Draghi’s New ECB QE4EVA Is A Mistake. Here Is What He Should Have Done…

Authored by Daniel Lacalle via DLacalle.com,

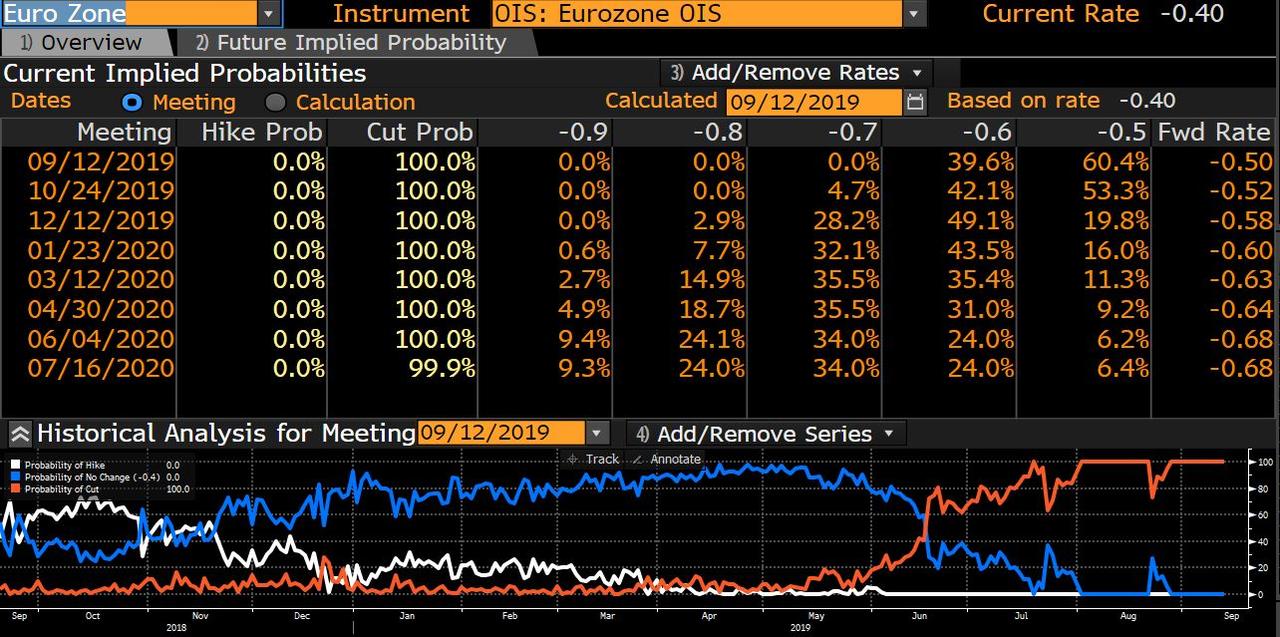

The ECB is creating a dangerous bubble and should not have cut rates by 10bps nor added a new purchase program of €20 billion per month.

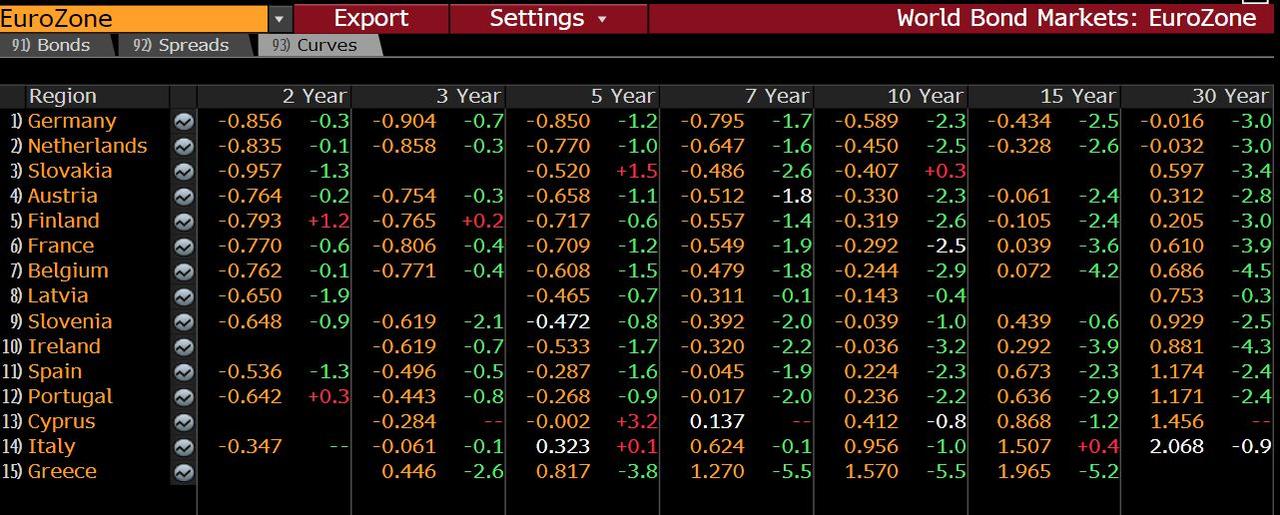

1) Eurozone states are already financing themselves at negative rates. There is no need for lower rates and this disguises real risk.

