“This Is Huge”: A Shocked Wall Street Reacts To Today’s “Ludicrous” China Threat

And to think just earlier this morning we were mocking the complacent market – and this Reuters headline – for justifying the latest overnight levitation in risk assets.

Just like last Friday, when out of the blue stocks tumbled when suddenly it appeared that a trade suddenly was far less likely after China canceled its trip to Montana and Nebraska, just before noon risk took a plunge when Bloomberg reported that the Trump administration was considering delisting Chinese companies from US stock exchanges and limiting Americans’ exposure to the Chinese market through govt pension funds, sending shares of some marquee Chinese companies including Alibaba and Baidu tumbling, and sparking yet another shocked among Wall Street analysts, which ranged from ignore this news, it’s just “another market burp” as Trump will “have a hard time making the case for capital controls” to “this is not little stuff… this is huge”, and serves as a “harsh reminder that we could very easily see trade talks fall apart next month.” Some even suggested that if Trump will limit US investment into Chinese stocks, Beijing may retaliate with its own nuclear weapon, and dump some or all of its US Treasury holdings: “You know those Treasury bonds you’re issuing? We don’t want so much of that anymore.”

And despite some marginal difference as to the severity of today’s news, all analysts appeared to agree that today’s news “opens up a new front in the U.S.-China trade conflict” and the only question is whether these are “just loose headlines with U.S. capital flows used as a bargaining chip, or whether the threat is real.”

We are confident that Trump’s twitter feed will give us the answer soon enough.

Below is a summary of some more notable Wall Street reactions, courtesy of Bloomberg and others:

Jennifer Ellison, principal at San-Francisco based BOS:

“This is not little stuff. This is huge. The cost of tariffs on the economy, the impact on growth around the world when you don’t have trade flowing, the potential impact of China getting really mad and looking at us and saying ‘You know those Treasury bonds you’re issuing? We don’t want so much of that anymore.’ There’s a lot more potential downside than there is upside when this is all resolved. To say ‘We’re closing the gates, you can’t invest your money outside U.S. borders, it’s just ludicrous. The market is a little tired of it.”

Ed Moya, senior market analyst at Oanda:

“Just like we saw in the previous lead-up to high-level talks in the past, the White House is trying to increase their negotiating chip count with a fresh threat that could cripple Chinese companies,” he said. “The limitation of American pension funds access to Chinese markets would see massive portfolio swings that spells disaster for the tech sector. This threat is harsh reminder that we could very easily see trade talks fall apart next month.”

Ed Al-Hussainy, a strategist at Columbia Threadneedle:

“This one is a non-starter. Even this administration will have a hard time making the case for capital controls at this scale. Just another market burp.”

Alan Ruskin, chief international strategist at Deutsche Bank AG:

“This policy risks reciprocity from China, where China is of course a much bigger player in U.S. portfolio markets, than the U.S. is in China. In general, headlines like this also suggest that U.S.-China relations remain extremely tense, so not a great sign on the state of the trade negotiations. These headlines help assets that do well in ‘risk-off’ like gold, Swissie and yen. The euro likely also benefits in part as China could in theory search for alternative liquid markets,” he said. “One important caveat to above is we need to see if these are just loose headlines with U.S. capital flows used as a bargaining chip, or whether the threat is real.”

Zach Pandl, co-head of global FX and emerging-market strategy at Goldman Sachs Group Inc.:

“The news opens up a new front in the U.S.-China trade conflict. Looks likely to weigh on the yuan and neighboring currencies, and support safe havens, especially the yen.”

Mike Collins, senior portfolio manager at PGIM Fixed Income:

“It’s another example of how every time people think this trade war is deescalating, it escalates again,” he said. “We’re in this for the long run. There’s no end in sight.”

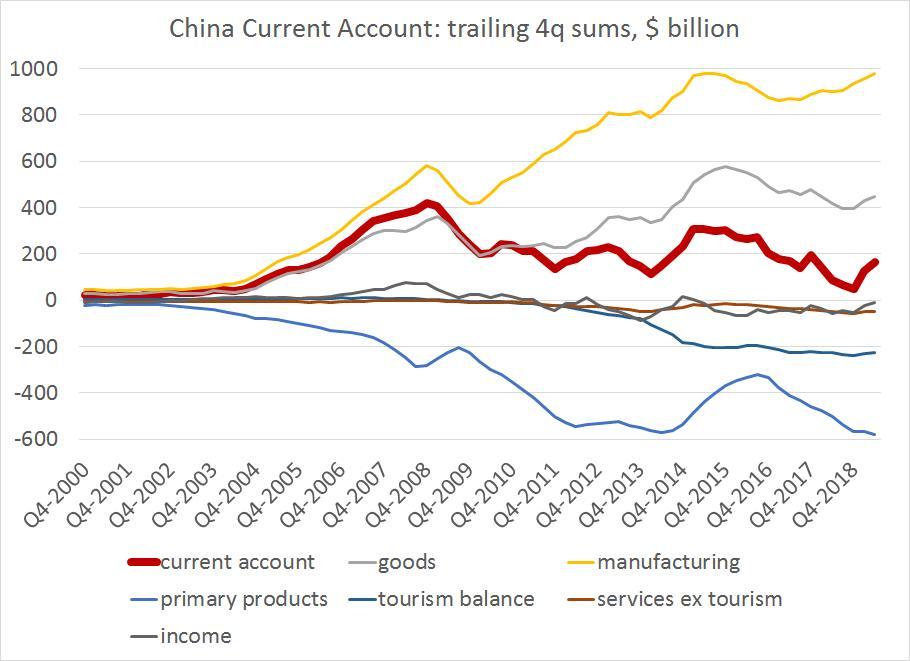

Brad Setser, senior fellow at the council on foreign relations.

Some argue that the US has leverage because China needs US financial investment. I am not at all convinced. China has plenty of domestic savings — its problem has been putting that to good use. It doesn’t need to import savings and China’s current account surplus has been rising (along with China’s trade surplus) this year — China is on net still a capital exporter.

Tyler Durden

Fri, 09/27/2019 – 13:53

via ZeroHedge News https://ift.tt/2nlyFNZ Tyler Durden