Global markets and US equity futures slumped as traders turned their attention to rising odds of a no-deal Brexit and awaited new developments in the increasingly unpredictable Sino-American trade war, while a deepening inversion of the U.S. bond yield curve a day earlier reignited worries over the possibility of recession, sending investors towards safe-haven assets from the Japanese yen to gold, while the 30Y Treasury yield tumbled to a new all time low amid a burst of overnight Asian buying.

On Tuesday, the U.S. yield curve inverted to levels not seen since 2007, stoking a sell-off on Wall Street, as 2s10s inversion has historically been the best predictor of a U.S. recession.

“Hope gave way to pragmatic realism about the outlook for the China-U.S. trade dispute,” Greg McKenna, strategist at McKenna Macro, wrote in a note Wednesday. “The market is still trying to get a feel for where it’s at and what it thinks as we get closer to the deadline for the tariffs this week.”

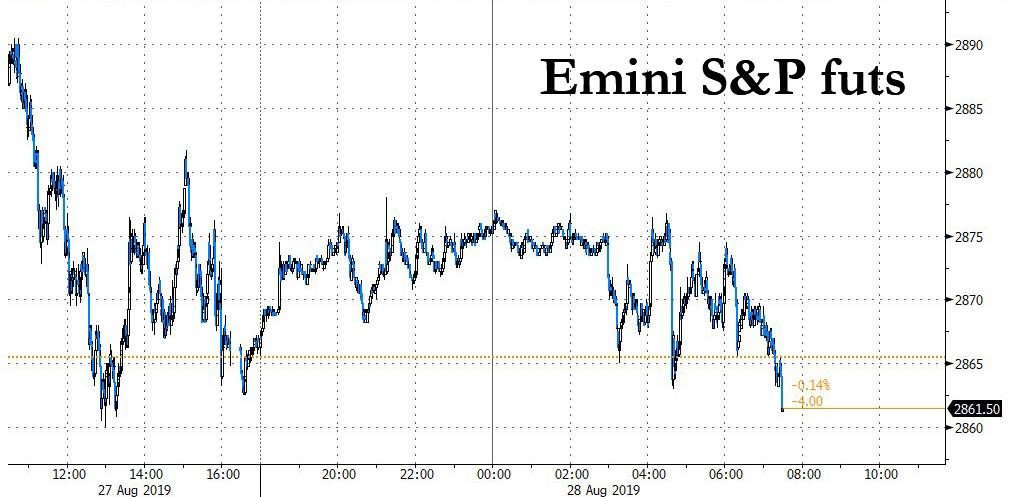

MSCI’s world equity index, fell 0.1%, dragged down by European shares. S&P500 futures traded in a range between 2865 and 2875 before sliding to session lows as US traders entered the office…

… while technology companies and insurers led a decline on the Stoxx Europe 600 index, which dropped as much as -0.9%, as bourses in Paris and Frankfurt underperformed.

“It’s become very difficult for investors to garner an idea of where we go to next,” said CMC Markets chief strategist Michael Hewson. “The weakness in bond yields and the strength in havens speaks to an investor that is becoming increasingly risk-averse.”

UK stocks bucked the trend, with the FTSE gaining sharply as sterling dived 1% on Prime Minister Boris Johnson’s move to restrict parliamentary time before Britain’s planned departure from the European Union. Johnson will limit parliament’s ability to derail his Brexit plans by unveiling his new legislative agenda on Oct. 14, a government source told Reuters, stoking fears of an economically disruptive no-deal departure from the EU. The pound, already trading lower on the day, was last down 0.6% at $1.2210.

In Italy, the FTSE All Italia Bank Index gained as much as 1.3%, outperforming the broader market, amid news that UniCredit is said to be exploring taking direct control of its holding in Turkish lender Yapi Kredi. UniCredit rose as much as 2%, among the SX7P top performers today.

Meanwhile, on the political front, the center-right Democratic Party leader signaled support for a potential coalition with Five Star. As a result Italy’s bonds surged after Five Star Movement and Democratic Party back Giuseppe Conte – who just resigned days earlier as part of his feud with the League’s Salvini – as Prime Minister, taking an important step toward forming a new government without a snap election.

Thanks to this political optimism, Italy’s 10-year yield fell 12bps to 1.01%, a record low, while the BTP-bund spread narrowed 10bps to 173bps, the tightest since May 2018.

