Google has reportedly become the latest company to aggressively move production out of China and in to Vietnam as it hopes to create a “low-cos supply chain in Southeast Asia” that “will serve as a springboard for its growing hardware ambitions,” according to Nikkei Asian Review.

Google, which is working with a partner to manufacture its smartphones, started work on converting an old Nokia factory in the North Vietnamese province of Bac Ninh where it will produce most of its Pixel phones, per two people familiar with the company’s plans. The area has a special significance in the history of smartphone development: It is the same province where Samsung built its first smartphone supply chain roughly ten years ago.

All of this history means Google will have access to an army of workers experienced.

The push to develop a Vietnamese production base reflects the twin pressures of higher Chinese labor costs and the spiraling tariffs resulting from the trade war between Washington and Beijing. The U.S. internet giant intends to eventually move production of most of its American-bound hardware outside of China, including Pixel phones and its popular smart speaker, Google Home, according to the sources.

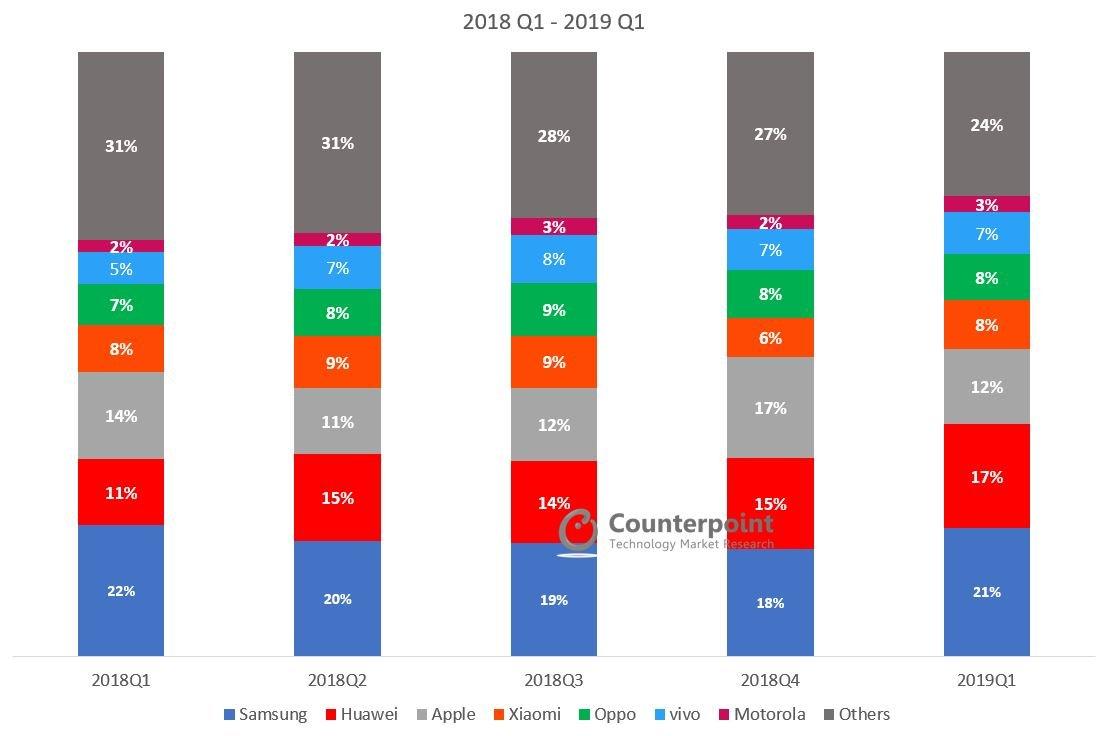

The Vietnam production lines will be a key part of Google’s drive for growth in the smartphone market. Google aims to ship some 8 million to 10 million smartphones this year, double from a year ago, sources told the Nikkei Asian Review. While Google’s Pixel smartphone brand is still a minor player in the industry – not even ranking in the global top 10, according to tech research firm Counterpoint – it is growing rapidly.

