US Equity Futures Trade Near All Time High After ECB Goes All In

If it was Powell’s intention to have the S&P trade at an all time when he cuts rates by another 25bps next Wednesday, he achieved it.

S&P futures rose alongside Asian and European stocks as shares globally headed for a third weekly gain and a six week high as markets cheered signs of progress in US-China trade talks and the ECB’s just launched open-ended QE. Treasury yields climbed, with the US 10Y rising as high as 1.81%; the dollar slipped while the yuan rose and pound soared on easing no-deal Brexit fears.

The resurgent risk appetite was largely the result of renewed trade war optimism after President Trump said on Thursday he was potentially open to an interim trade deal with China, although he stressed an “easy” agreement would not be possible.

Following a muted Asian session where many markets in the region were closed, we saw a groggy start in European trading after Bloomberg reported that most core European nations did not want to restart the ECB’s money printing program, the main bourses eventually traded well in the green, as basic resources and auto sectors outperformed, adding to what was already set to be a fourth straight week of gains.

“We have quite an interesting reaction to the ECB meeting with the sense of the pushback from the core countries, and that essentially that the ECB has now thrown its last cards in,” said John Hardy, head of FX strategy at Saxo bank. “It looks like we are also getting to some pretty interesting levels for yields. If the consolidation continues, at some point you have to question whether the easing (from the central banks) is actually there.”

Earlier in the session, Asian stocks advanced, heading for a third day of gains and ending their week at a six-week high. Japan’s Nikkei did even better and scored a 4-month peak, after the ECB aggressively resumed monetary easing (even as it complains that not enough fiscal easing was taking place), cutting interest rates for the first time in five years further below zero, while a report said that U.S. officials considered an interim trade deal with China. Utilities and industrial companies were among the strongest sectors as most markets in the region rose. China and South Korea were closed for the moon festival. The Topix rose 0.9%, capping its best week since July 2016, with SoftBank Group and Toyota Motor among the biggest boosts. Hong Kong’s Hang Seng Index climbed 1%, buoyed by AIA Group and China Construction Bank. India’s Sensex added 0.4%, with ICICI Bank and Infosys offering strong support.

In addition to the boost from Trump trade signals and the ECB’s salvo of easing measures, sentiment was also boosted by a U.S. tax overhaul plan aimed at middle-income households next year.

“Risk assets should find further support from accommodative policies, which are set to remain in vogue for some time, and not just in Europe as seen in the global easing trend,” said Natixis market strategist Esty Dwek.

Looking ahead, fed funds rate futures now imply a 0.25 percentage point interest rate cut by the U.S. central bank next week but no probability of a larger cut. The Fed will announce its policy on Wednesday, followed by the Bank of Japan on Thursday. Sources told Reuters the BOJ is leaning toward standing pat next week if markets are calm, but is brainstorming ways to deepen negative interest rates at minimal cost.

“I think a rally in stock prices will run out of steam soon. It’s typical buy-on-rumor-sell-on-fact trade on central bank stimulus and will be over by the Fed and the BOJ’s meetings,” said Tatsushi Maeno, senior strategist at Okasan Asset Management.

In FX, the big mover was the GBPUSD, which soared through 1.2400 to outperform other G-10 peers amid short covering and speculation that a no-deal Brexit is becoming unlikely; gains in EURUSD were capped by 1.1100 level as resistance. The euro shuffled up to a two-week high in foreign exchange markets too, as traders there suspected the ECB may have now exhausted all ammunition going forward; meanwhile, rising risk on sentiment pushed the safe-haven Japanese yen to a six week low.

In rates, US, Japanese and European long-dated bond yields were all at six-week highs. Ten-year U.S. Treasuries were trading as high as 1.81% compared with just over 1.4% at the start of September, while Germany’s Bunds settled at the new ECB deposit rate of -0.5%, and Japanese JGBs traded up to -0.17% from as low as -0.29% last week. The German curve bear steepened, with the 30y yield +3.5bp. Peripheral spreads widened to reverse some of the pronounced tightening observed post-ECB yesterday.

