Last Minute Hurdle Emerges In The ECB’s Attempt To “Shock And Awe” Markets

With just hours left until Mario Draghi has to “shock” markets with a bang in the ECB’s triumphant return to monetary easing, unleashing even lower rates and a new round of QE, which however as Goldman warned this morning has to be coupled with rate-tiering or else risks destabilizng Europe’s already frail banking system, the outgoing central banker may instead settle for a whimper.

As Mario Draghi approaches his Oct. 31 retirement, and prepares to welcome his replacement Christine Lagarde, who leaves the IMF’s reputation in tatters and scrambling to salvage a record loan to Argentina, the central banker has signaled plans for a massive burst of monetary stimulus to prop up a eurozone economy that is teetering on the verge of a recession with Germany’s economy already said to be contracting for two consecutive quarters.

As such most investor expect a roughly 50% chance of a 20bps rate cut to Europe’s already negative -0.40% deposit rate…

… coupled with a restart in roughly €30BN in corporate and sovereign bond purchases. This is, believe it or not, merely the “medium” package that the ECB will unveil according to banks, such as Goldman:

Yet for once, voices of reasons have emerged: why, if the ECB’s magic cocktail of negative rates and asset purchases, has achieved nothing for the past 5 years, will something be different this time? These same voices have also realized that by punting to the central banks for years, Europe has become crippled when it comes to providing the kind of fiscal stimulus boost that Europe truly needs.

What’s worse, these critical voices are multiplying, including a growing number from the ECB’s own 25-member rate-setting committee.

As the WSJ notes, on one hand, Draghi’s critics say the eurozone economy isn’t weak enough to warrant aggressive new measures just a year after the ECB began phasing out its €2.6-trillion bond-buying program. Borrowing costs for households, businesses and governments are so low, they argue, that easier money will have little effect. The bank’s key interest rate is already minus 0.4%.

Then there are those warning that the measures Draghi has extensively flagged – his “whatever it takes” swan song so to speak – which include further rate cuts and a new bond-buying program, risk leaving the bank with virtually no ammunition if the economy sinks further, while also exacerbating the risk of asset bubbles and damage to the region’s banks. Several eurozone governments moved in recent months to rein in excess lending, including France.

Even French members of the ECB committee are saying “Non!”. As Bill Blain noted earlier, we’ve got senior economists like Jurgen Stark, former ECB Chief Economist saying “with a second asset-purchase programme the ECB will continue to disturb markets and prices do not reflect the risks anymore…. All this is not thought through, just to be activist and show we are not at the end of our toolbox.” What is poor Draghi to do when even his former chief economist is warning that the ECB is pushing on a string and blowing an even bigger asset bubble?

“The ECB’s monetary policy is doing its duty, but it can’t do everything, and it certainly can’t perform miracles,” Bank of France Gov. François Villeroy de Galhau said in a recent interview with Swiss media.

