Stock buybacks as a result of cheap debt in the United States have been one of the key catalysts helping ram the stock market higher without rhyme or reason for the last decade.

And it isn’t until the U.S. enters into a recession that we will find out exactly how value-destructive companies buying back their own stock at ridiculous prices will have been.

But India isn’t waiting around to find out.

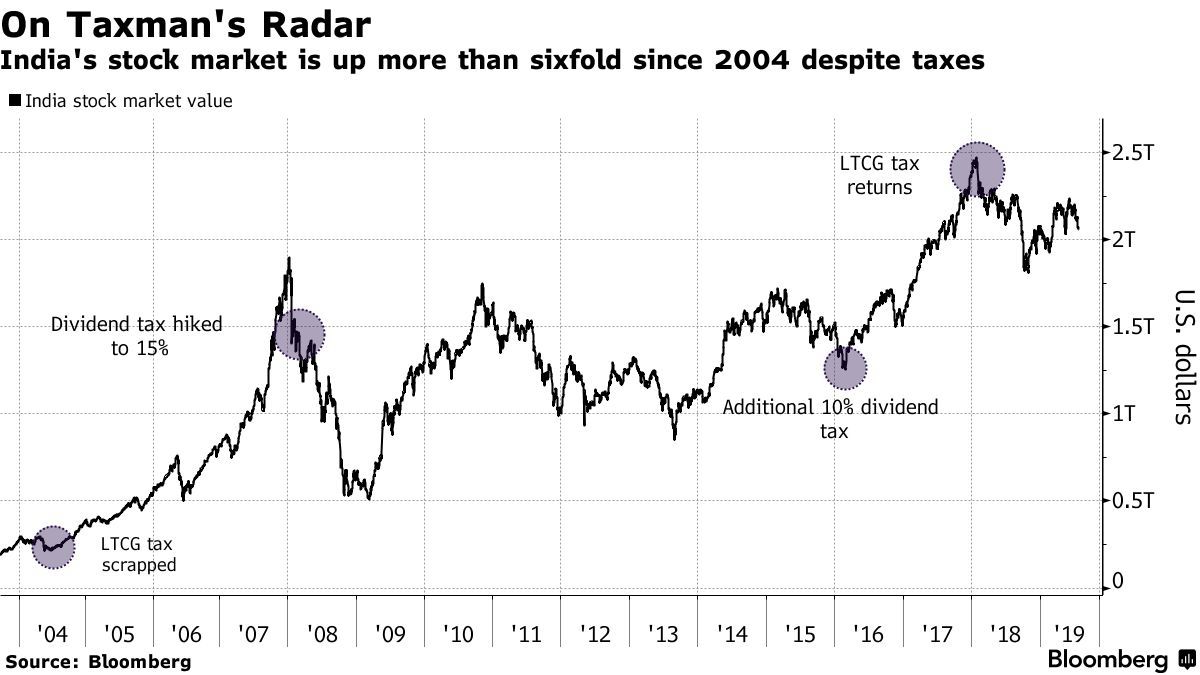

This month, it imposed a curb on its companies’ share repurchases in order to close a loophole after introducing a dividend tax two years ago. The goal is to make sure that companies wind up paying something, no matter how they return cash to shareholders, according to Yahoo Finance. India has been taxing its markets for about 15 years, after it put a duty on most financial transactions.

The taxes haven’t stopped the growth of India’s equity market, which now exceeds $2 trillion. This makes it three quarters of the size of the country’s economy. There has been some protest from the industry, both in India and echoing on Wall Street, that the taxes do more harm than good.

Nilesh Shah, who helps oversee $25 billion in assets at Kotak Asset Management Co. said:

“We need to reduce taxation on markets rather than increase it. Trust in the market is missing in every way. India’s government treats market players as speculators, not investors.”

Of course, share buybacks and dividends are nearly as old as the capital markets themselves and are two ways to return value back to shareholders. The argument is that taxing hurts entrepreneurialism and ultimately the investment that policymakers want in the first place.

Jeffrey Pontiff, a finance professor at Boston College’s Carroll School of Management said: “The big assumption that people are making in the background when they talk about preventing or limiting repurchases is, well, if shareholders get this money they are going to drink champagne. In reality people are going to invest it in other ideas.”

- Regardless, the 20% levy went into effect on July 23. Some companies had already abandoned their plans for share repurchases after the plan was announced on July 5.

Meanwhile, India already had the following financial levies:

-

A long-term capital gains tax of 10% on stock appreciation of more than 100,000 rupees ($1,449)

-

A 15% tax on companies distributing dividends, with a 10% levy on payouts exceeding 1 million rupees

-

A 10% tax on dividends paid out by equity mutual funds

-

A 0.1% tax on both the buyer and the seller in equity transactions. Differing levels of duties apply to transactions in bonds, mutual funds, commodities and stock derivatives

-

To help further address income inequality and fund the budget, the Modi administration this month unveiled plans to ramp up fees on the super-rich, with an income-tax surcharge on the highest earners more than doubling to 37%. The niggle there is that the move also affected some foreign investment vehicles. Perhaps not coincidentally, overseas investors pulled $1.8 billion in funds from Indian equities this month.

Samir Arora, the Singapore-based founder of Helios Capital Management said simply: “Forget about raising animal spirits — you have scared people.”

And these sentiments are echoing in the United States, too, as Republican Senator Marco Rubio has blasted the Trump administration for its tax cuts. Rubio has stated that the cuts benefit companies more than workers at a time where buybacks are at their highest in decades.

Alberto Manconi, a professor at Bocconi University in Milan said: “From both sides of the political spectrum, there are accusations that companies spend a lot of money on buybacks, and they invest less. That is an argument that is very puzzling to an academic. Whatever way you look at it, it is not clear the buyback is subtracting any money from the economy that could be used in a useful way.”

via ZeroHedge News https://ift.tt/30XehkP Tyler Durden