Despite resurgent risk sentiment, oil prices were on course to post weekly losses. Traders have begun speculating that the U.S. may ease sanctions on Iran after Trump ousted his hawkish national security adviser John Bolton this week. Brent crude futures fell 0.25% to $60.21 a barrel while WTI crude was down 0.2% at $54.98. Gold ticked up to $1,503 an ounce.

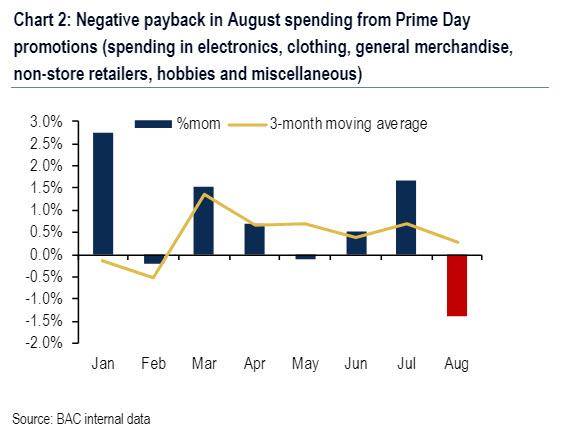

Expected data include retail sales and University of Michigan Consumer Sentiment. Recently we showed that Bank of America card spending data indicated that August showed the biggest monthly drop in spending in 2019, so beware a big miss here.

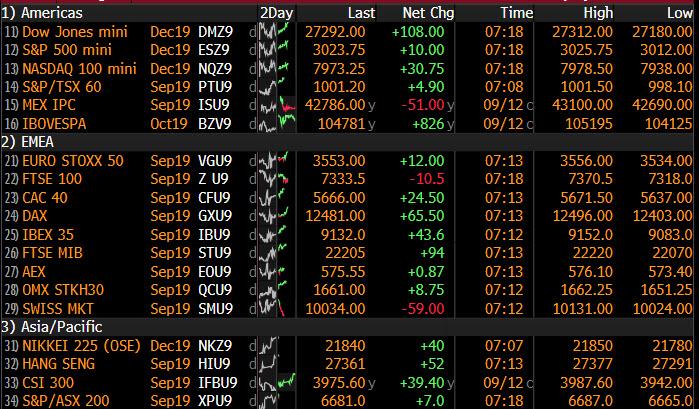

Market Snapshot

- S&P 500 futures up 0.2% to 3,017.50

- STOXX Europe 600 up 0.1% to 390.93

- MXAP up 0.7% to 160.02

- MXAPJ up 0.6% to 515.71

- Nikkei up 1.1% to 21,988.29

- Topix up 0.9% to 1,609.87

- Hang Seng Index up 1% to 27,352.69

- Shanghai Composite up 0.8% to 3,031.24

- Sensex up 0.2% to 37,179.77

- Australia S&P/ASX 200 up 0.2% to 6,669.18

- Kospi up 0.8% to 2,049.20

- German 10Y yield rose 1.5 bps to -0.501%

- Euro up 0.1% to $1.1081

- Italian 10Y yield fell 10.1 bps to 0.528%

- Spanish 10Y yield rose 2.5 bps to 0.246%

- Brent futures down 0.4% to $60.13/bbl

- Gold spot up 0.5% to $1,506.46

- U.S. Dollar Index down 0.3% to 98.00

Top Overnight News from Bloomberg

- China plans to encourage companies to buy U.S. farm products including soybeans and pork, and it will exclude those goods from additional tariffs, the editor-in-chief of a prominent state-run newspaper said.

- Trump administration officials have discussed offering a limited trade agreement to China that would delay and even roll back some U.S. tariffs for the first time in exchange for Chinese commitments on intellectual property and agricultural purchases

- The Times reported the Democratic Unionist Party, an ally of the ruling Conservative Party, would accept a new agreement to replace the contentious Irish backstop. The pound extended its rally even after some DUP members pushed back against the news

- Mario Draghi is leaving the ECB with a final stimulus package that has divided colleagues and drawn doubts over its economic effectiveness, putting governments under renewed pressure to step up with fiscal police

- Deutsche Bank AG will benefit the most by far from the ECB’s new tiered deposit rate, JPMorgan Chase & Co. analysts led by Kian Abouhossein said Friday. Germany’s largest lender stands to save roughly 200 million euros ($222 million) in annual interest payments

