Back in April and then again in June 2018, when the world was stressing about rising inflation, higher interest rates, future Fed rate hikes and so on, the strategist who over the past two years has emerged as the most insightful from JPMorgan’s analyst corps, Nikolaos Panigirtzoglou, made an extremely contrarian and very unpopular prediction – especially to his permabullish JPM colleague Marko Kolanovic – when he pointed out that contrary to expectations of rising inflation and steeper yield curves, the global forward bond curve had in fact just inverted, which suggested that despite what an army of bullish analysts was predicting, a sharp market drop was upcoming.

He was, of course, right and just three months later global stocks began their biggest drop since the financial crisis, which culminated in a mini bear market for the S&P, which however lasted just a few minutes as the crash in risk assets spooked Jerome Powell and prompted the Fed to slam the breaks on further tightening, to kill the Quantiative Tightening “autopilot”, to turn dovish and to eventually launch the first rate cut cycle since 2007 last week.

Needless to say, ever since then we have been especially focused on what JPM’s Panigirtzoglou has to say, because unlike all of his penguin peers who merely paraphrase the bullish echo chamber, he actually has some very valid and actionable insight.

Which is why, as we usually do, we read Panigirtzoglou’s latest weekly “Flows and Liquidity” periodical with great interest, not only due to its aggregation of some of the best financial thoughts and observations around, but because just like in early 2018, Panigirtzogou appears to have spotted a paradigm-shifting tipping point which could have dramatic, and dire, consequences for capital markets.

As is traditional, Panigirtzoglou starts off by focusing on the most important recent macro event, in this case the unexpected re-escalation in the US-China trade war, which similar to May, is creating recession-like/risk-off market dynamics with government bonds rallying and equities and risky assets selling off, resulting in the infamous “alligator jaws” chart.

But what JPM’s Greek strategist finds most troubling in this week’s events is that rate markets were signaling a higher risk of a US recession or protracted slowdown post FOMC even before the tariff announcement came out on Thursday.

In other words, even before this week’s tariff announcement, the Fed had failed to convince the rate markets that we are in a “mid-cycle adjustment”/ “insurance rate cuts” phase like 1995/1998, as Powell repeatedly claimed we are. Instead, and far more ominously, post-FOMC rate markets priced in an “even more protracted Fed rate cut cycle which is typically seen during severe economic slowdowns or recessions.”

First of all, the reason why the market is likely convinced that the Fed made a mistake is that as we noted last Sunday before the FOMC announcement, compared to 2007, or the last time the Fed launched an easing cycle – and cut rates by 50bps more than the current 25bps – conditions currently are far worse.

In other words, in attempting to avoid taking a hard-line easing stance as a result of two hawkish dissenting votes, Powell ended up taking a bad situation and making it even worse by only confusing the market.

Meanwhile, if one extends the comparison between the current economy and the “insurance” periods envisioned by Powell, i.e. when the Fed did precautionary rate cuts in 1995 and 1998, here are the differences one we can observe:

during both 1995 and 1998 the Fed had managed to re-steepen the front end of the US curve by cutting rates by 75bp. This is because at the time the Fed had over-delivered both in terms of the speed and magnitude of rate cuts, to wit:

- In 1995, a month before the first cut, rate markets were pricing around 60bp of rate cuts over 12 months and the Fed delivered 75bp over six months.

- In 1998, a month before the first cut, rate markets were pricing around 40bp of rate cuts over 12 months and the Fed delivered 75bp over three months.

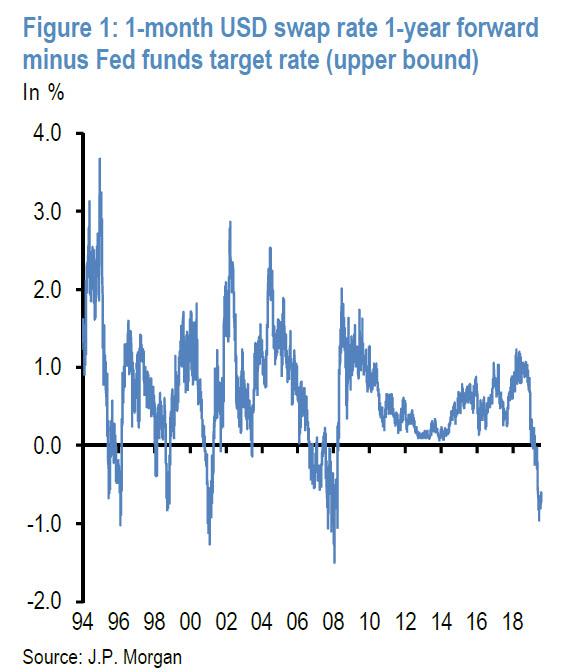

The re-steepening that the Fed had managed to engineer at the time is shown in Figure 1 which shows that the very front end of the US curve stopped being inverted and re-steepened sharply following 75bp of rate cuts (unlike now).

