It’s almost over.

In a landmark settlement that ends a more than year-long battle, the DOJ approved T-Mobile’s proposed merger with Spring Corp., clearing a major hurdle to a deal after the two companies agreed to create a new wireless carrier by selling a host of assets to Dish, which will be required to build a 5G network for cellphone customers as part of the deal.

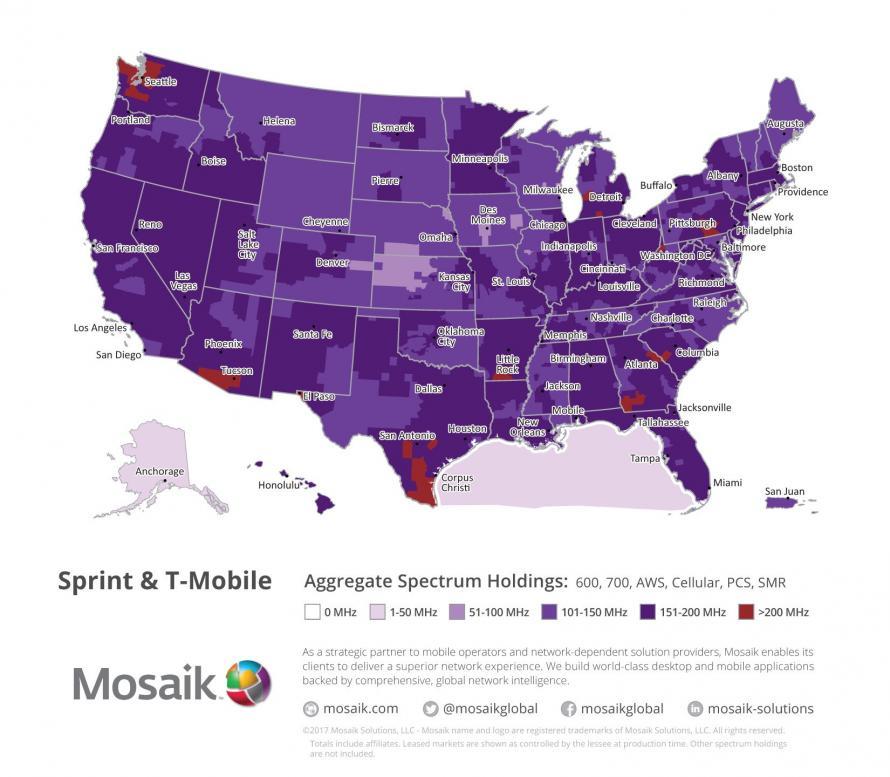

The landmark anti-trust ruling settles concerns about three carriers controlling 95% of the market by creating a new fourth carrier, Dish, albeit a carrier that will struggle to catch up to its much-larger rivals. The deal will make use of Dish’s valuable spectrum, which it has been sitting on for years, WSJ reports. In addition to Sprint’s prepaid business, Dish will have access to T-Mobile’s network for seven years after the spinoff. Dish will buy a portfolio of spectrum from Sprint, as well.

Though winning the DoJ’s approval means the deal will likely be consummated, there’s still one potential obstacle: several states attorneys general broke with the DoJ and filed their own anti-trust lawsuit seeking to block the $26 billion merger. Whether they will be successful or not remains to be seen. Five states that weren’t part of this lawsuit sided with the DoJ in Friday’s settlement.

BIG NEWS! After diligent review, the @TheJusticeDept & @JusticeATR has given clearance to our proposed merger with @Sprint! We are one step closer to bringing New T-Mobile to American consumers! https://t.co/jEoO85NeeT Key info: https://t.co/Ioa23FUBQe

— John Legere (@JohnLegere) July 26, 2019

“With this merger and accompanying divestiture, we are expanding output significantly by ensuring large amounts of currently unused or underused spectrum are made available to American consumers in the form of high quality 5G networks,” said Makan Delrahim, the Justice Department’s antitrust chief.

The deal will leave Dish with 9 million SPring prepaid customers, and some additional wireless spectrum. That represents about one-fifth of Sprint’s customer base.

So, while the US will still have four major wireless carriers, the fourth-largest carrier will be much, much smaller than Sprint. Soft Bank, which, as we reported earlier, is in the middle of raising a second Vision Fund, will be able to use money from the deal to finance the company’s stake in the venture fund.

Unlike other recent telecoms mergers, this isn’t a “vertical merger”, like the AT&T-Time Warner tie-up that the DoJ tried, and failed, to block. But it will likely save Sprint from bankruptcy, and set the nascent trust-busting movement in the US back a few steps.

The merger is still expected to create the largest cellphone carrier in the US, with around 120 million customers.

via ZeroHedge News https://ift.tt/2Y5e16A Tyler Durden