- Joe Biden battled Bernie Sanders and Elizabeth Warren on health care in a fight emblematic of the Democratic Party’s deepest schism

Asian equity markets traded higher as the positive tone rolled over from Wall St where the major indices edged mild gains and the DJIA notched a 7-day win streak with sentiment underpinned on the improving US-China trade climate and after the ECB announced a package of stimulus measures. ASX 200 (+0.2%) and Nikkei 225 (+1.0%) were higher throughout the majority of session although Australia later returned flat as the outperformance in industrials and financials was counterbalanced by weakness in the tech and mining sectors, while the Japanese benchmark cheered the recent currency weakness and eyed the 22k level. Hang Seng (+1.0%) conformed to the positive risk tone as the recent encouraging trade developments spurred hopes for a ceasefire in the US-China trade war with Chinese negotiators said to be making plans to boost purchases of US agricultural products and with US President Trump suggesting he could consider an interim deal with China. However, gains were restricted in Hong Kong amid the absence of the mainland due to the Mid-Autumn Festival holiday and ahead of a potential weekend of further clashes after the police banned a planned march for Sunday. Finally, 10yr JGBs traded lower in an extension of the recent weakness to track the losses seen in global counterparts, with demand also sapped after a softer enhanced liquidity auction in the long-end and amid reports some BoJ members were said to believe JGB yields are close to a tipping point and would consider action with a move below -0.3%.

Top Asian News

- Vietnam Central Bank Cuts Interest Rates as Global Risks Rise

- India Is Said to Mull Selling Refiner Stake to Foreign Oil Firm

- Turkey’s Jumbo Rate Cut Secures Uneasy Truce for Erdogan, Market

Major European bourses are modestly higher [EuroStoxx 50 +0.4%], following on from a similarly upbeat APAC session, in which sentiment was underpinned by optimism on the US/China trade front (US President Trump said he would consider an interim trade deal with China, while China appeared to recommence soybean purchases from the US) and following the ECB’s announcement of a package of stimulus measures. In terms of index performance, the FTSE 100 (is the laggard with Sterling strength weighing on exporters, although the index is somewhat underpinned with Credit Suisse now overweight in UK equities. Financials are the leading sector, aided by the recent rise in yields and curve steepening. On that note, according to JPM, Deutsche Bank (+3.4%) is set to benefit the most, with 10% relief (as a % of estimated 2020 profit before tax), although they do slightly lag the Eurostoxx banking index (+3.0%). Meanwhile, Materials are also higher, whilst the defensive utilities, consumer staples and health care sectors lag. In terms of individual movers; SSE (+0.9%) is up on the news that the Co. has agreed to sell its SSE Energy Services unit for GBP 500mln. Notable losers include Diageo (-3.3%), who are down after union strike threat relating to pay and Atlantia (-7.0%), who sunk on the news that Italian tax police are carrying

Top European News

- Swedish Economy Grinding to a Halt on Trade War, Housing Slump

- Kone CEO Wants Full Merger With Thyssenkrupp Elevator Unit

- SSE Sells U.K. Retail Unit for 500 Million Pounds to Ovo

- Pound Set for Best Week Since May as Brexit-Deal Hopes Resurface

In FX, the British Pound continues to piggy-back Euro gains in post-ECB trade, but with the added incentive of no deal Brexit risk declining further amidst reports that the EU could be poised to offer the UK yet another Article 50 extension, while the DUP shows signs of flexibility on the Irish border backstop. Hence, Cable has reclaimed another big figure and extended its stellar rebound from 2019 lows on September 3 to 500+ pips at circa 1.2476 vs 1.1959, while Eur/Gbp has retreated towards 0.8900 again as the single currency hits resistance just above 1.1100 vs the Dollar.