This has saved governments more than 1 trillion euro in interest expenses (handelsblatt.com/today/finance/…)

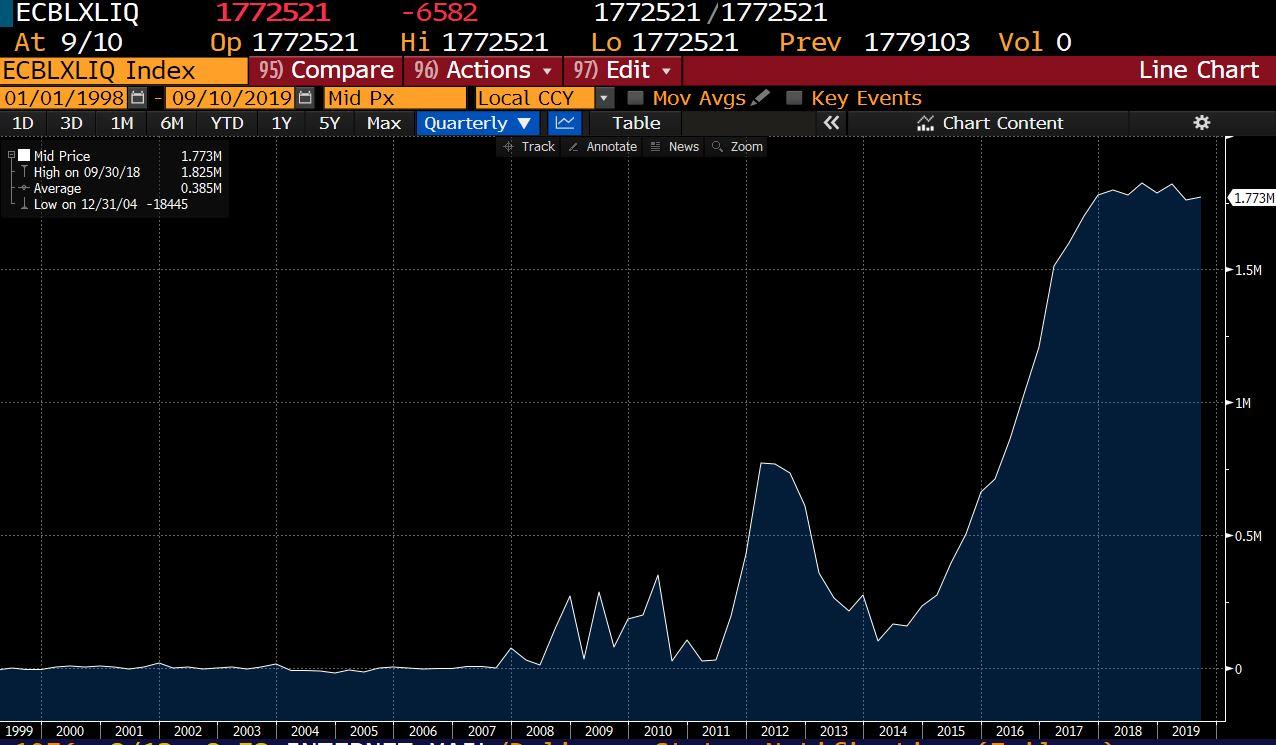

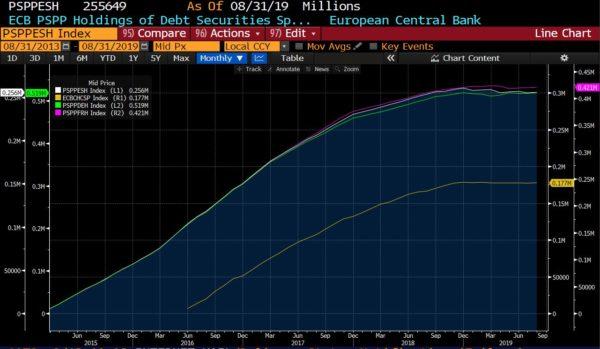

2) The ECB has not abandoned its stimulus. It repurchases all maturities, launched a liquidity injection (TLTRO) in March 2019 and balance sheet stands at almost 40% of eurozone GDP.