Earlier in the session, stocks nudged higher in Sydney and Seoul, were little changed in Tokyo, and slipped in Shanghai and Hong Kong. Material producers climbed and health care firms retreated, as China prepared for the worst in trade negotiations with the U.S. The Topix closed little changed as real estate firms rallied, countering declines in machinery makers. The Shanghai Composite Index dropped 0.3%, dragged by Kweichow Moutai and financial giants, even as China rolled out a series of guidelines to encourage consumption, easing car-purchase restrictions. India’s Sensex fell 0.8%, driven by HDFC Bank and Reliance Industries, after a gauge showed investment and consumption worsened in the country.

The 10-year Treasury yield stayed below 1.50%, near a three-year low, after falling on Tuesday to 6 basis points below the two-year yield, with the 10-year yield close to three-year low touched on Monday. Longer-dated bond yields also fell, with the 30-year Treasury yield dropping to a record low of 1.9039%, and was last down 6 basis points on the day.

Elsewhere, in rates, bunds rose and curves bull flattened as equities fall; 30-year swap spreads lead tightening, pointing to continued large receiving flows in euro swaps. The German 10y yield dropped -2bps to -0.72%; Sept. bund futures +30 ticks to 179.24; France 10y -3bps to -0.44%; Italy 10y -12bps to 1.02%. British Gilts rose, outperform bunds and Treasuries by 2bps and 3bps respectively as PM Johnson seeks to suspend Parliament in a move that hampers lawmakers’ attempts to prevent a no-deal Brexit.

In FX, sterling was the biggest mover as noted above, after U.K. Prime Minister Boris Johnson said he will ask the Queen to suspend parliament from mid-September to mid-October, increasing the risk of a no-deal Brexit. The safe haven yen traded at 105.78 per dollar. It held its gains from the previous day, when it advanced 0.35% to a 7-month peak amid rising trade fears. The dollar index gained 0.1% to 98.094, while the euro was flat.

Crude oil extended gains after API showed a bigger-than-expected drop in American crude inventories and as Iran all but ruled out a meeting with the U.S. Gold turned positive after starting the day in the red, and was last flat at $1,542.91. Silver gained 1.2%, putting it on course for its fourth straight day of gains.

Today’s expected data include mortgage applications, which tumbled 6.2%. Elastic, Five Below, Okta, and PVH are among companies reporting earnings.

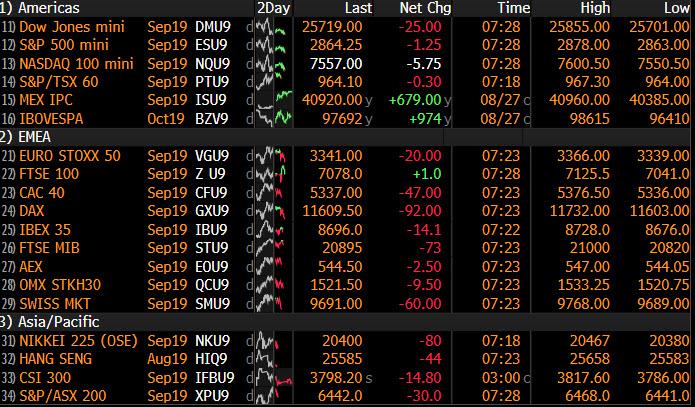

Market Snapshot

- S&P 500 futures down 0.1% to 2,861.50

- STOXX Europe 600 down 0.2% to 372.78

- MXAP up 0.05% to 151.10

- MXAPJ down 0.07% to 486.98

- Nikkei up 0.1% to 20,479.42

- Topix up 0.04% to 1,490.35

- Hang Seng Index down 0.2% to 25,615.48

- Shanghai Composite down 0.3% to 2,893.76

- Sensex down 0.8% to 37,353.64

- Australia S&P/ASX 200 up 0.5% to 6,500.64

- Kospi up 0.9% to 1,941.09

- German 10Y yield fell 0.8 bps to -0.701%

- Euro down 0.05% to $1.1085

- Italian 10Y yield fell 18.4 bps to 0.794%

- Spanish 10Y yield rose 0.2 bps to 0.085%

- Brent futures up 0.9% to $60.04/bbl

- Gold spot down 0.2% to $1,539.84

- U.S. Dollar Index up 0.2% to 98.16

Top Overnight News from Bloomberg

- Italian President Sergio Mattarella meets with the country’s main political leaders on Wednesday in a last-ditch bid to carve out a viable majority in parliament and avert a snap election. Negotiations between the anti-establishment Five Star Movement and the Democratic Party have stalled repeatedly

- President Trump’s credibility has become a key obstacle for China to reach a lasting deal with the U.S., according to Chinese officials familiar with the talks who asked not to be identified

- Members of the U.S. House Foreign Affairs Committee are pressuring Trump to sanction Turkey for the purchase of the Russian-made S-400 anti-aircraft missile system

- U.K. government sees an opportunity to restart Brexit negotiations with the EU after Prime Minister Boris Johnson’s meetings last week with German Chancellor Angela Merkel and French President Emmanuel Macron

- Oil extended gains after a report showed a bigger-than-expected drop in American crude inventories and as Iran all but ruled out a meeting with the U.S.