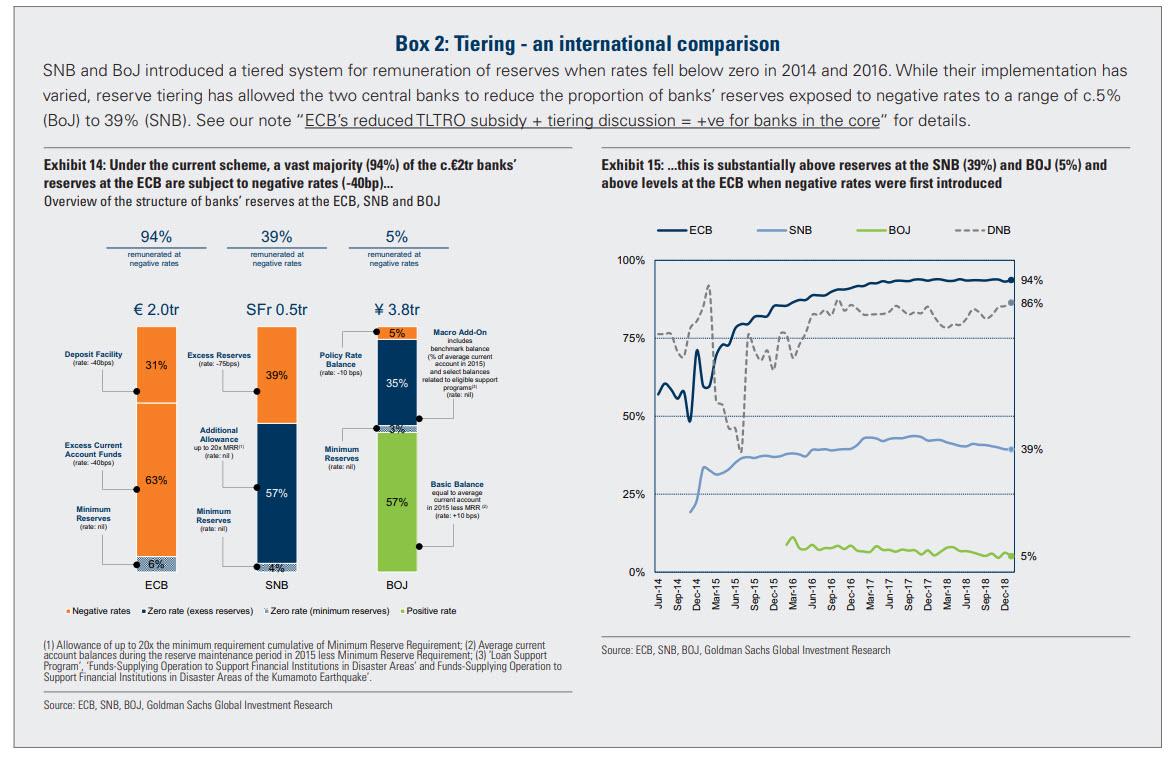

On the other hand, there are those who say that even if Draghi does pull out a bazooka, it will one make a bad situation worse unless Draghi also launches rate tiering with Goldman warning overnight that “it’s critical that tiering accompanies further rate cuts if a large profit hit for the sector is to be avoided. A -20bp cut could lower €-banks EPS by ~6%. A tiering with efficiency on par with SNB scheme could offset ~30% of the hit.“

As we reported previously, in Goldman’s view, tiering is a critical part of any incremental easing package, as without it, “an extremely challenging operating environment becomes worse, and may push an increased number of banks towards breakeven, or even loss-making territory.”

* * *

All of those objections, the WSJ writes, “raise the prospect of a rare defeat at Thursday’s ECB meeting for Mr. Draghi, whose bold new policies held together the fractious currency union during the sovereign-debt crisis.”

One option for Draghi is to do the right thing, do nothing tomorrow, and leave the decision to restart bond buying to Christine Lagarde, who is set to take over the ECB presidency on Nov. 1. Why? Because Lagarde, who was most recently seen leaving Argentina in flames – in some cases literally – after the IMF’s disastrous intervention in the Latin American country, said last week that she would reassess the costs and benefits of the ECB’s controversial policy tools.

Of course, Draghi still has defenders – those who have been elevated from market idiots to sheer investing geniuses by central banks who have made any market correction impossible – who say that it is easier to combat a downturn before it has taken root than to reverse it afterward, pointing for example, to new factory orders in Germany which have plunged to recession levels in while Italy’s economy has flatlined.

This has led to such brilliant non-sequiturs as the following from Olli Rehn, head of Finland’s central bank and a member of the ECB’s rate-setting committee: “If you don’t do anything then you don’t have any side effects, but you don’t have any impact on the economy, either.” Which is a circular way of saying that if you don’t blow up the economy, you… don’t blow up the economy. One of the ECB’s biggest legacy doves, he called on the ECB to launch a broad package of stimulus measures, including substantial new bond purchases. He is also one of the first the pitchfork brigade will be going after when it all comes tumbling down.

All this uncertainty – for a central bank which for years was led by the mantra to telegraph confidence uber alles, no matter how clueless it was – over ECB policy underscores the political and economic challenges facing central bankers in responding to the global slowdown that has followed the China-U.S. trade war.

The biggest problem for the Eurozone is that for the past five years, any time stimulus was needed, the local politicians would come crawling to the ECB’s lobby in Frankfurt demanding just one more hit, as cutting rates was far more easier politically than pushing through unpopular fiscal stimulus. It’s also why eurozone governments, led by notoriously stingy Germany, were unwilling or unable to loosen purse strings to stave off a slowdown.

As such, in a delightful example of reflexivity, the recovery that Draghi’s policies helped engineer is now at risk of collapsing as the consequences of Draghi’s actions finally catch up with the ECB, while Europe’s economy growing at an annualized pace of just 0.8% in the second quarter and its manufacturing sector in recession.

The very dangerous bottom line, as Blain summarized this morning, is that institutions and markets are starting to lose faith in central bankers:

“I find myself surprisingly skeptical, probably for the first time” Stefan Gerlach, a former deputy governor of Ireland’s central bank, said in an interview. “Draghi does not seem to hesitate to bind the hands of his successor. I’m not sure the economy needs it. I’m not sure it achieves much. Some of the arguments the hawks are making sound sensible.”

it gets worse: even establishment types admit the ECB is at the end of the road.

