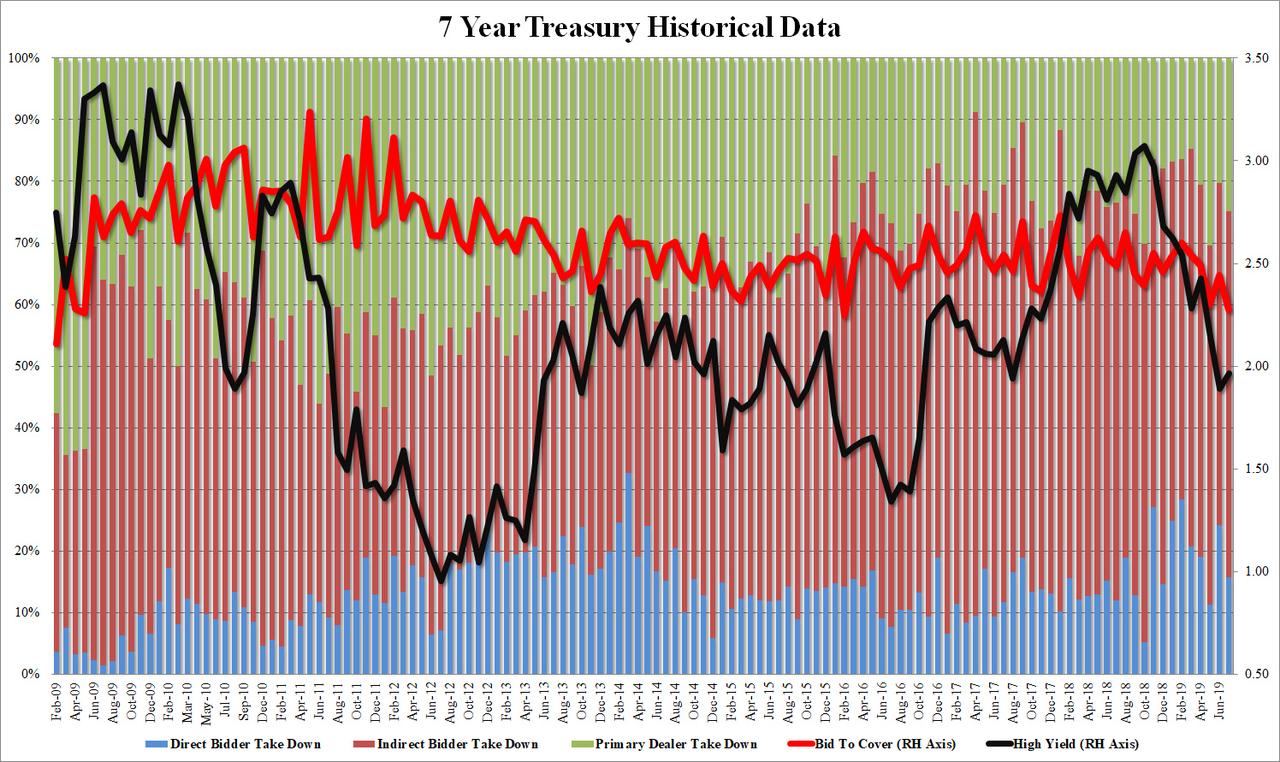

Moments ago, the US Treasury sold $32 billion in 7Y paper at a yield of 1.967%, higher than last month’s 1.889% and a surprisingly big 1.4bps above the 1.953% when issued on a day when the rate market has generally whipsawed aggressively.

The bid to cover tumbled from 2.44 in June to just 2.274 today, which was not only below the 2.48 six auction average, but the lowest in two and a half years, since February 2016.

At least the internals were not terrible, with Indirects rebounding from last month’s 55.5% to 59.4%, just above the 58.7% recent average, however it was the Directs’ turn to slump, and with just $5.1BN of the bids tendered and accepted, the Direct takedown dropped to 15.8% from 24.23% last month, leaving 24.8% for dealers, slightly above the 19.9% recent average.

Overall, a poor, tailing auction concluding a week of dismal, disappointing Treasury sales, yet even despite the subpar demand, the Treasury still had little problem in finding buyers for another $110+ billion in US paper.

via ZeroHedge News https://ift.tt/2SF9eTu Tyler Durden