Authored by Jack Martin via CoinTelegraph.com,

The new breed of stablecoins led by Facebook’s Libra could be vulnerable to failure in periods of network stress.

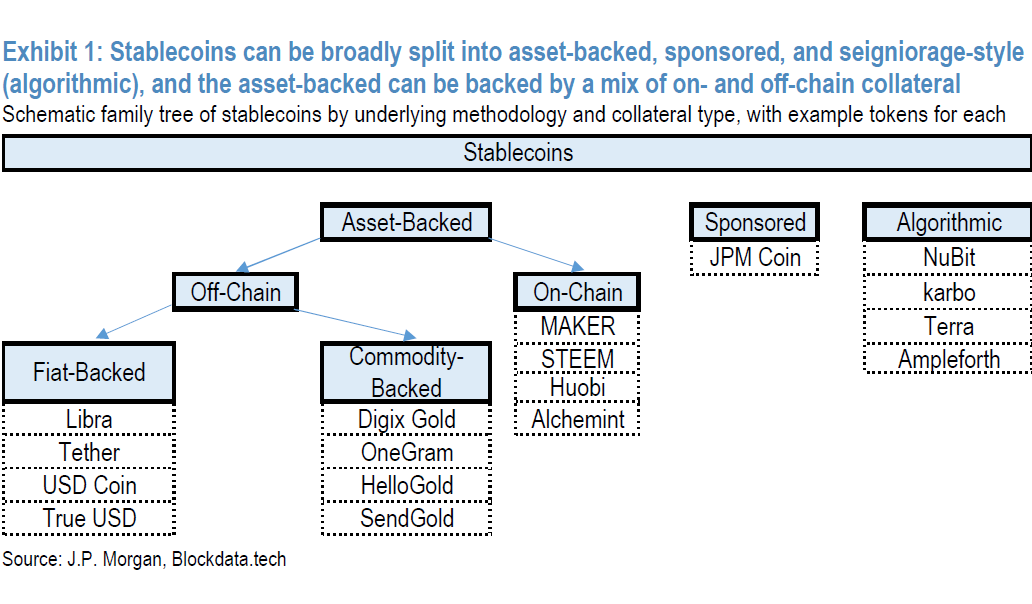

image courtesy of CoinTelegraph

According to an analysis from JPMorgan released on Sept. 5, they lack the short-term liquidity of other payments systems, so usage could grow faster than the network can safely support.

Transaction growth could outpace network capacity

In a note to clients, analysts highlighted the potential for substantial growth in stablecoin payment systems like Libra.

“Stablecoins, and Libra in particular, have the potential to grow substantially and ultimately shoulder a significant fraction of global transactional activity.”

But JPMorgan urges caution if the networks become responsible for a significant proportion of global transaction activity. The note explains:

“As currently designed and proposed, they do not take into account the microstructure of operating such a payment system. The risk of payment system gridlock, particularly during periods of stress, could have serious macroeconomic consequences.”

Further risk to Libra from negative yields

Another risk pointed out in the note was that of negative yields. Libra will rely on income from collateral in its reserve account of fiat currencies. However, yields on most major currencies are already negative, and trends point to further global monetary easing.

JPMorgan notes:

“Any system that relies on reserve-asset income to fund operational and other ongoing costs becomes unstable in a negative yield world…

…With more than half of high-quality short-term sovereign debt already negative, the vast majority of the remainder made up of U.S. government securities, and trends pointing towards global monetary easing, a fully negative yielding Libra reserve has become a plausible (some would argue likely) risk.”

Facebook’s Libra is one of a raft of incoming stablecoins from entities such as Binance, and even the Chinese central bank.

via ZeroHedge News https://ift.tt/2PPOkTT Tyler Durden