Gold has pushed much higher in recent weeks, breaking through the $1,400 level and holding. Silver has also rallied and has started to close the gap with the yellow metal. In a recent podcast, Peter Schiff said we are seeing signs that the investment world is starting to catch on. The psychology has shifted and investors are started to realize that the gold bull-run is for real.

A lot of it has to do with the anticipation of more easy money from the Federal Reserve. Fed-speak continues to boost anticipation of an interest rate cut. The only thing dampening expectations is the possibility of higher inflation. Peter said that doesn’t matter. Inflation or not, the Fed is cutting rates.

Last week, Fed Vice Chair Richard Clarida said, “You don’t want to wait until data turns decisively,” before cutting rates. Meanwhile, New York Federal Reserve President John Williams said the central bank shouldn’t leave a lot of dry powder in the keg. It should fire its bullets at the first sign of trouble. As Peter noted, the Fed used to claim to be “data-dependent.”

Why is the Fed so anxious to cut rates now?

Obviously, the reason is the Fed is so afraid of the next recession that they just want to do whatever they can to try to postpone that recession from happening. It’s not like they can stop it, but they want to postpone it. And the reason is because the Fed knows there’s nothing they can do, that basically, their chamber is empty anyway. So, you might as well shoot what you’ve got left because there’s no way they have enough firepower to deal with this recession the way they have been doing it. They can’t blow up a bigger bubble. They don’t have enough room between where rates are now and zero. And the amount of quantitative easing that would be required to monetize the enormity of the coming national debt is going to produce the overdose. So, all these clowns can think of is we’ve got to postpone this no matter what.”

But as Peter pointed out, every day the central bankers manage to put off the day of reckoning only exacerbates the problems.

If the recession is when the mistakes of the boom are corrected, why should we postpone that day? The sooner we correct these mistakes the better.”

Gold sold off a bit of its gain earlier in the week after the consumer sentiment numbers showed a bigger expectation for inflation. Peter said this led to the same old “brainless trade” we’ve seen over and over based on the notion that inflation is bad for gold and good for the dollar. The mainstream believes the Fed will adjust its policy if inflation starts to rear its head and that will put the kibosh on rate cuts. Peter said this isn’t the case. The consumer is right to expect more inflation. In fact, Peter thinks we’ll get a lot more than they expect. But the traders are wrong to expect the Fed to do anything about it.

They’re not going to do anything about it. They’re going to cut rates no matter how high inflation goes because they can’t stop it. But if they raise rates, they’re going to create in their minds a problem that is worse than inflation.

So, they would rather have inflation than the opposite, or what would be required to stop inflation, which would be a massive financial crisis because they have to raise interest rates and let this entire house of cards economy that they built on a foundation of cheap money – watch the entire thing implode.”

Inflation is going to win this battle. The Fed is going to surrender. This is why investors should be buying gold.

Higher inflation is not going to be seen as bad for gold. In fact, higher inflation is why people should be buying gold. The more inflation, the more gold you need to buy. So ultimately, higher inflation numbers, higher inflation expectations are going to be bought when it comes to gold, not sold.”

The opposite is true for the dollar. The mainstream only thinks inflation is good for the dollar right now because it believes the Fed will rush in and defend it. Peter said that’s not going to happen. That means the dollar will be losing value.

If the dollar is losing value, you want to get rid of dollars before it loses even more value. But the markets haven’t figured this out yet.”

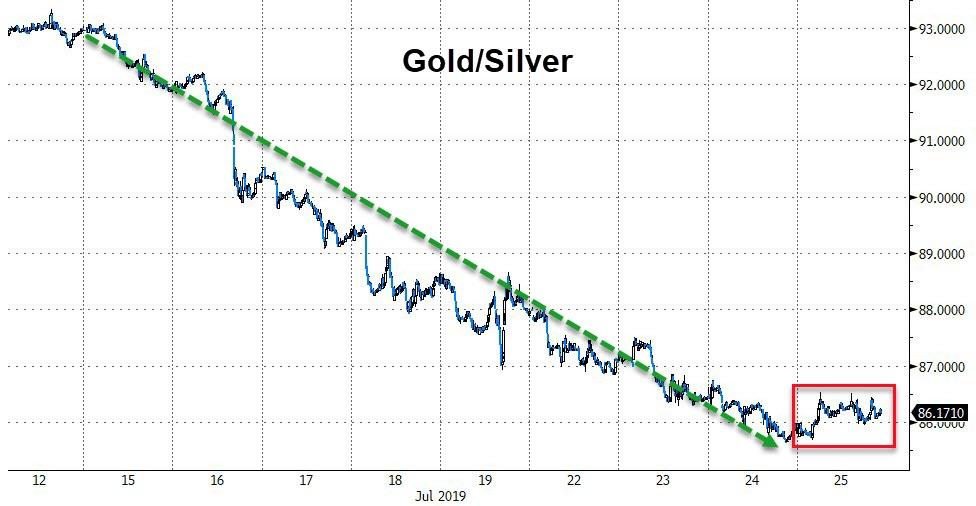

Peter noted that even as the price of gold dips with the daily market ebb and flow, investors are still buying gold stocks. And as he noted last week, silver is starting to play catch up.

Now we have all the elements that we need of a gold bull market. Before, the problem was gold was going up by no one believed it. That’s why silver was still going down. That’s why nobody was buying gold stocks, because everybody expected gold to fall. People were just so conditioned to believe that the rallies would be sold that they couldn’t believe the breakout, so there was a lot of skepticism. We were climbing this little wall of worry. But now we’re breaking down that wall.

Now we have silver outperforming gold and we have gold stocks outperforming the metal. That’s what happens in every bull market. Silver leads gold and stocks lead the metal. That’s what we’ve got all three firing on all three cylinders. That’s it. The market is going higher. People need to get in. They need to buy physical gold and silver.”

via ZeroHedge News https://ift.tt/2Y7B6Wi Tyler Durden