Accused pedophile Jeffrey Epstein’s Gratitude America Ltd. foundation somehow kept getting stock allocations in more than 40 underwritten offerings by Morgan Stanley, according to Barron’s.

Morgan Stanley led all of the offerings in question and was the sole underwriter on a dozen of them. They included IPOs of Roku and secondary offerings from companies like Tribune Media and Go Daddy.

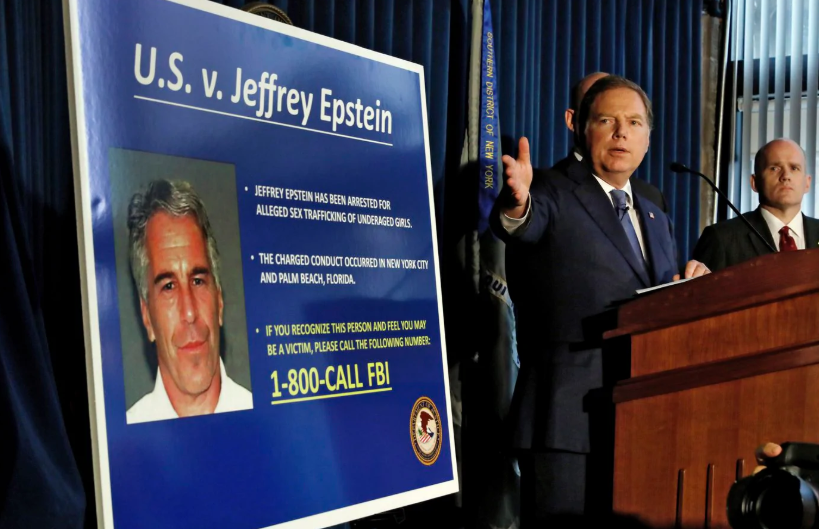

Epstein plead guilty in 2008 to soliciting child prostitutes and recently claimed assets of more than $500 million. Of that, he claimed $113 million in equities. Despite pleading not guilty, he has not been granted bail.

This year, Deutsche Bank dropped Epstein as a client of its private wealth division after he brought his money there in 2013. This followed having his money with JP Morgan Chase for years. But after the Miami Herald ran a series of articles last year about the plea deal Epstein took in 2008, the bank decided to end its relationship with Epstein.

That’s not to say that Deutsche Bank probably couldn’t use the wealth management business back at a time like this. But we digress…

Epstein’s foundation got a cut in numerous deals, including US Foods Holding and Norwegian Cruise Line holdings. Morgan Stanley acted as lead underwriter for both offerings. The foundation also got shares in Chinese delivery company ZTO Express.

Morgan Stanley declined to comment.

Epstein’s foundation began in 2017 with just $9 million in assets.

A Deutsche Bank spokesperson said: “Deutsche Bank is closely examining any business relationship with Jeffrey Epstein, and we are absolutely committed to cooperating with all relevant authorities.”

via ZeroHedge News https://ift.tt/32OD64p Tyler Durden