- EUR/CHF/AUD/JPY – All firmer against the Greenback, but as noted above Eur/Usd has faded after crossing the 1.1100 line and failing to sustain its recovery momentum to challenge the 50 DMA at 1.1130, while the Franc faces some psychological obstacles at 0.9850 having breached 0.9900 in the run up to next week’s FOMC and SNB Quarterly Policy review. Elsewhere, the Aussie remains capped below 0.6900 and the 100 DMA (0.6904), with Aud/Usd currently holding between 0.6877-60 and more technical levels spanning 0.6880-67 including the 55 DMA and the apex of a daily chart formation. The safe haven Yen has pared some losses against the backdrop of improving US-China trade relations as prospects of an interim accord forged at the upcoming mid-level meeting grow on the back of latest tariff exemptions from Beijing. Usd/Jpy has slipped back through 108.00 from around 108.27, while Usd/CNH has retraced further towards 7.0000 without PBoC prompting given China’s mid-Autumn festivities, to sub-7.0400 and not far from the 50 DMA (7.0193).

- CAD/NZD/NOK/SEK – Marginal G10 laggards even though the DXY has dipped under 98.000 from just over 99.000 at one stage in the fleeting ECB aftermath on Thursday, with the Loonie unable to retrieve 1.3200 against the backdrop of soggy crude prices and Kiwi pivoting 0.6400 as the Aud/Nzd cross finally breaks above 1.0700 and with conviction to just shy of 1.0750. Next up for the Kiwi, Westpac’s Q3 consumer survey after scant improvement in the manufacturing PMI overnight (still some way below 50) and house sales slumping in August. In Scandinavia, the Crowns are narrowly mixed after revised Q2 Swedish GDP data and amidst the aforementioned dip in oil, with Eur/Nok elevated within 9.9150-9600 range vs Eur/Sek closer to the middle of 10.6290-6775 parameters.

In commodities, choppy trade in the oil complex, albeit prices remain within yesterday’s ranges with WTI and Brent futures around 55.0/bbl above 60/bbl respectively. Looking at weekly performance, both benchmarks are poised to end the week in the red, with the the former closer to the bottom of the weekly range (USD 54-58.73/bbl) whilst the latter showed a similar performance within a USD 58.94-63.74/bbl weekly parameter. Over the week, EIA and OPEC downgraded their respective global oil demand forecasts for 2019 and 2020 whilst IEA maintain its forecast. Meanwhile, the JMMC saw little by way of major decision, although the energy ministers reportedly “unanimously” agreed to fully comply with the OPEC+ supply pact, which may see 400k BPD crude outflow from the market, given the undercompliance from some producers. A full review of the current pact will take place in December. Elsewhere, gold prices are on the rise as the USD is weighed on by a firmer EUR and GBP. The yellow metal remains above the USD 1500/oz, having visited a weekly base at USD 1484/oz earlier in the week (vs. weekly high of 1524/oz). Copper prices are poised to notch another day of gains, largely aided by the receding Buck as prices move further north of 2.60/lb ahead of its 100 DMA at 2.66/lb.

US Event Calendar

- 8:30am: Import Price Index MoM, est. -0.5%, prior 0.2%; 8:30am: Export Price Index MoM, est. -0.3%, prior 0.2%

- 8:30am: Retail Sales Advance MoM, est. 0.2%, prior 0.7%; Retail Sales Ex Auto MoM, est. 0.1%, prior 1.0%

- Retail Sales Ex Auto and Gas, est. 0.2%, prior 0.9%; Retail Sales Control Group, est. 0.3%, prior 1.0%

- 10am: U. of Mich. Sentiment, est. 90.8, prior 89.8; Current Conditions, est. 107.8, prior 105.3; Expectations, est. 85.2, prior 79.9

DB’s Jim Reid concludes the overnight wrap

If you want the ultimate expression of middle class and middle age behaviour then the following sentence will tick all the boxes. Tonight (on a Friday) I’m going to a classical music recital at someone’s home near to where I live. I’ve been to about 2-3 classical music events in my life but I find myself more and more putting on a “relaxing classics” Spotify playlist at home to introduce calm into my life. I tend to also write research to it on my headphones these days. So hopefully I’ll know some of the hits tonight and can join in at the choruses.