“We are at the end of the efficiency of monetary policy,” France’s finance minister, Bruno Le Maire, said in an interview. “The risks that we are now facing are not related to financial stability [but] how to fuel growth. The response is not only in the hands of the ECB.”

And so, with political pressure rising on central bankers around the world, Draghi may want to leave Ms. Lagarde with room to maneuver according to the WSJ.

“The next ECB president will really need to come up with a game plan to deal with the next downturn,” said Elga Bartsch, head of macro research at BlackRock. “Just turning around and saying, ‘Sorry, we are out of policy options,’ is not going to serve the independence of central banks well.”

Knowing Draghi, however, the last thing he will do is go out with a whimper, so expect a bang for the simple reason that central bankers are now trapped, as Bill Blain explained this morning:

What really, really worries me this morning is the very real possibility markets are losing their faith in Central banks.

What if Central Banks were to ‘fess-up and admit ZIRP and QE has been utter bunkum, hasn’t worked and we need to do something else? What if such an outbreak of honesty triggers a Taper Tantrum of monstrous proportions? It would kill the bond market – just a time when investors are still putting in money to bonds out of stocks in search of yield and because they believe most corporates will weather the looming global recession!

Such a confidence collapse might be about to happen.

The last 10-years of distorted markets and addiction to Central Banks has been the consequence of unwise monetary experimentation, (aided and abetted by some extraordinarily stupid political decisions, like austerity, stupid regulation and bureaucratic behaviour – read my book: The Fifth Horseman for the whole picture).

Collectively, they’ve got the financial markets into their current mess. Bond yields are a massive bubble. Stocks are overvalued. We’re due a reset. Personally, I want to put more money into alternatives – real assets decorrelated from the distortions in financial assets. As a private PA investor, I’m struggling to find such funds to invest in! (IDEAS PLEASE?)

My current worry is Central Bankers are increasingly trapped. If they don’t keep interest rates artificially low rates, then both the bond and stocks bubbles will burst. Even if they sustain the illusion, but keep on cutting, its effectiveness is weakening. The bubbles may burst anyway. It will result in that most of amusing of financial moment… discovering who has been swimming without any swimwear.

Stocks should be in trouble because the global economy is going to slow. Bonds should be in trouble because low rates are not justified by inflation expectations (which are rising) or by deflationary threats – which are real, but not powerful enough to justify NIRP in a real world. Something has to give.

There are two forces at play.

- The first is political: In the US, the president is trying to boost his re-election chances by screaming it’s the fault of the Central Bank for not juicing the economy more by slashing rates. In more sensible places, politicians are realising monetary policies don’t drive growth, so they want to juice economies with Fiscal policy – borrow more money to spend into growth.

- The second force is overcoming the orthodoxy – which holds fiscal policy is dangerous because it hikes debt to levels where investors lose confidence in the economy. It’s a fair point that’s been proven many times.

All of which makes me look at the recent headlines in Europe; the number of ECB members openly disagreeing with Draghi’s calls to further ease, or German politicians arguing against a fiscal boost for the ailing German economy. These sound very negative and orthodox. But are we looking at a under the radar Central Banking coup in Europe?

According to a number of well briefed papers and articles, the ECB may not give us the easing and bond buying bonanza the markets have been promised. Even French members of the ECB committee are saying “Non!”. We’ve got senior economists like Jurgen Stark, former ECB Chief Economguesser saying “With a second asset-purchase programme the ECB will continue to disturb markets and prices do not reflect the risks anymore.” Or how about Olli Rehn’s recent gem: “if you don’t do anything, then you don’t have any side effects, but you don’t have any impact on the economy either!” Or the French Finance Minister, Bruno Le Maire: “We are at the end of the efficiency of monetary policy. The risks we are now facing are not related to financial stability, but how to fuel growth. The response is not only in hands of the ECB.”

Is it deliberate? If the ECB can’t keep buying.. then maybe its time for Plan B? These comments above all play into the hands of new ECB head, Christine Legarde, whose job will be to politically herd the felines of the ECB and European governments into a Fiscal Union to boost German and European fiscal spending.

Tomorrow’s ECB meeting is going to be critical. Don’t miss it.

Tyler Durden

Wed, 09/11/2019 – 18:25

via ZeroHedge News https://ift.tt/2NYf1D8 Tyler Durden