3) Excess liquidity is 1.7 trillion euro. More liquidity does not lead agents to spend/invest more.

There is no higher solvent credit demand because monetary policy perpetuates overcapacity and zombifies the economy. Share of zombie companies has soared c30% since 2013 (BIS)

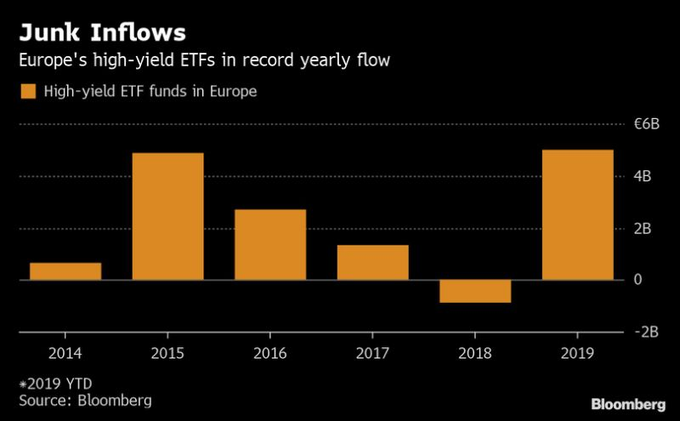

4) Interest rates are already negative. This has caused a 23 billion euro loss for banks (according to Scope Ratings) and a worrying rise in junk debt demand.

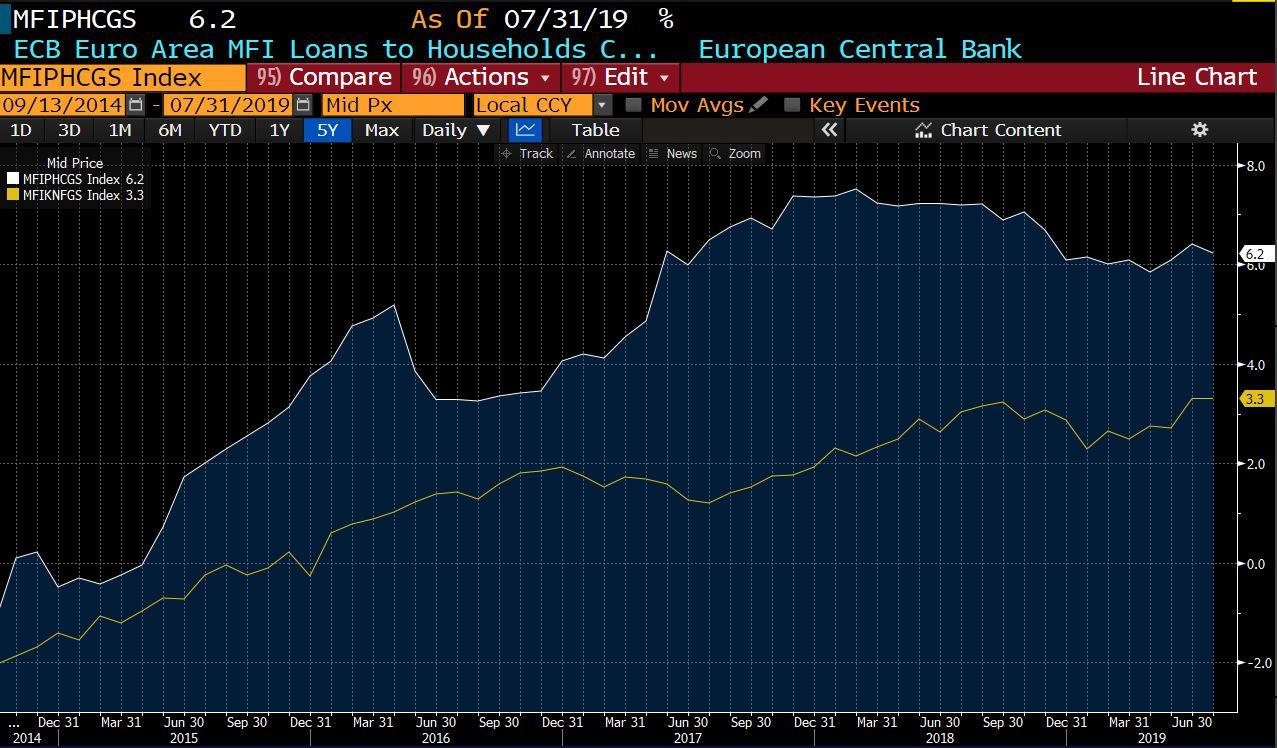

5) There is no evidence of a need for more credit growth. Rather the opposite.

