Core Retail Sales Disappoints, July ‘Web Sales’ Downwardly Revised

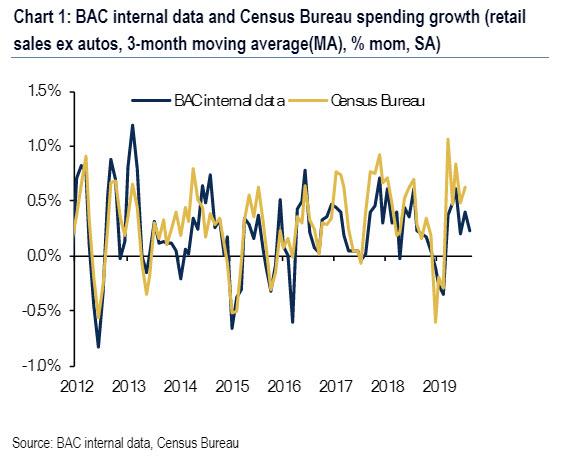

After a huge surprise beat in July, retail sales growth was expected to slow in July on the back of Amazon’s Prime Day demand pull-forward. Also, weighing on sentiment was the fact that BofA card spending data also showed that August was a difficult month for the retailers, and the bank expects to similarly see a weak retail sales report from the Census Bureau on Friday.

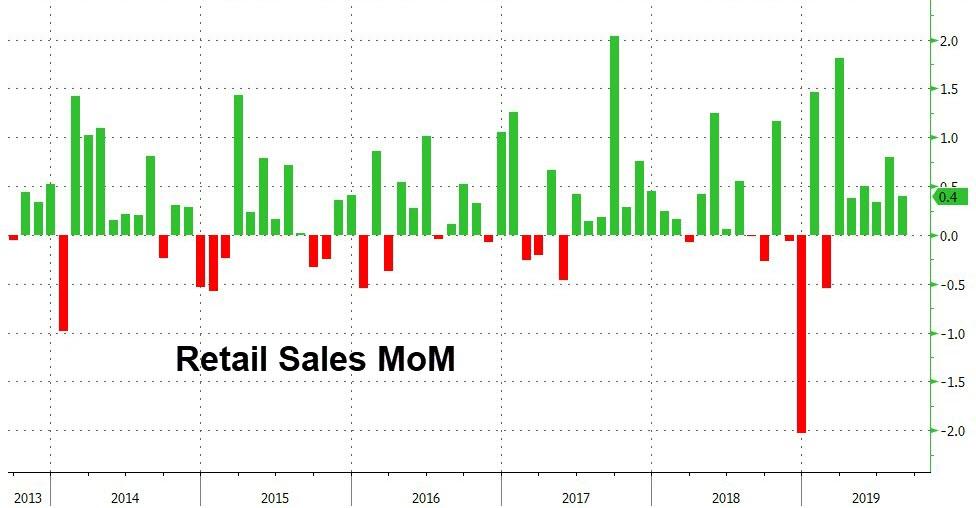

However, headline retail sales printed a better than expected 0.4% rise MoM (+0.2% exp)…

Source: Bloomberg

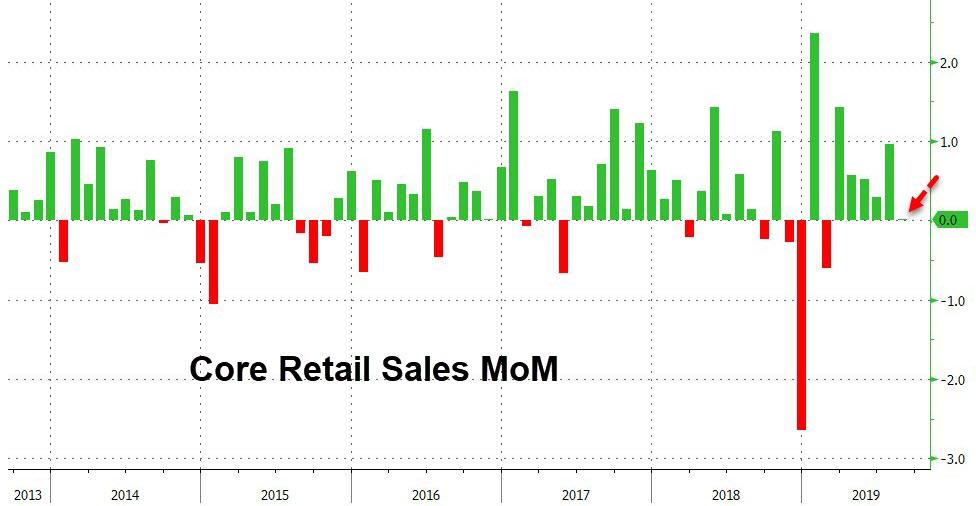

But core Retail Sales (ex Autos/Gas) disappointed, unchanged on the month…

Source: Bloomberg

Sales in the closely watched “control group” subset – which some analysts view as a more reliable gauge of underlying consumer demand – increased 0.3%, matching projections. The measure excludes food services, car dealers, building-materials stores and gasoline stations.

Non-Store Retail sales were revised dramatically lower from a 2.8% MoM surge in July to +1.7%, followed by a +1.6% MoM rise in August… (but remains up 16% YoY)

Source: Bloomberg

And the antithesis of that, Department Stores have had a positive YoY print just twice in the past 8 years…

Source: Bloomberg

Ex Autos, sales were weak:

-

Furniture stores -0.5%

-

Food and beverage stores -0.2%

-

Gasoline stations -0.9%

-

Clothing stores -0.9%

-

General merchandise stores -0.3%

-

Restaurants -1.2%

On a year over year basis, retail sales (headline and core) are accelerating…

Source: Bloomberg

The report suggests another solid quarter of household consumption, which grew in the April-June period at the fastest pace since 2014.

Along with record high stocks, sounds like the perfect time to cut rates.

Tyler Durden

Fri, 09/13/2019 – 08:41

via ZeroHedge News https://ift.tt/2UP01Jg Tyler Durden