Stocks Drop, Gold Pops As Powell Promises (Not)QE & Trump Dumps On Xi

Fed Chair Powell promised moar (but with a caveat)…

“I want to emphasize that growth of our balance sheet for reserve management purposes should in no way be confused with the large-scale asset purchase programs that we deployed after the financial crisis.”

“…in no sense is this QE“

“…it’s not QE, did i mention that?”

“Anyone who calls QE4, QE4, and not “not QE” is a Russian spy…”

OK, the last one was not true, but if Powell has to deny the obvious this much, does he really expect the market to buy the bullshit he is selling?

And so, because we do not want to argue with Fed Chair Powell, we will call it “NotQE.”

And the market utterly rejected Powell’s comments…

This came minutes after Chicago Fed’s Evans’ comments that “certainly, asset valuations are quite high,” and Powell claimed that he “doesn’t see any bubbles in housing or financial markets.”

The sun is setting on any semblance of credibility for The Fed as helicopter money comes closer to reality.

Unfortunately for Fed Chair Powell, President Trump stole the jam from his donut, announcing notable actions against human rights abusers in China – pouring cold water on any hopes of a trade deal and crushing the gains from Powell’s promised printfest.

Additionally, Powell said that “tariffs are a one-time increase in prices and is different from inflation,” therefore confirming (following the slide in PPI today) that Trump is right, and US consumers aren’t hurt by trade war.

