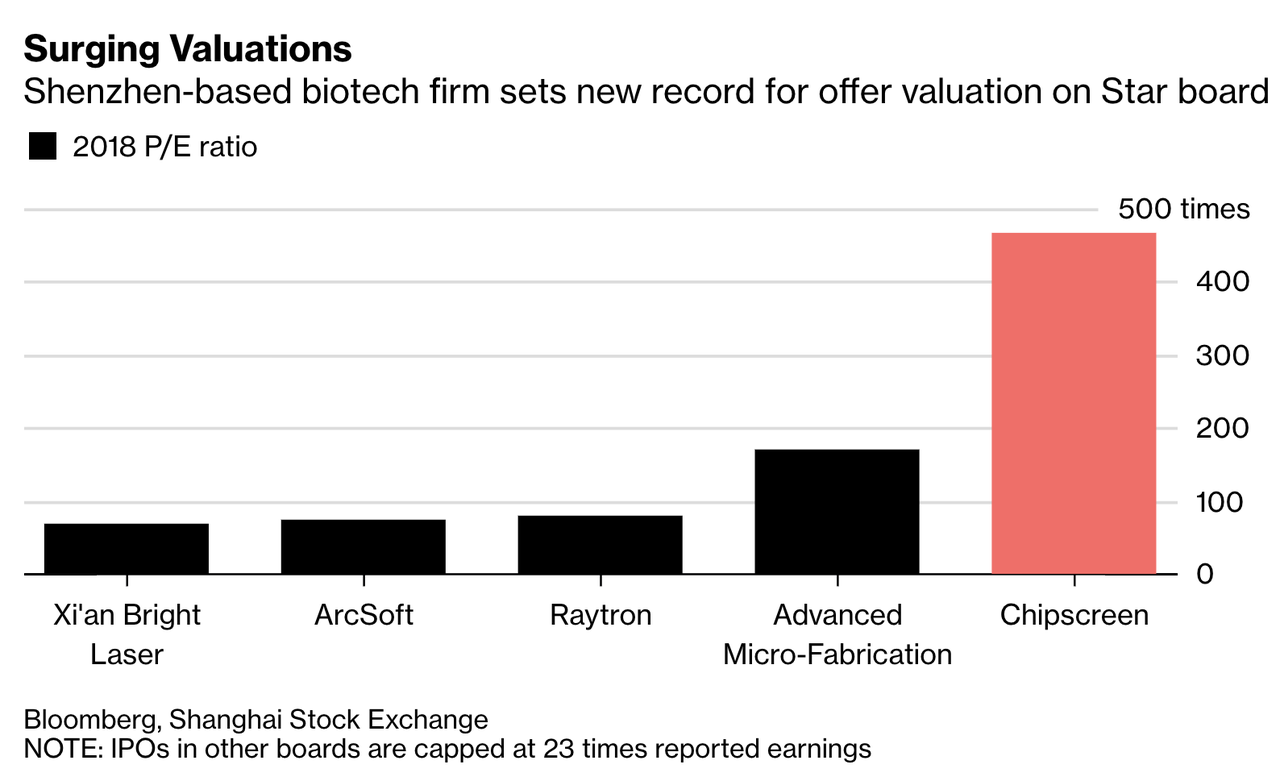

When policymakers in Beijing made the decision to remove the unwritten valuation cap for companies trading on the country’s new Star market, they probably didn’t realize that they were about to open Pandora’s box.