The Vietnam production line is a critical component of Google’s strategy to boost growth in its Pixel smartphone brand. The company is planning to ship some 8 million units this year, roughly 2x the level from last year.

The Vietnam production lines will be a key part of Google’s drive for growth in the smartphone market. Google aims to ship some 8 million to 10 million smartphones this year, double from a year ago, sources told the Nikkei Asian Review. While Google’s Pixel smartphone brand is still a minor player in the industry – not even ranking in the global top 10, according to tech research firm Counterpoint – it is growing rapidly.

The mid-priced Pixel, launched in April, helped Google become the fifth largest mobile brand in the U.S. for the second quarter of 2019, grabbing market share despite a wider industry slump.

Google’s aggressive hardware campaign is expected to heap pressure on second-tier mobile makers such as LG Electronics and Sony, which are struggling as the industry faces its third consecutive year of decline.

Google shipped fewer than 5 million Pixel units last year, accounting for only 0.3% of the global smartphone market. Nearly all of its smartphone sales were recorded in the US.

In 2018, Google shipped some 4.7 million smartphones, which only accounted for 0.3% of global market share, research company IDC said. However it has already shipped 4.1 million units in the first half, according to IDC, thanks to the Pixel 3A, priced at $399.

Nearly 70% of Google’s smartphone sales in 2018 were in the U.S., its biggest market, followed by the U.K. and Japan, according to IDC. For smart speakers, the U.S. accounted for some 64% of shipments.

In the chart below from Counterpoint Research, a firm that tracks the global smartphone market, Google’s Pixel brand is incorporated into the ‘other’ category.

To be sure, even if Google hits all of its targets, it’ll still be only a minor player in the global smartphone market, at best. As for its smart speakers, which compete with Amazon’s Echo, some production will be moved to Thailand, though much of its initial production will remain in China.

Google is the latest company to diversify production outside China to protect itself from the fallout from the burgeoning US-China trade war. While it’s not much of a player in the smartphone market, its Android operating system is a dominant player that runs on Samsung phones, and phones made by other companies. Android is so dominant, that the company’s decision to cut off access to Huawei for the Chinese telecoms giant’s smartphones sold outside China created serious problems for the company.