- Australia’s sovereign wealth fund has reiterated future returns won’t be as strong as recent years, joining a chorus of big investors concerned about the investment outlook

- Wary of Trump, China is preparing for the worst case in trade talks. After a weekend of confusing signals, Trump’s credibility has become a key obstacle for China to reach a lasting deal with the U.S., according to Chinese officials familiar with the talks who asked not to be identified

- Emerging market investors are piling back into safer asset classes as mounting trade tensions spell the end of this year’s clamor for yield. Fears of global slowdown — the fallout of Trump’s trade war — and the collapse of the Argentine market have dealt a blow to junk and local-currency bonds this month

Asian equity markets struggled for direction after the subdued performance on Wall St, where the major indices failed to sustain initial gains amid the recent mixed signals on US-China trade and as the US yield curve inversion deepened. ASX 200 (+0.4%) was led higher by strength in tech and miners although gains were capped by weakness amid telecoms as and with earnings in focus, while Nikkei 225 (+0.1%) also lacked firm direction amid an uneventful currency. Hang Seng (-0.2%) and Shanghai Comp. (-0.3%) traded tentatively and failed to benefit from the government’s recent announced measures to boost consumption with markets wary after the recent flip-flopping in the US-China trade saga, while a neutral PBoC liquidity operation and deluge of earnings ahead of the Big 4 bank results added to the cautious tone. Finally, 10yr JGBs were slightly higher as super-long yields declined to multi-year lows with both 30yr and 40yr JGB yields at the lowest since July 2016, while the moves also followed the bull flattening seen in their US counterparts where the 2s/10s inversion briefly widened past -5bps.

Top Asian News

- Indonesia Sees Second Wave of Trade War Fallout as More Damaging

- Hong Kong Tycoon Kadoorie Urges Effort to Ease Youth’s ‘Despair’

European equities are lower across the board [Eurostoxx 50 -0.6%] with the exception of the FTSE 100 (+0.3%) as exporters benefit from a weaker Sterling amid reports that UK PM Johnson is said to be moving to block attempts by pro-EU MPs from making a no-deal Brexit impossible. Sectors are mostly in the red with underperformance seen in the IT sectors, potentially amid reports that Permira is planning a Frankfurt listing for software company TeamViewer GmbH this year which could be the Germany’s largest IPO in almost 20 years. Meanwhile, the energy sector is the marked outperformer as oil prices are underpinned by a larger-than-forecast draw in API crude inventories. In terms of individual movers, H&M (+4.4%) shares are at the top of the Stoxx 600 amid an upgrade at RBC. Meanwhile, losses in UK homebuilders exacerbated amid the aforementioned move by UK PM Johnson. Elsewhere, AstraZeneca (+1.2%) trades higher after an FDA granted an orphan drug designation and after its Breztro Aerosphere Phase III trial met its primary endpoint.

Top European News

- Banks Near Tipping Point as Negative Rates Draw Danish Warning

In FX, a week may be a long time in politics, but for Sterling 24 hours is all it has taken to turn from major outperformer to laggard as Brexit positivity evaporates and the prospect of a no confidence vote in the UK Government rises on the back of PM Johnson’s request to the Queen to suspend Parliament. In short, the move is being framed as a tactical decision to head off legislative attempts to stop a no deal Brexit by curtailing the amount of time between the now delayed Queen’s speech (October 14 from 7 originally) and October 31 Article 50 extension date. In response, Cable tumbled from just under 1.2300 to circa 1.2156 and not far from technical support around 1.2150 in the form of the 21 DMA at 1.2149, while Eur/Gbp rebounded almost a full point towards 0.9125 before the Pound pared some lost ground.

- USD – The Dollar is obviously deriving indirect impetus from Sterling’s demise, but also firmer against all G10 counterparts bar the Euro that is holding close to 1.1100 on more progress towards a new Italian political partnership between the PD and 5-Star Movement. Hence, the DXY is consolidating above the 98.000 level, albeit within a confined 98.173-003 range ahead of a couple of Fed speakers and the latest Beige Book.

