China Needs Money – Evidence In Desperate FDI Actions, Not Words

Authored by Mike Shedlock via MishTalk,

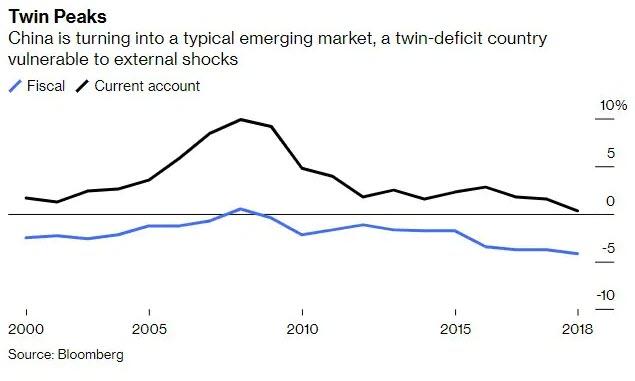

China is heading for fiscal and current-account deficits amid an escalating trade war. Its response is to encourage FDI.

New Open Door Policy

Bloomberg reports China Is Throwing Open Its Market Door. Be Wary.

China’s latest welcome to foreigners smells of desperation.

Global funds no longer need quotas to buy Chinese stocks and bonds, the State Administration of Foreign Exchange said in a statement Tuesday. That removes a hurdle to foreign investment that’s been in place for almost two decades, since the nation first allowed access to its capital markets.

Scrapping the quota is less a confident liberalization by a maturing economy and financial system than an overt admission that the country needs money. China has been edging dangerously close to twin deficits in its fiscal and current accounts. It needs as much foreign capital as it can get — even in the form of hot portfolio flows — to keep control over the balance of payments and avoid a further buildup of debt.

This thirst for overseas funds explains why China has been opening its financial services industry, allowing global investment banks to take majority control of their local brokerage joint ventures after years of resistance. The question now is whether foreigners will take the bait.

Michael Pettis on FDI Quota Scrapping

Pettis Questions Current Account Thesis

A good piece by @Aidan_Yao_AXAIM, who might be right that Chinese current account surpluses are a thing of the past, but as @Brad_Setser and I discussed recently, this depends on how optimistic you are that Beijing gets debt under control… https://t.co/MzcgY63j4C via @scmpnews

— Michael Pettis (@michaelxpettis) September 11, 2019

…Debt either funds investment or increases consumption (i.e. reduces savings), so that if Beijing is able successfully to control the growth in debt, the gap between savings and investment will rise and, by definition, so will the surplus. In theory it is possible for…

— Michael Pettis (@michaelxpettis) September 11, 2019

…consumption to rise without debt, but it requires substantial wealth transfers to households, something Beijing has found difficult in the past and cannot do quickly. It’s not easy to predict, but I think the surplus is more likely to rise than fall in the next 2-3 years.

— Michael Pettis (@michaelxpettis) September 11, 2019

Bonds Not Tempting

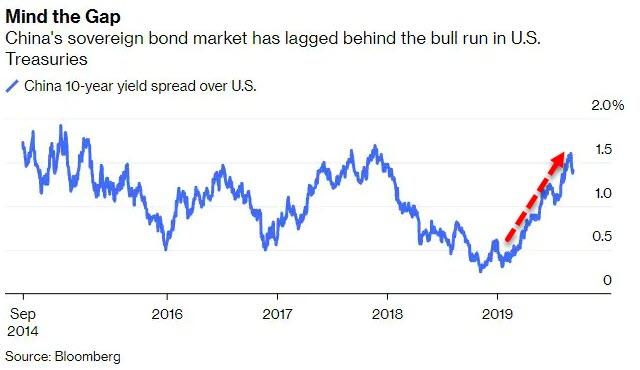

Chinese bonds yield almost 1.5 percentage points more than US bonds.

Tempted?

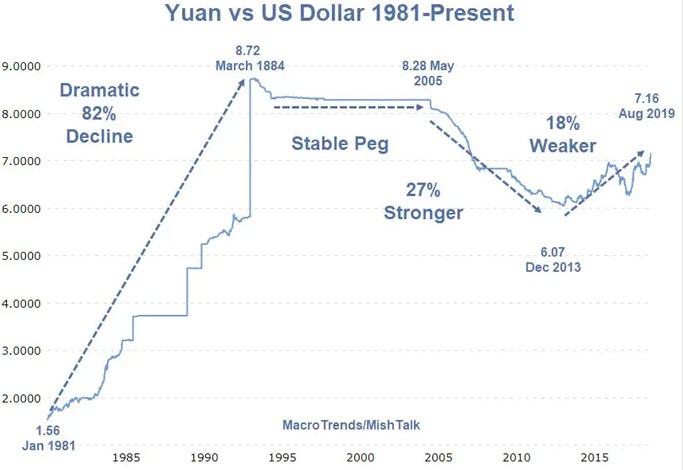

Yuan vs US Dollar 1981-2019

Yuan chart from MacroTrends. Anecdotes mine.

If the yuan was strengthening, an extra 1.5% per year might be tempting.

However, the yuan has weakened 18% since January 2014.

Stability Not

Nothing about any of these actions suggests more stability. It’s all about preventing a stock market collapse while praying for a miracle.

Tyler Durden

Thu, 09/12/2019 – 19:05

via ZeroHedge News https://ift.tt/2LwkY8V Tyler Durden