Six years ago, back in 2013, we presented what we then viewed (and still view) as the best trading strategy of the New Abnormal period, when we said that buying the most shorted names while shorting the names that have the highest hedge fund and institutional ownership is the surest way to generate alpha, to wit:

… in a world in which nothing has changed from a year ago, and where fundamentals still don’t matter, what is one to do to generate an outside market return? Simple: more of the same and punish those who still believe in an efficient, capital-allocating marketplace and keep bidding up the most shorted names.

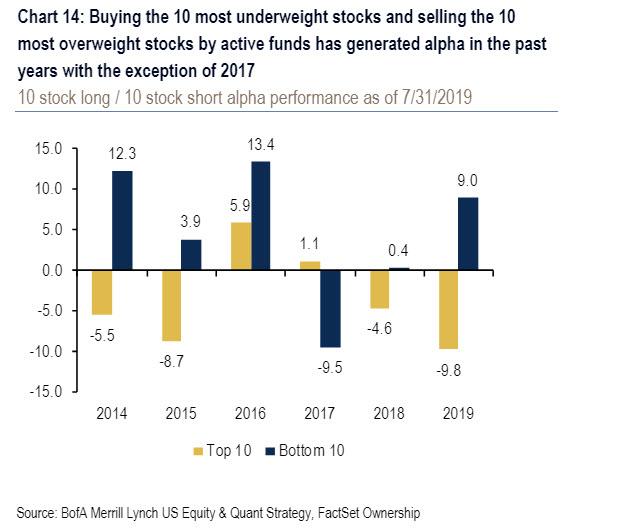

Fast forward to today, when Bank of America confirms once again that with just one exception, the historically unvolatile 2017, going long the most shorted names and shorting the most popular ones has continued to be not only the most consistently profitable, alpha-generating strategy, but that in 2019 YTD, the top 10 crowded stocks underperformed the 10 most neglected stocks by 19% YTD, a 5-year record!

One simplistic reason for this – besides the ones we enumerated six years ago – is that the most overowned stocks are generally clustered in either high secular growth or defensive/yield/low beta, leaving a broad swathe of high quality cyclical stocks neglected and inexpensive.

It’s also why high quality cyclicals are BofA’s preferred area of the market, because as the bank claims, absent a full-blown recession, cyclicals likely represent “coiled springs”.

There is another, more credible reason why such a contrarian strategy continues to be the best performing one: technicals, specifically crowding, and massive lazy bets among Wall Street professionals which, when unwound once a poorly-researched thesis collapses, result in a major overshoot in the opposite direction that is a gift to those who had the trade on.

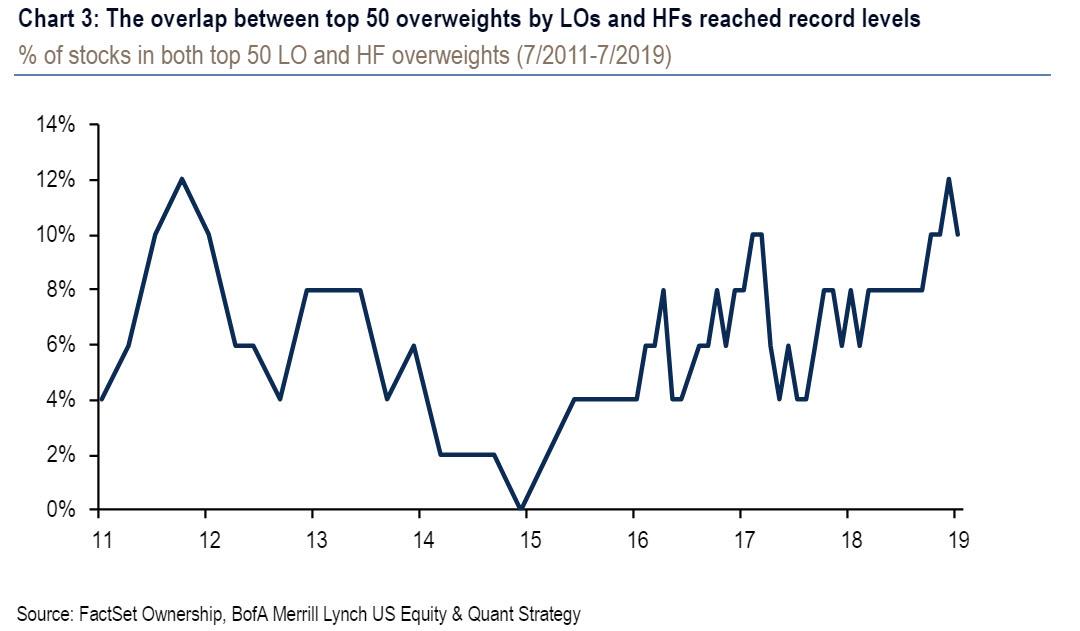

Indeed, never has the power of positioning been more actuve than in 2019, when as BofA recently calculated, the overlap between positioning by mutual funds and hedge funds reached an all time high, and as a result, “positioning has been a big driver of returns in 2019” (we discussed this topic far more extensively back in April in “BofA Finds The Secret Recipe How To Consistently Beat The Market“)

This means that if one were to short those stocks that were bought by virtually everyone (and vice versa on the short side), it was only a matter of time before a paradigm shift resulted in countless stop outs, and a generous payday for those who bet against the crowd.