Here’s the bigger problem: unlike 1995 and 1998, rate markets are currently doubting that the Fed will do enough to re-steepen the curve in the foreseeable future. Case in point: the spread between the 1-month OIS rate 2-years forward vs the 1-month OIS rate 1-year forward had declined to -11bp post FOMC vs. -8bp before the FOMC meeting. In other words the forward curve flattened rather than steepened following this week’s FOMC meeting with rate markets effectively implying a lower likelihood of a repeat of the re-steepening experience of 1995/1998. In fact – and this is why what the Fed achieved last week is nothing short of policy failure – the front end is currently implying that even if the Fed cuts rates three more times over the next year, the curve would still be inverted at the front end!

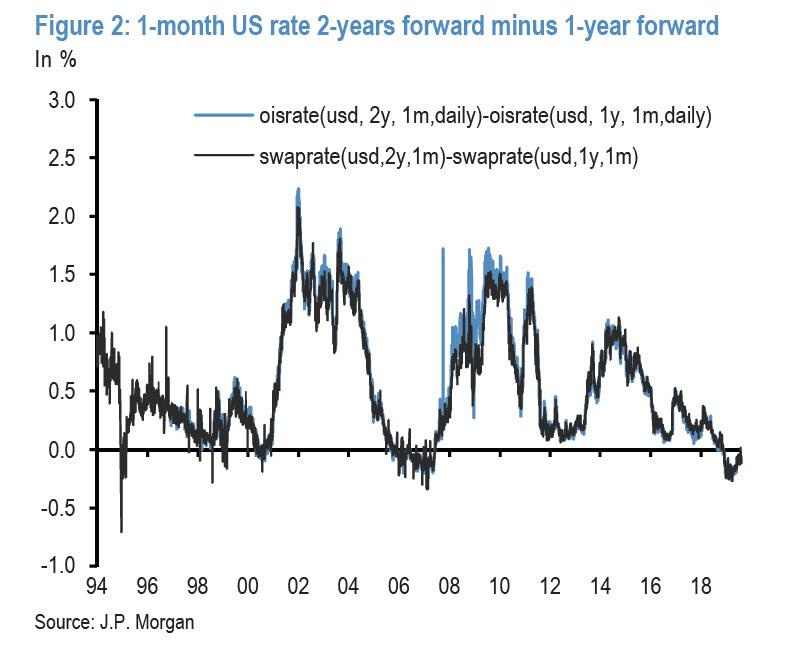

During both 1995 and 1998 episodes the forward spread i.e. the 1-month rate 2-years forward minus 1-year forward, entered negative territory only very briefly.

However, as the JPM strategist shows, the persistent negativity of this forward spread at the moment is reminiscent more of the 2001/2007 recession episodes rather than the 1995/1998 mid-cycle Fed policy adjustment episodes.