- NZD/CAD/AUD/JPY/CHF – As noted above, all weaker vs the Greenback, albeit to varying degrees as the Kiwi slips back below 0.6350 and towards 1.0650 against the Aussie that is pivoting 0.6750 and only partially impeded by overnight data showing considerably weaker than forecast Q2 construction work. Meanwhile, the Loonie is still straddling 1.3300 as fragile/weak risk sentiment offsets firm crude prices, with the Yen and Franc regaining some safe-haven allure, but remaining off recent peaks, as Usd/Jpy hovers near 105.75 and Usd/Chf meanders between 0.9810-30. Note, several hefty option expiries could have a bearing on direction into Wednesday’s NY cut including 1.8 bn in Eur/Usd at the 1.1100 strike, 1 bn in Aud/Usd from 0.6700-10 and 1.1 bn in Usd/Jpy between 105.75-80.

- EM – Broad weakness vs the Buck, but the Lira deriving comfort from another significant improvement in Turkish sentiment and this time on the consumer front. Indeed, Usd/Try is probing 5.8000 support even though Turkey and Russia are pressing ahead with more arms deal plans and the US House of Foreign Affairs Committee is urging President Trump to sanction Turkey. Conversely, the Rouble and Rand are not benefiting from the rebound in Brent and latest SA economic package respectively.

In commodities, WTI and Brent futures are higher as prices are underpinned by last night’s API crude inventory data which printed a significantly larger-than-forecast draw in API crude stocks (-11.1mln vs. Exp. -2.1mln). WTI futures reside north of 55.50/bbl ahead of its 200 and 50 DMAs at 560.7/bbl and 56.53/bbl respectively, whist its Brent counterpart remains just above 60/bbl. ING point out that the WTI/Brent Arb has narrowed further after initially feeling pressure from China’s 5% tariff on US oil. Elsewhere, gold prices remain flat just under the 1550/oz mark whilst copper are modestly firmer with the red metal back above the 2.55/lb mark. Finally, Dalian iron ore prices fell to the lowest in 2 ½ months as falling steel prices continue to raise concerns regarding iron ore demand. Morgan Stanley lowers oil demand growth forecasts: 2019 to 800k BPD (Prev. 1.0mln BPD), 2020 to 1.0mln BPD (Prev. 1.4mln BPD), Brent prices are now expected to fluctuate around USD 60/bbl (Prev. USD 65/bbl)

US Event Calendar

- 7am: MBA Mortgage Applications, prior -0.9%

- 12:20pm: Fed’s Barkin Speaks to West Virginia Chamber of Commerce

- 5:30pm: Fed’s Daly Speaks at RBNZ/IMF Conference in New Zealand

DB’s Jim Reid concludes the overnight wrap

Given the UK temperature before I went on holiday was at record levels and given the temperature since I’ve come back has returned to fresh late August records my daughter Maisie asked me last night whether holidays abroad were actually to cool down. She only seems to know hot English summers and miraculous England cricketing victories. I don’t know how to break the cruel realities of the world to her.

I might also have to tell her that bond yields can also go up as well as well as down as a peripheral led rally in Europe saw yields break lower again yesterday. Indeed 10y Bunds closed at -0.693% and -2.7bps on the day while OATs ended -4.2bps lower at -0.418%. It was BTPs which really stood out though, rallying -18.4bps to 1.133% and the most since July 3rd. That means BTPs are now within 10bps of the 2016 yield lows of 1.042% while the spread to Bunds is now down to 183bps and the tightest since May last year. Those moves seemed to bleed through to the Treasury market where 10y yields ended -6.4bps lower at 1.471%. We are now only just over 11bps from the all time low in summer 2016 and have actually only traded lower than current levels on 18 days in the whole of US history covering 11 days in mid-2016 and 7 days during the Euro sovereign crisis in 2012.

Meanwhile the 2s10s curve flattened -4.7bps to a new cycle low of -5.3bps (c -4bps in Asia). The inversion is in danger of being locked in. Whether the Fed wants to or whether it’s even merited, they may have to cut 50bps in September to encourage the yield curve back into positive territory. An interesting conundrum for them.