* * *

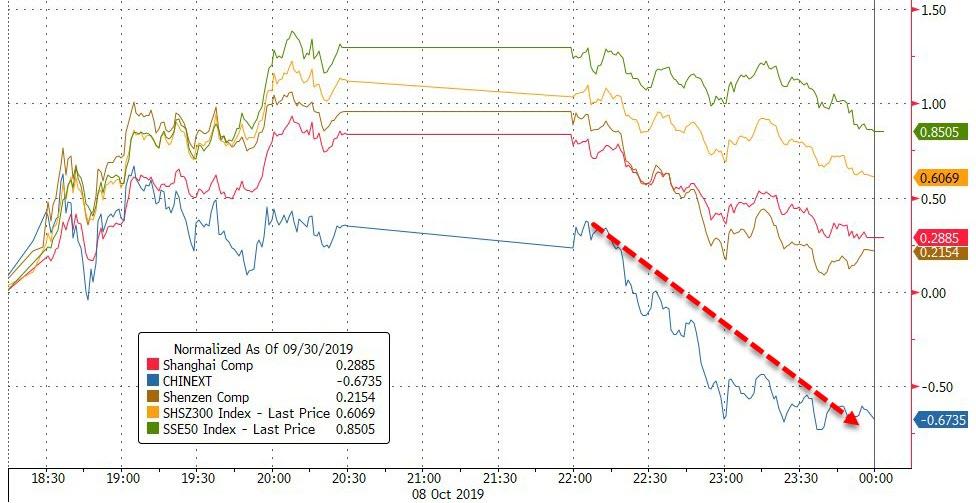

China is back from Golden Week and after a weak PMI, tech stocks sank…

Source: Bloomberg

US futures show the chaos from headlines today…

And cash equities are all notably weaker on the day, ending ugly…

Which left all the US major equity markets at or near critical technical levels…

Gold was just as chaotic, but ended back above $1500…

And gold rose despite a surge in the dollar…

Source: Bloomberg

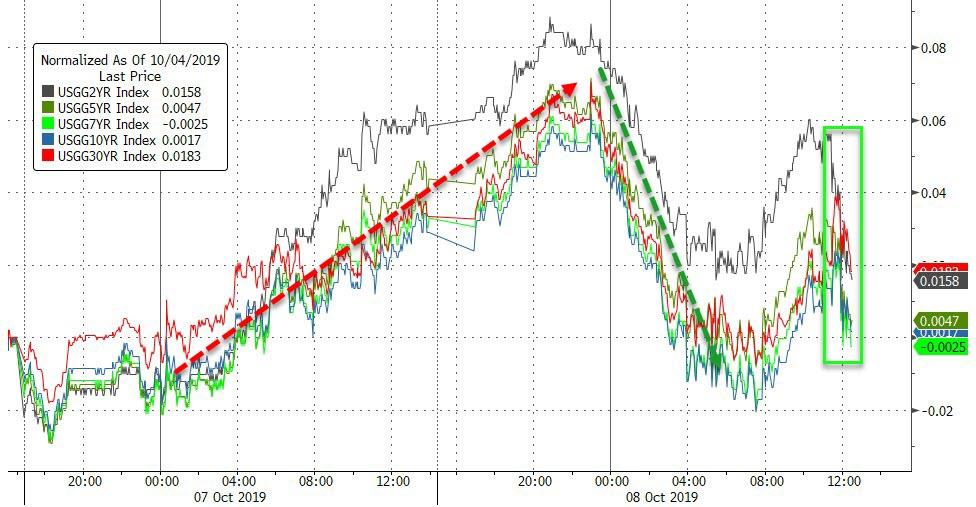

Treasury yields were all lower on the day with the short-end outperforming (2Y -4bps, 30Y -1.5bps), leaving the belly actually lower in yield on the week…

Source: Bloomberg

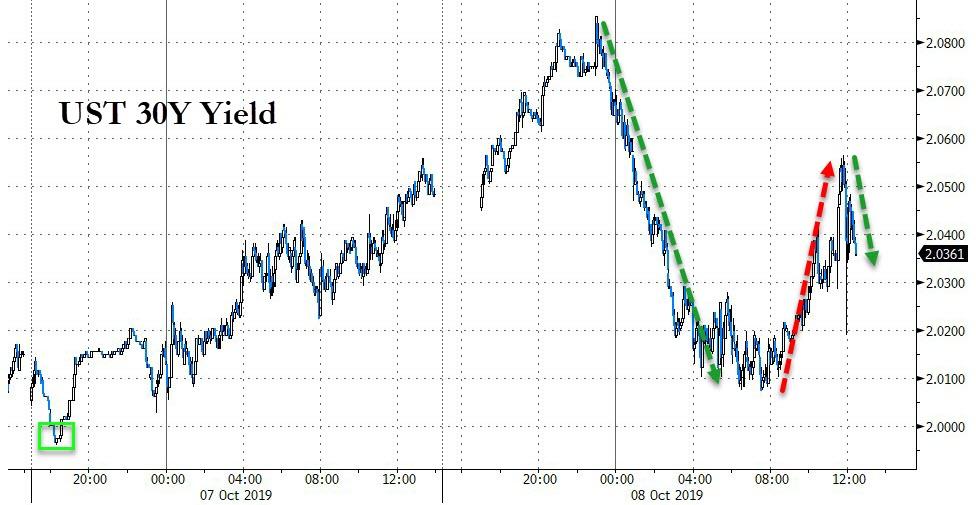

With 30Y testing back down towards 2.00%…

Source: Bloomberg

Fed Funds markets shifted dovishly, pricing in slightly more rate-cuts this year…

Source: Bloomberg

Cryptos lagged on the day…

Source: Bloomberg

Cable tumbled on Brexit headlines…

Source: Bloomberg

Yuan was ugly as Golden Week ended…

Source: Bloomberg

Silver outperformed on the day and crude lagged…

Source: Bloomberg

Silver was aggressively bid overnight and extended gains during the day…

And dramatically outperformed gold on the day…

Source: Bloomberg

WTI dropped back below $53 ahead of tonight’s API inventory data….

Finally, “You Are Here”…

Source: Bloomberg

And fun-durr-mentals aren’t helping anymore…

Source: Bloomberg

It would seem that President Trump is very confident that Jay Powell do anything to save the market.

Tyler Durden

Tue, 10/08/2019 – 16:01

via ZeroHedge News https://ift.tt/2LXiuQT Tyler Durden