The Top Lesson From The Quant Carnage: Too Many Investors Are Poorly Exposed To Positive News

Over the weekend, Morgan Stanley – once again ahead of its peers – pointed out what it saw as a major, if not the biggest, challenge facing today’s market: what if things got better. Separately, three weeks ago – long before Bloomberg published “Carnage in Crowded Hedge Fund Stocks May Mean Some Don’t Survive” – we wrote “Crowding Is Now One Of The Biggest Market Risks“, in which we explained that virtually all funds are on the same side in both the most loved momentum stocks and most hated value stocks.

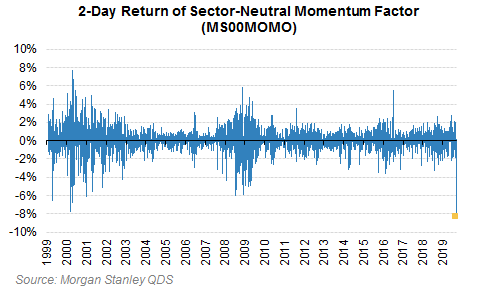

Well, fast forward to this week when the combination of “good news” suddenly dominating the newsflow, together with a massive unwind of the most crowded stocks, led to the historic, worst ever 2-day return in the sector-neutral momentum factor.

As such, looking at the events of this week and asking rhetorically, what are the lessons to be learned, together with what comes next, SocGen’s Andrew Lapthorne concludes that the recent events showed that “too many investors are poorly exposed to positive news” and that “value stocks, a portfolio of doom-laden stories as we have seen in recent days, provide such a hedge.”

First, a quick step back: for those who may have missed the fireworks of the past few days, that week we saw some of the most extreme factor moves ever, with Value stocks bouncing back strongly and Quality stocks suffering. As SocGen’s Andrew Lapthorne writes, “both on Monday and Tuesday, we experienced factor performances unseen in more than ten years, across all major regions.”

What is astonishing, however, is that at the same time global equity markets barely moved. “So, this was not the typical Value rally of a bull market, but a strong reversal of the Quality vs Value trade”, according to Lapthorne.

To be sure, none of this is a surprise to the SocGen analyst who has been arguing, for some time now, “that Value stocks are extremely cheap and Quality stocks or bond proxies were expensive.”

We had a polarised equity market created by collapsing bond yields, which has been a feature of the market since QE came along but went to extreme levels over the summer.

What added to this problem was fear of an impending slowdown and a search for perceived safety; as such “any asset with volatility and drawdown was to be avoided”, while value being both volatile and cyclical and having underperformed for almost three years was shunned. Finally, with bond yields plummeting further this summer, Value stocks underperformed further and, more importantly, to a rally in all things “bond-like”.

As such, as both we and Morgan Stanley warned ahead of time, “a strong reversal was always a risk”, especially if it was in the form of good news.

What was the trigger for the biggest quant crash in history?

While there are various theories here, the simplest one is perhaps also the right one – a violent trend rejection. Over the past week, as a result of over $100 billion in investment grade bond issuance in September which led to an in kind shorting of matched maturity Treasuries, bond yields broke their downtrend and bounced back strongly. It was the force of the move, however, that highlighted how polarised the markets are as Morgan Stanley pointed out yesterday.

Essentially, as Lapthorne summarizes, the Quality versus Value trade gave back months of gains in two days. As a result, many investors freaked out out as most of the things they own lost money quite quickly. Conversely the one thing they don’t own, Value stocks and cyclical risk more generally, which many were short rallied violently.

And while it remains to be seen if this historic rotation is over, what are the lessons one can draw so far?

According to Lapthorne, the main lesson is that bond risk in equity markets should not be overlooked. SocGen’s primary argument for Value was not dependent on accelerating GDP growth or an economic regime change, but largely about the need to diversify interest rate risk, a point it first made a year ago when rates were rising. The same applies today.

As a result, there is (or rather, was) too much bond price momentum priced into asset prices and to hedge this risk investors need to buy cyclical upside, “that might be bank stocks, autos, the Nikkei 225 or Value, which by definition is a portfolio of the world’s problems.”

So what happens next?

While value stocks are still attractively valued despite the recent surge, they will likely require positive economic newsflow to extend their rally, because despite some relief from macro fears and trade talks, the economic environment has not changed. This means that rates and credit spread moves following the upcoming central bank meetings will be key to watch. Meanwhile, as we noted earlier today, “value” has already given back some of its gains in Europe following the ECB meeting today.

Irrespective, the biggest lesson to Lapthorne is that “investors need to diversify their bond and bond proxy risk. Too many investors are poorly exposed to positive news” and that “value stocks, a portfolio of doom-laden stories as we have seen in recent days, provide such a hedge.”

Tyler Durden

Thu, 09/12/2019 – 15:37

via ZeroHedge News https://ift.tt/2NZHKro Tyler Durden