Chinese youth may have more to worry about than their social credit score. According to the Wall Street Journal, China’s younger generations are loading up on debt like drunken sailors.

And according to the Journal’s Stella Yifan Xie, Shan Li and Julie Wernau, this boost in consumption couldn’t come at a better time for the Chiense economy.

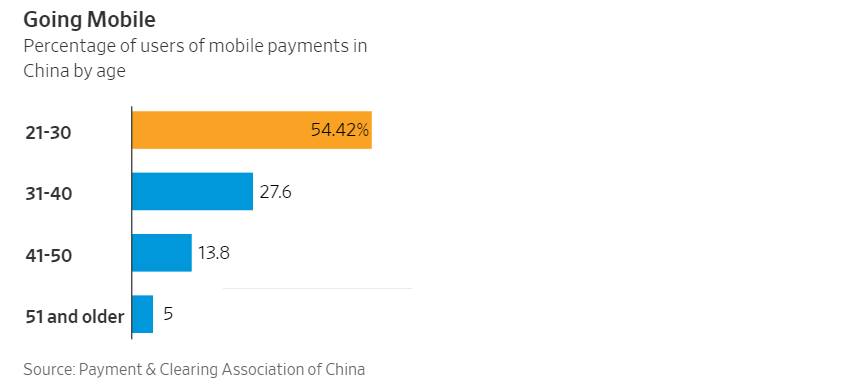

While previous generations were frugal savers—a product of their years growing up in a turbulent economy with a weak social safety net—the more than 330 million people born in China between 1990 and 2009 behave much more like Americans, spending avidly on gadgets, entertainment and travel. –WSJ

The result? China’s economy is receiving a much-needed diversification at a critical juncture – mainly amid pressure from a tariff-driven slowdown thanks to the Trump administration. Beneficiaries of the spending glut include Alibaba Group, Tencent Holdings, and other tech companies according to the report.

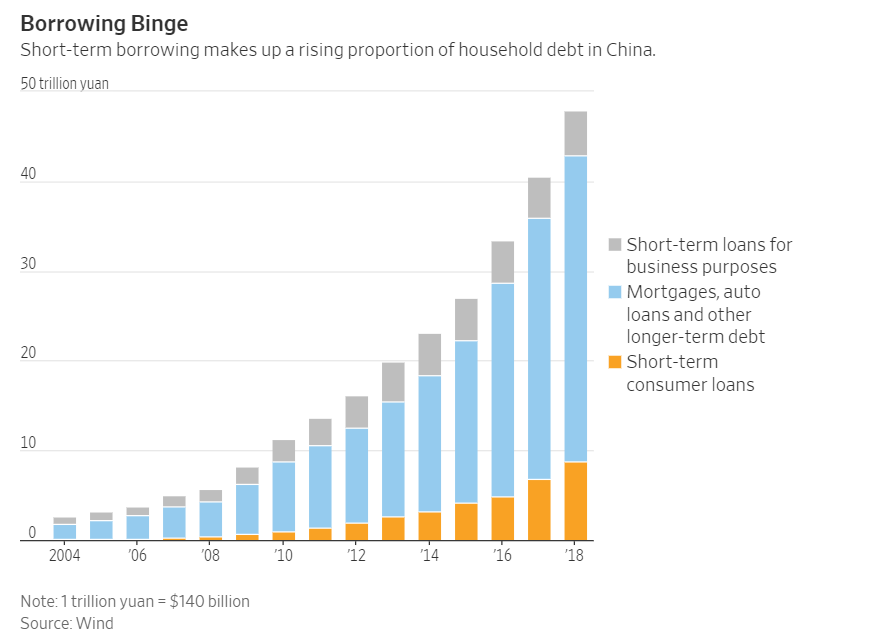

The downside – as all to many in the West know – is rising household debt over the past several years as Chinese youth continue to borrow for their purchases. “As household debt climbs, some economists worry the country’s debt burdens overall could become unmanageable and weigh on China’s growth,” according to the Journal.

Nearly a quarter of Chinese car buyers under 30 – a figure expected to rise to around 60% by 2025 according to Volkswagen Group head of market research and customer intelligence, Zhou Ya, who adds that the demographic will be crucial to the company’s success in the country.

Fueling the fire are short-term lenders such as Ant Financial Services Group, which charges up to 16% APR depending on the borrower’s credit.

A 2018 survey in China by Rong360, a loan recommendation website, found that around half of respondents who took out consumer loans were born after 1990.

Most had borrowed from multiple lending platforms, the survey found, and nearly a third took out short-term loans to repay other debts. Nearly half of them had missed payments.

One of the most popular ways to borrow is a Huabei account, a revolving credit line embedded in China’s Alipay mobile payments network. Huabei has extended loans in excess of 1 trillion yuan, or more than $140 billion, since its launch in April 2015, a person familiar with the matter said. Ant Financial, which owns Alipay, declined to disclose any figures related to Huabei.

