Shorts Steamrolled As FitBit Soars On Google Purchase Report

It could be worse.

That’s what shorts in Fitbit are saying right now, because moments ago FIT stock exploded higher, soaring as much as 40%…

… on a Reuters report that Google is in talks to purchase the health-tracker company.

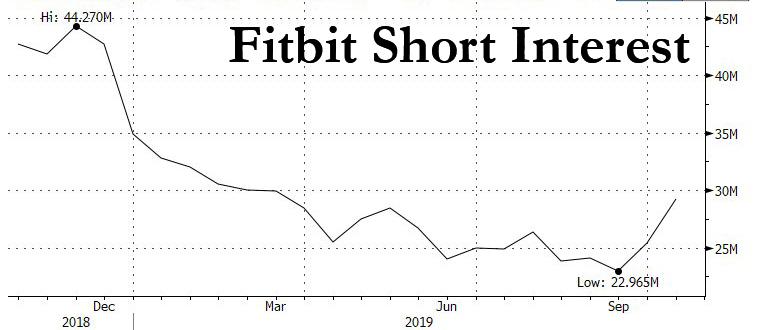

And while it could indeed be worse for the company’s army of shorters, which one year ago was at 44 million, or about 20% of float, this morning’s surge came as skeptics held some 13.1% of the FIT float short, or about 29.3 million shares.

Ironically, the Reuters report does not disclose what value a potential transaction would be worth, however once the short-squeeze avalanche kicks in, the only concern is covering before everyone else does.

As we noted recently, Fitbit was traditionally one of the most shorted names, so today’s news means that any hedge fund that attended “that” particular idea dinner, is now even further away from its true benchmark, the S&P500, which is trading at a new all time high, while all those collecting 2 and 20 will soon have to scramble to explain to their LPs just why they are lagging the risk-free asset (because in a world in which central banks intervene any time there is even a modest drop in the S&P, it is indeed risk free) for the 10th consecutive year. It also explains why as the S&P trades at record highs, the Goldman hedge fund VIP basket is plumbing multi-year lows.

Tyler Durden

Mon, 10/28/2019 – 12:06

via ZeroHedge News https://ift.tt/2BRwfLi Tyler Durden