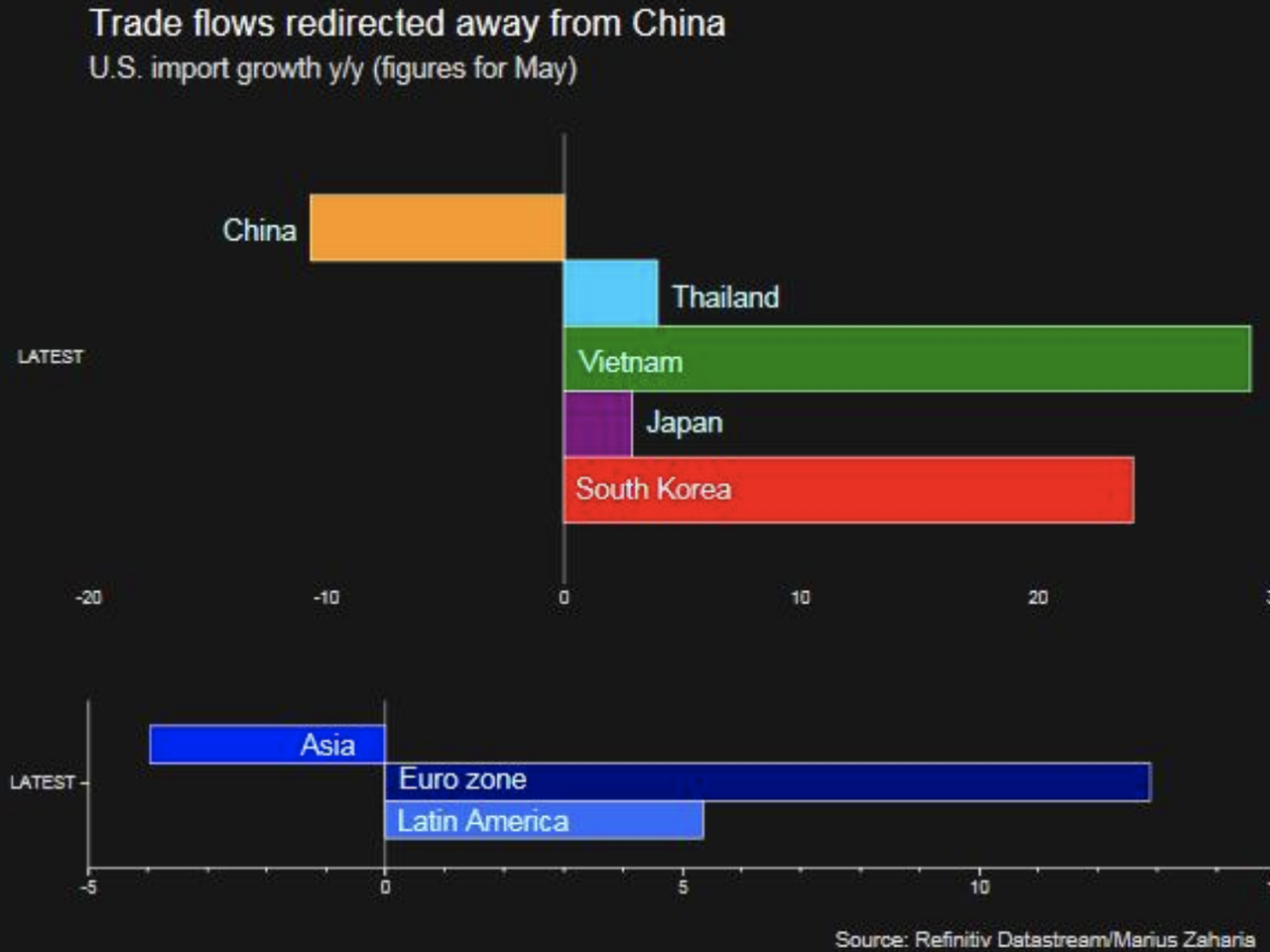

Both Vietnam and Thailand have benefited from the companies efforts to diversify production outside China, lending some credence to President Trump’s claims that the trade war is hurting China’s critical manufacturing sector. Though, of course, Beijing has retaliated by ramping up tariffs on American agricultural goods, harming American farmers.

But for Google, building up its smartphone business is less about shifting units, and more about demonstrating the power of its Android OS, as one analyst pointed out.

“For Google’s smartphone business, it’s still less about selling hardware but is really to demonstrate how powerful its mobile system and software could be,” said Joey Yen, an analyst at IDC. “The main goal of Google’s hardware business is to help the expansion of its core software, data, and advertisement business and to grow its ecosystem.”

And as Google continues to quietly prepare for its re-entry into the Chinese market (see: Project Dragonfly, which it told the world it had scrapped but appears to still be active) it knows it can’t move all of its Chinese production elsewhere.

“Google are likely to keep some activities inside China. The US company knows that if it is going to be serious about making hardware, it could never give up the massive Chinese market,” one of the sources said. “However, they also understand that, due to rising costs and the macro-environment, they need to have production outside China for the long term in order to support their hardware manufacturing.”

Google is the latest to seek safety by diversifying its production as the trade war intensifies. HP and Dell have relocated their server production away from China to dodge Washington’s punitive tariffs, while also shifting some notebook production to Taiwan and other Southeast Asian countries such as Vietnam, Thailand and the Philippines. Apple also has started to evaluate how it might diversify its supply chain, though it remains heavily reliant on China with more than 90% of its hardware manufactured in the country.

The US tech giant refused to confirm or deny these reports, but Nikkei Asian Review has been at the forefront of reporting about tech companies and their plans to diversify production outside of China. As they’ve explained in the past, the trade war isn’t the only factor driving this trend: Rising wages on the mainland have also inspired companies to look to establish production in cheaper markets like Vietnam.

via ZeroHedge News https://ift.tt/30Bs4Ol Tyler Durden