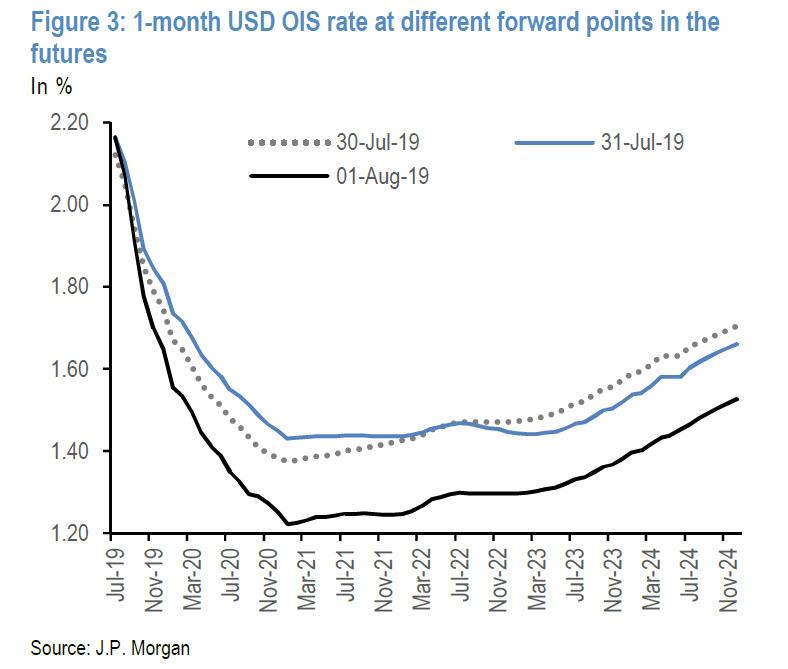

The flattening at the front end of the US curve following this week’s FOMC meeting is also depicted in Figure 3 which shows the 1-month US OIS rate at different forward points in the future, pre-FOMC (July 30th) and post- FOMC (July 31st).

Not only did rate markets continue to price in a protracted rate cut cycle until the beginning of 2021 after this week’s FOMC meeting , but the curve flattened completely between the beginning of 2021 and the beginning of 2023, pointing to persistent flatness. This suggests that, even before this week’s tariff announcement, the Fed was seen by rate markets after this week’s FOMC meeting as less likely to deliver the 1995/1998 “mid-cycle adjustment” “insurance rate cuts” experience that both the Fed and equity markets have been looking for.

This means that even before Trump’s shocking tariff announcement, the disconnect between rate and equity markets had worsened after the FOMC meeting! Naturally, Trump’s announcement – which may well have been to prompt even more rate cuts by the Fed – only made things even worse with the market now demanding even more easing from the Fed.

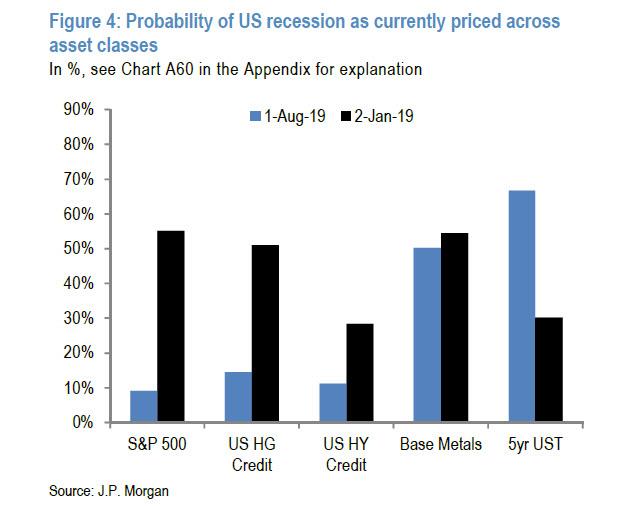

Meanwhile, if one looks solely at the bond market instead of stocks, recession risk increased further after the tariff announcement on Thursday with the front end of the US curve as of August 1st squeezing in an extra rate cut by next year, effectively pointing to a deeper rate cut cycle. In turn this makes the disconnect between equity and rate markets even more striking when viewed through the lens of JPMorgan’s US recession probabilities framework shown in the next chart, which shows a simple analysis for gauging US recession risks based on the current distance of asset prices from their most recent peak, compared with the peak to trough move seen in a typical US recession.

Following this week’s UST rally, the 5yr UST yield is now pointing to an implied probability of a US recession of 70% vs. only 5%-10% probability implied by the S&P500 or US HY credit. In other words, after this week, it is becoming even more difficult to reconcile government bond markets with risky markets, i.e. equity and credit markets.

Which brings us to the $64 trillion question: will the Fed keep cutting rates by another 100bp by the beginning of 2021 to only provide insurance in a good growth environment to satisfy both equity and bond markets at the same time. In other words – and here we urge readers to once again look at the alligator jaws chart above – the only way the divergence between bonds and stocks is sustainable, is if the Fed cuts at least another 4 times.

Will the Fed do this? According to JPMorgan, “most likely not” unless of course Trump manages to transform World Trade War III into something even more dire, so as Panigirtzoglou concludes, “one of the two markets is likely to prove wrong.” It was so obvious which one, that the JPM strategist didn’t even both to point out which.

via ZeroHedge News https://ift.tt/2T1Ymz7 Tyler Durden