The ECB impact on markets was anything other than calm. It was more like a death metal playlist with loud noises from all angles. So first what did the ECB announce? Well the more expected policy changes included the 10bp cut on the depo rate to -0.50%, better TLTRO3 terms and two-tier tiering – the latter being confirmed with a multiplier at six times banks’ required reserve levels. As for QE, while it was still expected, markets had started to water down expectations leading into the policy meeting so the €20bn per month announcement was the main talking point and ensured a big bond rally immediately following the statement release (subsequently reversed in a big way – see below). The fact that it was left open-ended (or until the ECB starts raising rates) was perhaps the biggest takeaway. QE infinity is back if that’s not an oxymoron. To be fair headlines came through on Bloomberg after the European close that the French, German and Dutch governors opposed more QE, as did Coeure and Lautenschlaeger and a couple of others. So this was a contentious move and rightly so. At the other end of the scale the one area of unanimity on the Council was over the need for fiscal policy.

Indeed the most interesting line in DB’s Mark Wall’s piece on the package was that for this not to be seen as a policy mistake, the ECB must expect fiscal easing with a strong degree of confidence. As such our economists are nervous that the indefinite QE risks flattening the curve and counteracting the stimulus, especially for banks. See the full piece here for more.

To be fair yields and the curve were all over the place yesterday with Mr Draghi’s press conference leading to a sharp reversal of the post announcement trends. Prior to the statement, 10y Bund yields were trading at -0.591%. By the time the statement was announced and Draghi started to speak, yields had fallen to -0.654%. However by the time the press conference had finished, bonds had made a complete reversal and in fact yields finished at -0.516% – so +6.5bps above where they were at roughly 12.44pm BST and +13.1bps off the lows at 1.06pm BST. The high-to-low range was also the most since May 1 while the 2s10s curve flattened 7.3bps to (at 20.3bps), just 4bps off its cyclical low – probably the biggest negative of the package. In fact, two-year yields rose +11.8bps, their sharpest selloff since December 2015 when the ECB disappointed markets. Looking at two-year z-scores, that equated to a pretty shocking 7.6 standard deviation move. One positive note was the rebound in inflation expectations, with 5y5y inflation swap rates rising +8.0bps to 1.30% but only back to post Sintra levels.

It was a similar volatile day across the rest of European bond markets but with various different magnitudes. To be fair BTPs only retraced partially after the large initial rally. They ended -10.3bps lower at 0.867% but that was after hitting 0.749% at the lows. Italy was a big winner overall on the day. Meanwhile the euro traded in a range of 1.45% but ultimately ended up +0.50% after completing a similar u-turn. European banks meanwhile ended up a modest +0.24% after being up as much as +1.77% and then down as much as -2.68%. Tiering was a positive, and yields eventually rose, but if curves flatten further then this won’t go down as a successful meeting for banks. The STOXX 600 ended +0.20% also after similar intra-day swings.

The U-turn seemed to come with the strong emphasis on both the negative side effects of monetary easing and the stressing of the need for fiscal policy. Specifically, Draghi referred being “very concerned about the pension industry” and also suggesting that the answer to speeding up positive side effects as being fiscal policy. Draghi’s repeated recognition of the side effects on banks implies that in his eye the reversal rate is not much lower than where we are today.

It’s hard to therefore get away from feeling that even the ECB feel we’re nearing the end game in terms of the limits of monetary policy. Something that has been obvious to the outside world for sometime. To be fair to them, if there is no fiscal policy of any note they could argue they have little choice but to ease, however it’s clear that easing in its own right is now at the edge of being counterproductive.

Meanwhile on the CSPP, Michal in my credit strategy team has published a piece called “The ECB CSPP Is Back, Indefinitely” in which he estimates the likely size of the upcoming corporate purchases in light of buying in various historical episodes, provides commentary on other measures within the stimulus package, incl. tiering and its P&L impact on the banking sector, discusses the odds of the ECB expanding the eligibility criteria for the CSPP such as by including bank senior preferred bonds, and finally he offers a broader assessment of the impact on credit, incl. relative value views on CSPP-eligibles vs. ineligibles. You can find the full note here.

To throw a spanner into the global fixed income works yesterday, the US August core CPI print came in higher than expected at +0.3% mom (vs. +0.2% expected). The unrounded number was ‘only’ +0.2565% but it was still enough to push the annual rate up two-tenths to +2.4% yoy and to a post-crisis high. Ultimately Treasuries tracked the move for European bonds and 10y yields ended +4.3bps while the 2s10s curve finished a bit flatter at 5.9bps. It’s worth noting that we’re now down to pricing 25bps of cuts for the Fed next week and 52bps for the rest of the year. As for equities, the S&P 500 finished +0.29% – just 0.54% from its all-time high – and the NASDAQ closed +0.30%, with both boosted somewhat by the trade chatter which we’ll come to shortly.

