The IMF just broke its own record of incompetence: less than a year after its record, $57 billion bailout of Argentina was finalized, S&P just downgraded the country from B- to Selective Default – the equivalent to a default rating – following the government’s “reprofiling” of its debt on August 28, when it unilaterally extended the maturity of all short-term paper due to the continued inability to place short-term paper with private-sector market participants. Some $101 billion in debt is affected.

However, the selective default state will last for just one day, as only a few hours later, S&P will upgrade Argentina from SF to CCC-. As S&P explains, “under our distressed exchange criteria, and in particular for ‘B-‘ rated entities, the extension of the maturities of the short-term debt with no compensation constitutes a default. As the new terms became effective immediately, the default has also been cured. Therefore, we plan to raise the long-term ratings to ‘CCC-‘ and the short-term ratings to ‘C’ on Aug. 30, in line with our policies.”

Here is the full summary of today’s action, per S&P:

- Following the continued inability to place short-term paper with private-sector market participants, the Argentine government unilaterally extended the maturity of all short-term paper on Aug. 28. This constitutes default under our criteria, and we are lowering the local and foreign currency sovereign credit ratings to ‘SD’ and the short-term issue ratings to ‘D’.

- The administration is also sending legislation to Congress seeking support from the Argentine political class to engage in a re-profiling of the remaining debt, so we are lowering our long-term foreign and local currency issue ratings to ‘CCC-‘ on heightened risk of a default under our criteria.

- As the new terms for short-term debt have become effective already, we plan to raise the sovereign credit ratings from ‘SD’ on Aug. 30. We plan to raise the long-term sovereign credit ratings to ‘CCC-‘ and the short-term sovereign credit ratings to ‘C’.

The rating agency also provided the following rationale for its action:

Following the continued inability to place short-term paper with private-sector market participants, the Argentine government unilaterally extended the maturity of all short-term paper on Aug. 28. Under our distressed exchange criteria, and in particular for ‘B-‘ rated entities, the extension of the maturities of the short-term debt with no compensation constitutes a default. As the new terms became effective immediately, the default has also been cured. Therefore, we plan to raise the long-term ratings to ‘CCC-‘ and the short-term ratings to ‘C’ on Aug. 30, in line with our policies.

Lowering the long-term issue ratings on Argentina to ‘CCC-‘ from ‘B-‘ reflects heightened risk of another distressed exchange as the Macri Administration seeks approval from Congress to engineer a possible maturity extension of all long-term debt in the remainder of its current term in office. This action is in line with our ‘CCC’ rating criteria and distressed exchange criteria as we see the most likely scenario as an extension of maturities, which will not be compensated by the issuer. Alternatively, there are risks associated with failure to advance, and prospects for ongoing stressed market dynamics post the national elections.

We lowered our transfer and convertibility assessment to ‘B-‘ from ‘B’. The transfer and convertibility assessment remains higher than the sovereign rating because the government aims to avoid capital controls and preserve international reserves with its action on short-term debt and potential action on long-term debt.

The heightened vulnerabilities of Argentina’s credit profile stem from the quickly deteriorating financial environment, the absence of confidence in the financial markets about policy initiatives under the next administration–elections are not until October–and the inability of the Treasury to roll over short-term debt with the private sector.

This has immensely stressed debt dynamics amid a depreciating exchange rate, a likely acceleration in inflation, and a deepening economic recession.

These factors have stressed capacity to pay, leading to the maturity extension of short-term debt.

The catalyst for the downgrade was Wednesday’s largely expected announcement by Economy Minister Hernan Lacunza, who said that the government will postpone $7 billion of payments on short-term local notes held by institutional investors this year and will seek the “voluntary reprofiling‘’ of $50 billion of longer-term debt. It will also start talks over repayments on $44 billion it has received from the IMF (this means that the IMF’s biggest source of funding, the US, will likely be impaired).