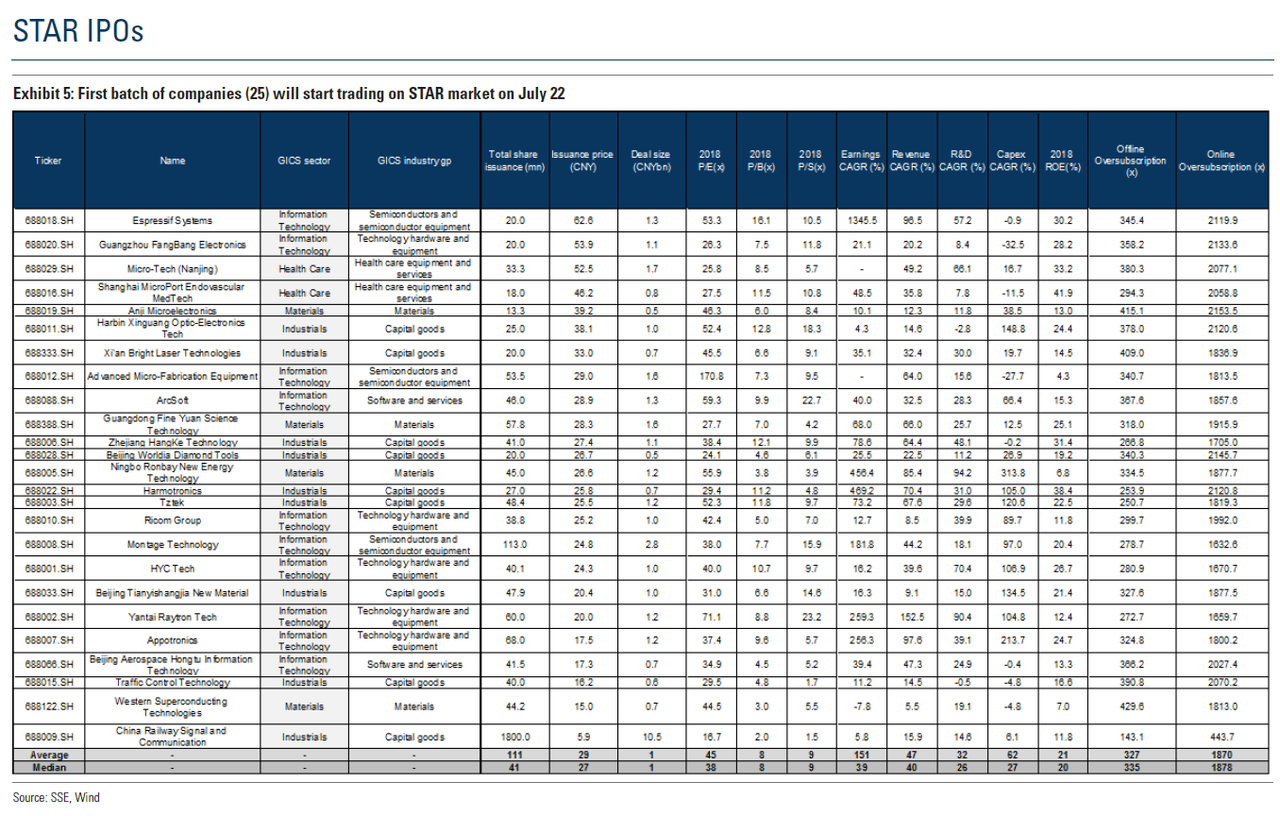

Because in a market that has become infamous for its frothy trading debuts – the 25 original Star Market stocks added $44 billion to the total A-shares market cap during their first day of trading last month – new valuation records are being set at a ridiculous pace. Earlier this week, a biotech firm that has been around for nearly 20 years priced its shares at about 468x reported earnings during its trading debut on the exchange, according to a filing.

That’s almost three times the most extreme valuations from the 25 stocks that debuted when the exchange opened last month, according to Bloomberg.

By comparison, Beyond Meat, the fake meat company stock that has been unstoppable since it debuted on the Nasdaq back in May, with its shares climbing more than 700% from its IPO price. The company’s shares currently trade at around 55 times sales (the company has yet to report a profit).

The company, Shenzhen Chipscreen Biosciences, was founded in 2001 and focuses on cancer medicines. SCB planned to raise about 1 billion yuan ($145 million) from the offering, which was 27% more than the company’s initial target.

By removing the valuation caps, Chinese regulators hope to persuade more Chinese firms to list domestically, instead of pursuing IPOs in Hong Kong, London or New York. By the looks of it, they’ve done a pretty good job. More than 120 companies are lining up to list on the exchange. Since 2014, Chinese regulators have imposed a regulatory cap of 23x earnings for all IPOs. That was intended to prevent retail investors from getting their faces ripped off in China’s notoriously volatile equity market. Though, apparently, regulators’ priorities have shifted.

Advanced Micro-Fabrication Equipment was the priciest IPO among the venue’s first batch of 25 stocks, which started trading last week. It has almost tripled in value since originally listing at 171x earnings.

In its filings, SCB said its rivals typically trade at 31 times reported earnings.

We’ll let you work out the math on that one.

via ZeroHedge News https://ift.tt/33c0jOf Tyler Durden