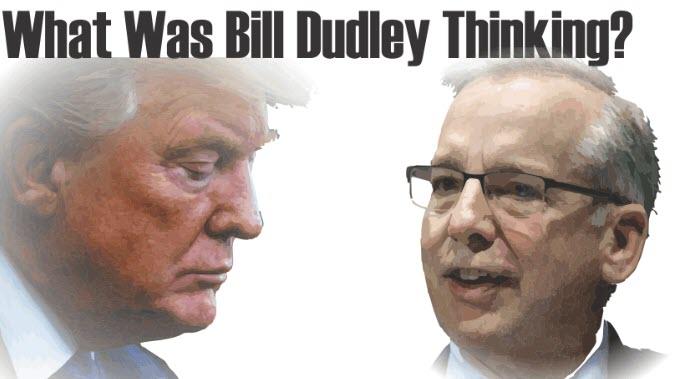

“Deep State” Dudley Flip-Flops, Urges Fed To Cut Rates, Avoid Trump-Killing Recession

In late August, none other than former Goldman chief economist and the former head of the NY Fed, Bill Dudley, broke the golden rule of central-banking elitism – he publicly crossed the line into politics, arguing that “there is even an argument” that the Fed should crush the economy (arguably by hiking or not cutting rates) and start the next recession, thereby preventing Trump from getting re-elected.

…”this manufactured disaster-in-the-making presents the Federal Reserve with a dilemma: Should it mitigate the damage by providing offsetting stimulus, or refuse to play along?”

Dudley’s advice: “If the ultimate goal is a healthy economy, the Fed should seriously consider the latter approach“, i.e., defy the president.

A week later, after widespread derision, Dudley doubled-down – despite attempting to clarify what he meant in his previous op-ed.

First, the Fed needs to be cautious that it does not inadvertently enable the president’s trade war with China.

As I wrote: “what if the Fed’s accommodation encourages the president to escalate the trade war further, increasing the risk of recession? The central bank’s efforts to cushion the blow might not be merely ineffectual. They might actually make things worse.”

In my judgment, there is a risk that the Fed, by easing, might encourage the president to take even more aggressive actions on trade and in raising tariffs. This might create even greater downside risks for the economy that monetary policy might prove ill-suited to address.

And the absolute punchline:

“I wrote the article to express my concern that the president had placed the negative economic consequences of his trade war at the feet of the Fed, and that Fed officials had not pushed back against this more forcibly.”

Which is amusing, because after all those often contradictory words, Dudley leaves his readers where they started: asking him how the Fed should “push back more forcibly” against the president, one which the Fed can prevent from getting re-elected – as Dudley himself admitted last week – if it only chooses, but it would never choose to do so as it is so apolitical, it should push to “achieve a better economic outcome” than the one sought by the president.

And now, six weeks later, Dudley appears to have flip-flopped completely, urging The Fed to cut rates as insurance against an imminent recession – the exact recession that he had previously willed into being to ouster President Trump in November 2020…

People shouldn’t be as worried as they are about the risk of a U.S. recession. That said, it wouldn’t take much to trigger one, which is why the Federal Reserve should take out some insurance by providing added stimulus this week.

Market participants see all sorts of reasons to fret about an imminent slump. Global growth is slowing, trade wars are adding to uncertainty, the economic expansion is getting old and, until recently, yields on short-term Treasury bills were higher than those on long-term notes – the kind of “yield-curve inversion” that has tended to precede recessions.

I’m less concerned. Consumers are in good shape, and the Fed’s rate cuts have kept financial conditions easy. It takes more than age to kill an expansion: Typically, either unwanted inflation forces the Fed to snuff out growth, or some shock hits demand so hard and fast that the Fed can’t respond quickly enough to prevent a recession. The yield curve is flat not because short-term rates are high, but because long-term rates are so low. Investors are buying bonds as a hedge against bad outcomes on growth; they’re not worried about higher inflation. Importantly, monetary policy is still supporting growth, as can be seen in home sales and residential construction.

What, then, can go wrong? Sometimes, an adverse event and human psychology can reinforce each other in such a way that they bring about a recession. Given how slowly the economy is growing, even a modest shock could do the trick.

To understand the risk, consider the historical behavior of the unemployment rate. Looking at a three-month average (to eliminate month-to-month noise), a remarkable pattern appears: When the rate rises, it moves either trivially or a lot. That is, either it goes up by less than a third of a percentage point, or it goes up by 2 percentage points or more and the U.S. economy falls into recession. Since World War II, there has never been anything in between.

Why the gap? The answer probably lies in a dynamic that Yale economist Robert Shiller describes in his new book, “Narrative Economics.” Suppose some minor economic shock, such as heightened uncertainty about trade policy, precipitates modest job losses. When other workers hear that their acquaintances, or their acquaintances’ acquaintances, have been laid off, they worry that they could be next. So they tighten their belts a bit, eat out less, hold off on that kitchen remodeling. This reduces demand further and leads to more layoffs. Pretty soon the negative narrative is pervasive and self-reinforcing, with the unemployment rate rising persistently. The Fed can’t respond in time because definitive data take a while to appear, and because it takes time for monetary easing to stimulate economic activity.

There are plenty of identifiable risks that could trigger such a negative feedback loop right now. They include developments in the trade war between the U.S. and China and the drag exerted by slowing global growth — along with people’s memories of the last deep recession, which could increase the power of gloomy narratives.

This danger bolsters the argument for the Fed to ease monetary policy at this week’s meeting of the Federal Open Market Committee. Such a preemptive move will reduce the chances that the economy will slow sufficiently to hit stall speed. Even if the insurance turns out to be unnecessary, the potential consequences aren’t bad. It just means that the economy will be stronger and the inflation rate will likely move more quickly back toward the Fed’s 2% target.

* * *

Of course, as we detailed previously, what Dudley is concerned about is not the trade war itself, but how it could implicate the Fed as the global economy continues to grind to a halt, and as he says, “the Fed’s problems might not end there. Not only might the Fed be unable to rescue the economy, but it also might be blamed for the economy’s poor performance. This risk is higher because of the president’s ongoing attacks on the Fed.” This is a point he echoes toward the end of the article as well, writing that “I don’t think the Fed should be attacked for the economy’s performance when the president’s own actions are creating the downside risks.”

Bingo: that’s it right there – the “risk” that the Fed may be blamed for not just the “economy’s poor performance” but that the great unwashed masses may one day wake up and realize that the reason why the global financial system is facing a crisis of monumental proportions has nothing to do with Trump – who is merely a vessel and a symptom of a broken system – and everything to do with a central bank which ever since its creation in 1913 has had one purpose, to make the rich richer and perpetuate a broken monetary system (even Mark Carney is saying the days of the dollar as a reserve currency are now over), is why Dudley is so very much on edge.

After all, those same great unwashed masses, following the moment of epiphany may pay Dudley a visit in his mansion and demand an explanation of their own why everything has gone to hell, as it almost certainly will after the next recession.

Tyler Durden

Mon, 10/28/2019 – 12:33

via ZeroHedge News https://ift.tt/36bwxdN Tyler Durden