While the Fed probably wants to focus on their macro objectives, they received another broadside in the press yesterday, this time from former NY Fed President Dudley. In a Bloomberg opinion piece, he openly questioned if the Fed should ease policy to counteract the negative effects of the ongoing trade uncertainty. He said that “Trump’s reelection arguably presents a threat to the US and global economy, to the Fed’s independence and its ability to achieve its employment and inflation objectives. If the goal of monetary policy is to achieve the best long-term economic outcome, then Fed officials should consider how their decisions will affect the political outcome in 2020.” Truly unchartered waters for an ex-Fed official.

The driver of the moves in BTPs came as coalition talks between Five Star and the PD gained momentum, even if there was some posturing from Five Star and threats to end the talks unless there was a commitment from PD to publically commit to a new government led by Conte. This morning Italian daily Corriere della Sera is reporting that the PD has accepted Five Star’s demand to keep Conte as premier but is holding out for a larger number of ministries in exchange – possibly including finance – and also no Di Maio in government. More news likely on this story today.

Not to be outdone though, Greek 10y yields rallied -13.8bps yesterday following the announcement on Monday that the last of the capital controls were to be lifted from September 1st. Greek equities also closed higher, with the main stock market finishing +0.32%.

The rest of equity markets in Europe also ended slightly higher with the FTSE MIB (+1.52%) the obvious outperformer with an index of Italian Banks also up +1.08%. In the US the mood was a little more negative with the S&P 500 (-0.32%), DOW (-0.47%) and NASDAQ (-0.34%) fading to close lower. The only substantive news was the reiteration by China’s foreign ministry that they are unaware of any high-level phone calls between the two sides that moved negotiations forward. They were just reiterating their previous statement, but it still poured some cold water on any signs of progress as per Mr Trunp’s G7 remarks just before the European open on Monday. Cyclical sectors mostly underperformed in the US – financials in particular ending down -0.98%.

Overnight, Asian markets are trading mixed with the Nikkei (+0.15%) and Kospi (+0.59%) up while the Shanghai Comp (-0.33%) is down and the Hang Seng (+0.05%) is trading flattish. As for FX, all G10 currencies are trading weak (range c. -0.1% – -0.3%) this morning and the onshore Chinese yuan is trading flattish at 7.1575. Yields on 10y JGBs are trading down -0.7bps to -0.285% and are within touching distance of their September 2016 low of -0.295%. Elsewhere, futures on the S&P 500 are up +0.38% and WTI oil prices are +1.04% this morning on a report from the American Petroleum Institute highlighting that US crude stockpiles fell by 11.1mn barrels last week and as Iran all but ruled out a meeting with the US until sanctions are lifted.

In other news yesterday, the economic data in the US ended up surprising to the upside. That was particularly the case for the August consumer confidence report which saw consumer confidence print at 135.1 compared to expectations of 129.0. The present situations component jumped 6.7pts to 177.2 which shows some resilience to the recent trade noise, and in fact puts it at the highest level since 2000. The expectations component did nudge a little lower though. On the other hand another plus was the jobs-plentiful/jobs hard-to-get series which rose to the highest since 2000 too. Interestingly the data goes against that of the University of Michigan survey and in fact the gap between the two consumer confidence readings is the largest since 1969 and second largest on record.

Meanwhile, the Richmond Fed manufacturing index climbed yesterday, jumping 13pts to +1 in August (vs. -4 expected). So that further complicates the picture from the mixed PMIs and regional Fed surveys. The only other data came from the housing market where the S&P CoreLogic house price index rose +0.04% mom in June and a little less than expected.

As for the data that was released in Europe yesterday, in Germany we got confirmation that Q2 GDP contracted -0.1% qoq, unrevised from the preliminary estimate. In the eyes of our economists, this confirmed their “technical” but no “severe recession” situation in Germany with their expectation that the economy contracted by around 1/4% qoq in Q3. Meanwhile, in France the August confidence indicators were broadly on the positive side with beats for the business and manufacturing indicators, while consumer confidence printed in line.

Elsewhere, the ECB’s Guindos said yesterday that the ECB “has to act with determination” when asked about negative rates and also that the ECB will have to be much more data dependent and take market expectations “with a pinch of salt”. A reminder that the ECB meeting is just over 2 weeks away now on September 12th, kick-starting a period of 7 days in which we’ll have central bank meetings at the ECB, Fed, BoJ and BoE.

To the day ahead now, where the data this morning includes the July import price index reading in Germany and July M3 money supply reading for the Euro Area. There’s no data due in the US however we are due to hear from the Fed’s Barkin and Daly this evening at separate events.

via ZeroHedge News https://ift.tt/2ZuNb3t Tyler Durden