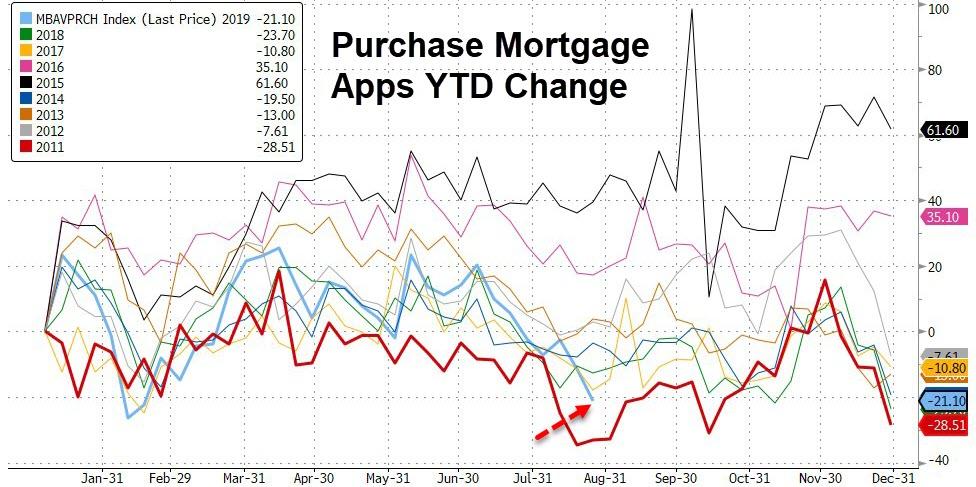

Despite mortgage rate plunging to near two-year lows, the mini refi-boom has stalled and purchase applications continue to plunge…

Overall mortgage applications fell 6.2% from last week with both refi (-7.6%) and purchase (-4.0%) sliding. Purchase apps are back at their lowest since February

Source: Bloomberg

And while rates have tumbled it has sparked no incremental demand for new purchases…

Source: Bloomberg

This is the weakest purchase mortgage year since 2011…

Source: Bloomberg

Mortgage bankers appear to be blaming Trump for the lack of buying…

“U.S. Treasury yields were volatile over the course of the week, as the ongoing trade dispute between the U.S. and China continued to generate uncertainty among investors. Rates increased for the first time since the week of July 12, but were still 80 basis points lower than the beginning of the year,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting.

“With rates edging higher, refinances and purchase applications fell, at 8 percent and 6 percent, respectively.”

Added Kan, “Purchase applications were still up around 2 percent year-over-year last week, but the drop in rates this summer have not yet led to a significant boost in activity. Uncertainty over the near-term economic outlook and low supply continue to be the predominant headwinds for prospective homebuyers.”

So, why exactly is The Fed being urged to cut rates?

via ZeroHedge News https://ift.tt/2Pjt5tg Tyler Durden