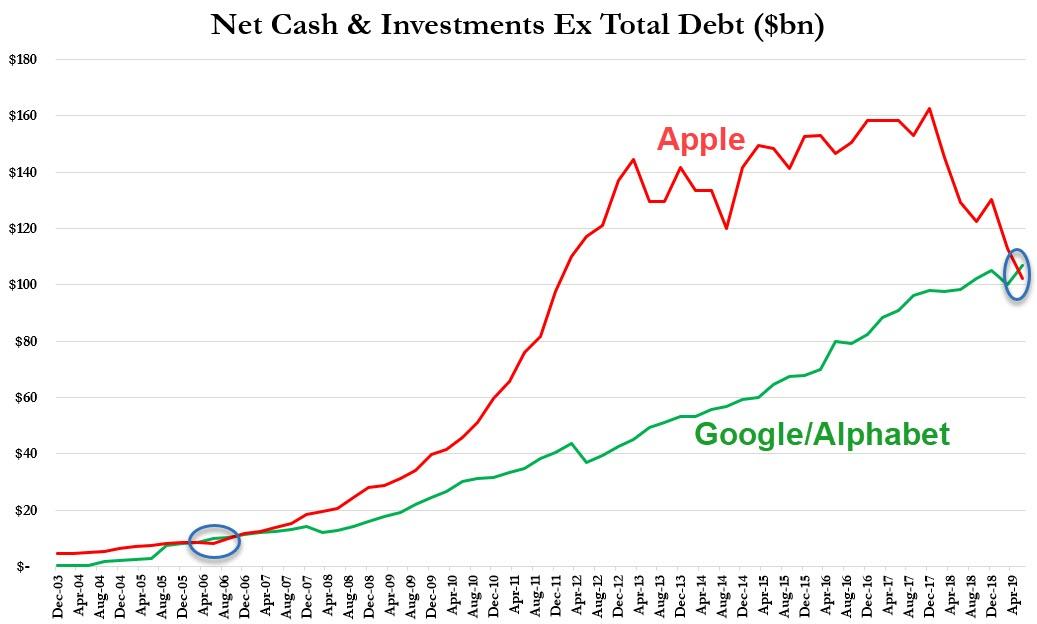

The corporate world has a new king of cash…

For the first time since 2006, Google’s (Alphabet) cash-pile is larger than Apple’s as the former hits a record high and the latter is blowing cash like a drunken sailor.

Alphabet’s $107 billion horde tops Apple’s $102 billion pittance…

As The FT reports, the switch in leadership follows a concerted effort by the iPhone maker to reduce its liquid reserves, six years after it first came under pressure from activist investor Carl Icahn to pay out more of its cash hoard. Apple’s holdings of cash and marketable securities, net of debt, has fallen to $102bn (the lowest since 2011), down from a peak of $163bn at the end of 2017.

Apple is not alone in its share repurchase panic, but even the heightened rate of buybacks may not cap the growth in Alphabet’s cash mountain. Its free cash flow this year was forecast to top $30bn, rising to almost $40bn next year, said George Salmon, an analyst at Hargreaves Lansdown.

The new buyback intentions “don’t represent a step change” big enough to actually reduce the company’s total reserves, he said.

The company’s preference for hoarding its money and spending it on trying to break into new markets, rather than using it to reward shareholders with buybacks or dividends, as Apple has done, also antagonises some investors.

“In general, their attempts to reinvent themselves with their new initiatives aren’t working out,” said Walter Price, a portfolio manager at Allianz Global Investors.

“I wish they’d return more cash to shareholders and waste less.”

Finally, we note that the rise of Google’s parent to the top of the corporate liquidity rankings puts its corporate wealth and power on conspicuous display at a politically sensitive moment. After being hit with €8.2bn in antitrust fines to the EU in the past two years, it now faces intense scrutiny in Washington… and after last night’s debate, we suspect these tech cash-piles will quickly get ‘taxed’ away under a Democrat.

via ZeroHedge News https://ift.tt/2LSxdhc Tyler Durden