Something like that happened last week on Wednesday, when the Fed cut rates by 25bps, and provided commentary interpreted as somewhat more hawkish than market expectations. What happened next – the sharp initial selloff – confirmed that active positioning was far more dovish than what we got. Indeed, as we warned last weekend, based on CFTC data, not only were stocks massively overbought ahead of the Fed’s (disappointing rate cut), but asset managers’ equity futures exposure reached a post-crisis high. In other words, contrary to the fake news spewed on CNBC, everyone was – in fact – long, and the whiplash that ensued resulted in substantial losses for countless hard and trend-following funds.

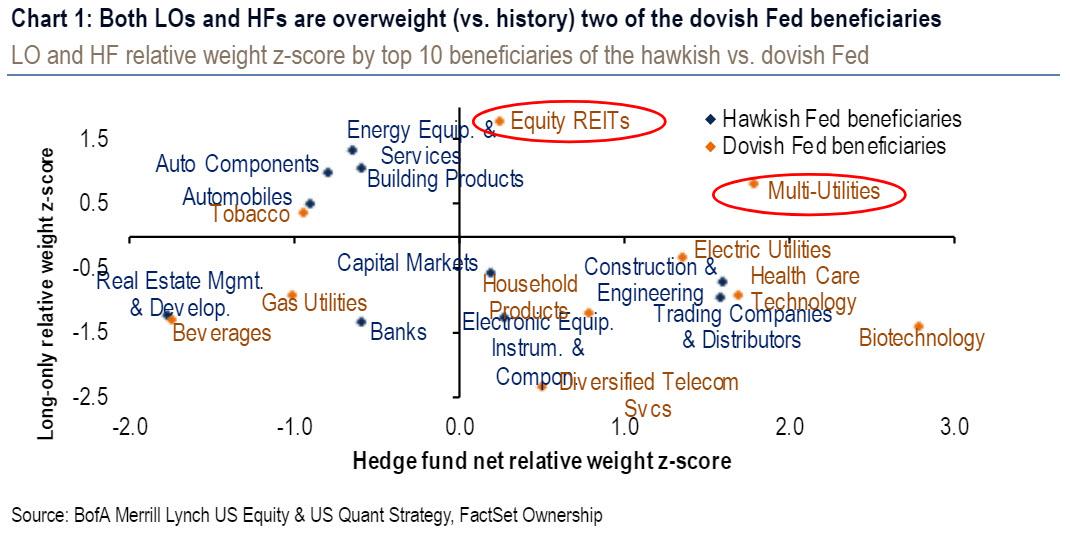

Meanwhile, as BofA warns, the only two industries with Fed risk that were overweight by both “long only” funds and hedge funds, were dovish beneficiaries (Multi-Utilities and Equity REITs).

It is these most crowded, high-dividend yielding segments that could be at risk if the Fed fails to mollify or reverse the market’s hawkish interpretation.

And while that is BofA’s micro recommendation, the big picture still stands: for anyone who wants to consistently make money in this broken market in which nothing is as it seems, and in which the vast majority is always wrong, the best way to do that is to do what we said back in 2013, namely to always bet against the crowd on both the long and short side.

The bottom line: when we said 6 years ago to buy the most hated names while shorting the most loved ones, we were right. As shown by BofA, this is how much alpha this strategy has returned in subsequent years:

- 2014: +17.8% (12.3% from shorts, 5.5% from longs)

- 2015: +12.6% (3.9% from shorts, 8.7% from longs)

- 2016: +7.5% (13.4% from shorts, -5.9% from longs)

- 2017: -10.6% (-9.5% from shorts, -1.1% from longs)

- 2018: +5.0% (0.4% from shorts, 4.6% from longs)

- 2019 YTD: 18.8% (9.0% from shorts, 9.8% from shorts)

The question now is whether this apparently still obscure trade will finally stop generating alpha if more investors put it on. On the other hand, since by definition there will always be stocks that are “most crowded” and “most shorted”, this may be a strategy that is limited to those who are relatively small and nimble and can avoid moving the entire market. Which incidentally may be the latest reason why this is a market where smaller, contrarian traders will be rewarded even as the “whales” who trade based on idea dinner recommendations are doomed to fade into obscurity.

via ZeroHedge News https://ift.tt/2T9uGQz Tyler Durden