To avoid catastrophe, some economists say the Chinese will have to rein in household borrowing to sustainable levels. Worst case, a glut of consumer, government and corporate debt could amplify the economic slowdown.

This is worth watching, as rapid growth in consumer credit is often a precursor to financial crises. pic.twitter.com/7MDNi1tunU

— robert cyran (@rob_cyran) August 29, 2019

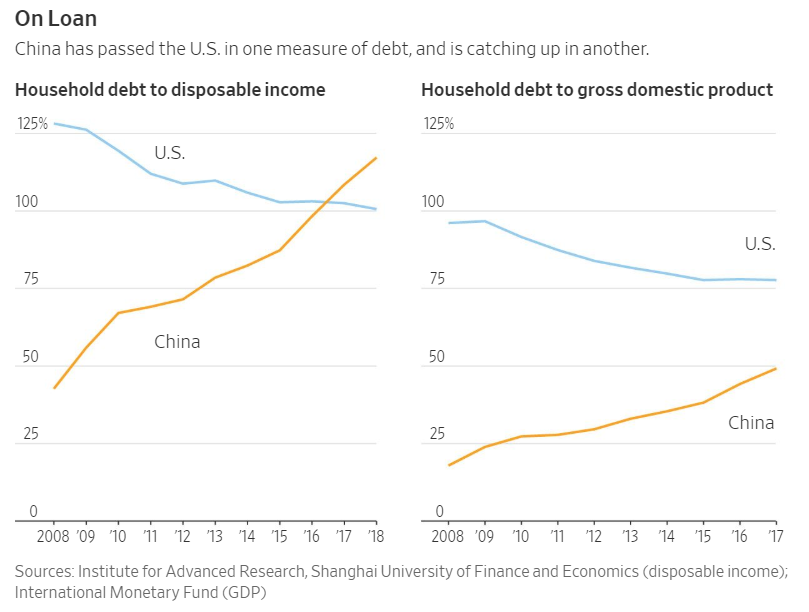

According to JPMorgan, China’s ratio of household debt to GDP will reach 61% by 2020, up from 26% in 2010. Currently, this is higher than both Italy and Greece, and could quickly become a full blown crisis if young Chinese workers lose their jobs or see their wages cut. That said, at present default rates on consumer loans appear relatively low.

Right now, over 8.3 million Chinese college students are expected to graduate vs. around six million just 10 years ago, and only 165,000 in 1989. Unfortunately for the glut of new “qualified applicants,” some of China’s largest employers such as e-commerce company JD.com have cut jobs as their growth has stalled.

Where have we heard that one before?

As the U.S. saw in the 2008 financial crisis, default rates can shoot up rapidly when growth slows.

This generation “has no idea what a rainy day feels like,” said Dong Tao, an economist at Credit Suisse in Hong Kong. “Any consumer credit boom will always be tested—no exception,” he says.

He points to mortgage debt as a deepening problem across China’s economy, including for young people. Mortgage debt outstanding grew from $1.1 trillion in the fourth quarter of 2012 to $3.9 trillion as of June.

Mortgages accounted for about a third of China’s medium- to long-term loans, up from 20% in 2012, according to the People’s Bank of China.

The Journal’s case studies in spendthrift Chinese youth sounds a lot like kids in America. First, we meet Liu Biting – who’s operating at the margin and hasn’t yet taken on debt.

Liu Biting, 25 years old, says she spends all of her paycheck each month: 10,000 yuan ($1,400) a month from her marketing job in Shanghai. About a third goes to rent, and the rest on food, her sewing hobby, going out, music and other products. So far, she has avoided falling into debt.

Until recently, one of her monthly expenses was a clothing rental subscription that cost $70 a month. She liked it, she says, because she could “try out a lot of strange clothes.” She discovers makeup brands on a WeChat account she follows that recommends products, many of them local.

“For my parents’ generation, for them to get a decent job, a stable job, is good enough—and what they do is they save money, they buy houses and they raise kids,” she says. “We see money as a thing to be spent.”

Her parents repeatedly ask her how much she has saved in her three years of working. “I say, ‘I’m sorry, probably nothing.’ All my friends are like this. We have no savings and we don’t really care about it.”

Next, we have 24-year-old Wang Xinyu – who says he has about $11,200 in debt spread over six credit cards. Most of Wang’s debt was accrued while he was in college. Now, he earns around $600 per month at a Beijing bookstore – putting “his entire salary toward paying down his debt,” while still relying on credit to pay for food and rent.

“[S]ometimes uses one credit card to pay back another,” according to the report.

Chinese parents, meanwhile, are helping their kids to buy homes – which Tao, the Credit Suisse Economist, sees as a red flag. Japan saw similar multi-generational real-estate purchases in the 1980s, “sometimes with three generations helping to pay for a mortgage,” which may be a sign that the market is overheated.

Shortly thereafter, Japan’s economy took a nosedive and real-estate prices corrected.

What happens in China if your social credit and your financial credit bottom out?

via ZeroHedge News https://ift.tt/2ZDEu77 Tyler Durden