Overnight in Asia markets are following Wall Street’s lead with the Nikkei (+1.03%), Hang Seng (+0.36%) and Australia’s ASX (+0.14%) all up. Markets in China and South Korea are closed for a holiday. 10y JGB yields are up +5.4bps this morning at -0.170% after recently hitting a three year low of -0.295% on September 4th. So a big move. Elsewhere, futures on the S&P 500 are up +0.11% while 10y UST yields are up another +1.6bps.

In other overnight news, the US President Trump said that he’s planning a tax cut directed at the middle class that will be announced in the next year. He added that, “It will be a very substantial tax cut,” and would be “very, very inspirational” without providing details. The statement comes after the White House decision, earlier in the week, of not going ahead with cutting the tax on capital gains by indexing gains to inflation. Elsewhere, the Treasury Secretary Steven Mnuchin had told CNBC earlier that the administration has also put off the idea of a possible cut in payroll taxes while adding that Trump was focused instead on a second round of proposed tax cuts. However, delivering on the tax cut ahead of the 2020 election is likely to face stiff opposition in Congress. Elsewhere, the IEA warned overnight that OPEC+ faces a significant challenge in managing the market in 2020 as production surges from their competitors. WTI oil prices are down -0.33% this morning.

Back to yesterday, where on the trade subject, Bloomberg reported that the Trump administration have “discussed offering a limited trade agreement to China that would delay and even roll back some US tariffs”. The story goes on to say that this would be in exchange for commitments from the Chinese side on intellectual property and agri purchases. The story did however suggest that the Huawei issue would remain. Interestingly CNBC downplayed the story later saying that the White House is not considering an interim deal but subsequently while speaking to reporters at the White House, President Trump said that it is something he will consider. He said, “A lot of people are talking about, and I see a lot of analysts are saying: an interim deal, meaning we’ll do pieces of it, the easy ones first. But there’s no easy or hard. There’s a deal or there’s not a deal. But it’s something we would consider. ”

Prior to that story, China’s Commerce Ministry confirmed that working teams will meet soon to prepare for the next round of high-level meetings. The Dow Jones later reported that China was seeking to narrow trade talks with the US “to only trade matters” and “putting thornier national-security issues on a separate track.” Again though, it was not clear if this possible olive branch would allow the Huawei issue to be separated from the tariff discussions, since national security could also refer to Hong Kong and arms sales to Taiwan. Still, the rhetoric continues to point in the right direction for now and towards a more positive outcome.

Meanwhile, here in the UK, The Times has reported overnight that the DUP has said it would accept North Ireland abiding by some European Union rules after Brexit as part of a new deal to replace the Irish backstop which includes dropping objections to regulatory checks in the Irish sea. However, the DUP leader Foster subsequently tweeted that the UK must leave the EU as one nation while adding that the DUP is keen to see a sensible deal but not one that divides the internal market of the UK. So take whichever side of that that you’d prefer. However it’s obvious talks are going on to try to find common ground between the government and the DUP.

As for the data in Europe yesterday, the July industrial production was a fair bit worse than expected at -0.4% mom (vs. -0.1% expected) however this was countered by upward revisions to the prior month. Meanwhile there were no final surprises in the August CPI readings for France and Germany and +0.5% mom and -0.1% mom respectively, both unrevised from the initial readings.

Finally to the day ahead where data this morning includes the July trade balance and Q2 labour costs print for the Euro Area. In the US it’ll be all eyes on the August retail sales report while the August import price index and preliminary September University of Michigan consumer sentiment survey are also due. Recall that last month, the headline UoM survey fell -8.6 points, the most since 2012, to its lowest level in almost three years. Our economists have noted that when the UoM falls far below the Conference Board survey, it tends to be a recession indicator. While that is worrying, they do forecast a slight pickup in tomorrow’s print to 92.0, which would be up +2.2 points and slightly above consensus which is for 90.8.

Tyler Durden

Fri, 09/13/2019 – 07:50

via ZeroHedge News https://ift.tt/2AgQPUo Tyler Durden