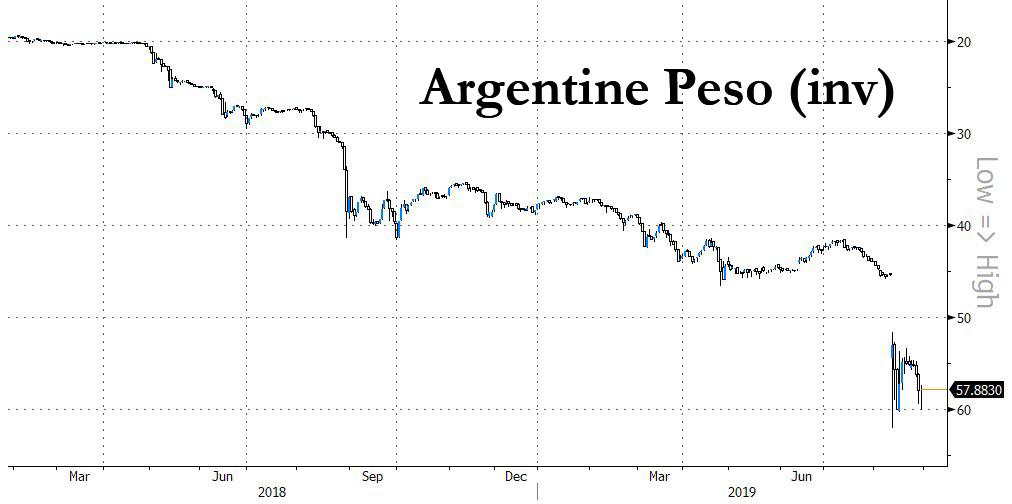

Argentina’s currency and bonds, which have been in freefall since opposition leader Alberto Fernandez routed market favorite President Mauricio Macri, in an Aug. 11 primary vote, plunged more today, with the peso down more than 20% since then and bonds have hit record lows. CDS traders now price in an over 90% chance of default in the next five years.

S&P’s downgrade to SD follows two, less draconian actions from both Fitch, and itself: on Aug. 16 Fitch cut the country’s long-term issuer rating by three notches to CCC from B, while S&P lowered the country’s sovereign rating to B- from B and slapped a negative outlook on it.

IMF officials who were visiting Argentina at the time of the announcement said they are analyzing the measures. “Staff understands that the authorities have taken these important steps to address liquidity needs and safeguard reserves,” the lender said in a statement.

The discredited IMF, which was also intimately involved (and some say caused( in Argentina’s prior bankruptcy, is expected to disburse another $5.3 billion in the next few months from a record $57 billion agreement, although it’s no longer certain given the current crisis, especially with Christine Lagarde leaving the IMF on her way to take over the ECB and destroy Europe.

Should the IMF cut off Argentina, and without markets access, the country is facing a quick and painful insolvency. According to Bloomberg, Morgan Stanley estimated that Argentina needed $12.9 billion for repayments on Treasury bills and bonds in the last four months of the year. Most of those payments have now been pushed back to next year.

Meanwhile, Argentina is burning through its last remaining dollar reserves. Gross foreign exchange reserves have fallen to $57.5 billion, but Capital Economics estimates that net reserves which exclude deposits at commercial banks are currently at $19 billion, down from $30 billion in mid-April, and the central bank has been spending about $300 million per day to avoid a total collapse in the ARS. According to Bloomberg, that amount only covers a quarter of Argentina’s gross external financing needs of $100 billion, which includes debt maturing over the next year plus the current account deficit. In other words, either the country’s creditors will agree to a massive haircut, or the IMF must prepare for another, even recorder bailout of Argentina with no assurance that the state won’t just keep defaulting.

And speaking of humiliation, while this is the IMF’s 2nd default involving Argentina, for Argentina it’s just another day in the park: the Latin American country has had 8 defaults since independence. After this week, mark it 9.

via ZeroHedge News https://ift.tt/2UdZ396 Tyler Durden