The ECB believes the eurozone problem is one of excess saving and lack of demand when it is of excess debt and oversupply.

6) Negative rates zombify the economy and are a massive transfer of wealth from savers and productive sectors to the indebted and inefficient.

7) The ECB already accumulates a disproportionate amount of sovereign debt as well as corporate bonds of issuers that never had a problem financing themselves at low rates.

This disguises risk and creates an enormous bubble.

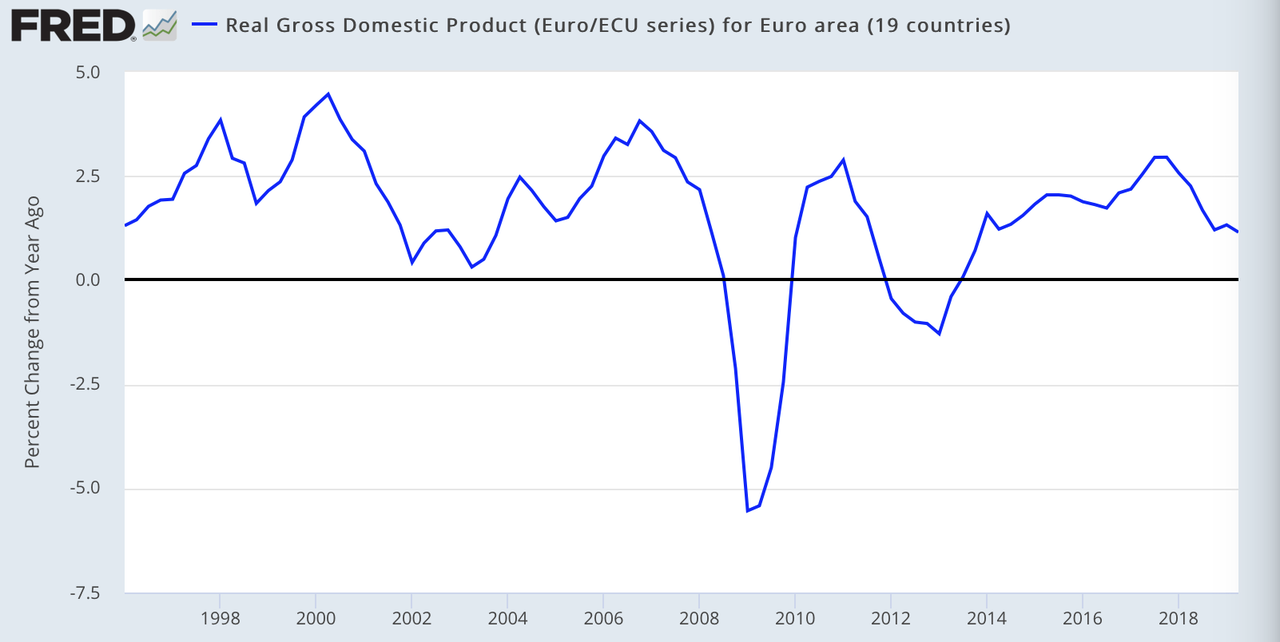

8) The problem of the eurozone is not one of lack of stimuli, but an excess of them.

Governments burden the productive private sector with higher taxes and unnecessary regulations, so economic surprise falls despite massive stimulus.

9) When this fails or -even worse- explodes, central planners will likely blame “markets” or “lack of stimulus” to repeat.

10) Saying that negative rates are “demanded” by investors is a sad excuse.

Financial repression leads economic agents to take more risk for lower yields and central banks go from lenders of last resort to enablers of financial bubbles.

The ECB should have:

-

Raised rates modestly to show signs of normalization putting rates closer to inflation, as well as giving the opportunity to understand what is the real demand in the secondary market for sovereign bonds.

-

Condition all asset purchases on governments implementing structural reforms and delivering on deficit targets.

-

Redirected the liquidity injections to a broad-based asset purchase system for specific requirements with a dividend and solvency commitment from financial entities (so the ECB gets liquidity back in dividends) and eliminate the negative rate on deposits.

-

Increased detail on forward guidance to monitor the level of success of measures.

Tyler Durden

Fri, 09/13/2019 – 05:00

via ZeroHedge News https://ift.tt/2NZGwfq Tyler Durden