Consumers Will Be Next Domino To Fall, Signaling Broader Economic Slowdown Ahead

We’re beginning to see more evidence that suggests the consumer is the next domino to fall.

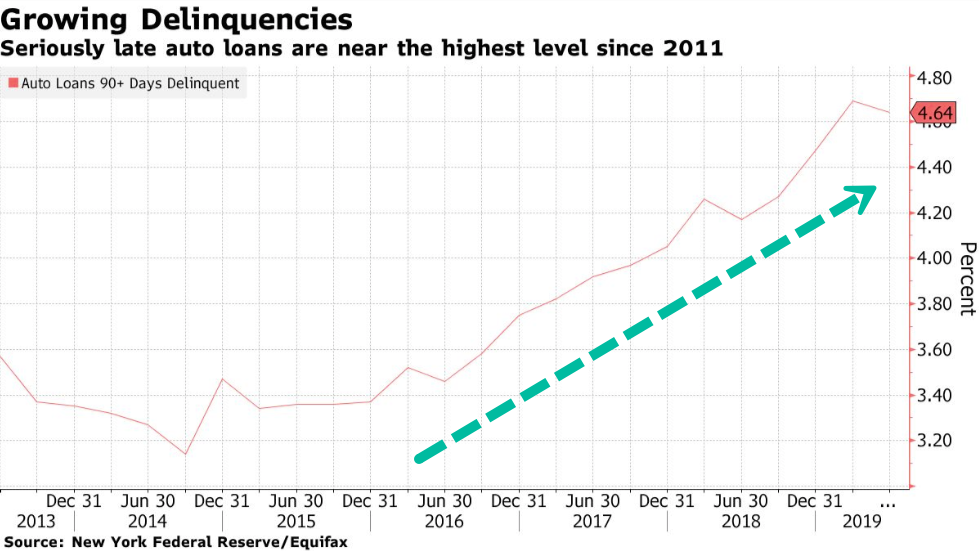

Cracks are developing across the auto loan spectrum as subprime defaults accelerate at rates not seen since the dark days of 2008.

The whole mid-cycle narrative is nothing more than a fairytale, as Wall Street’s big bet on a healthy consumer might only end in disaster.

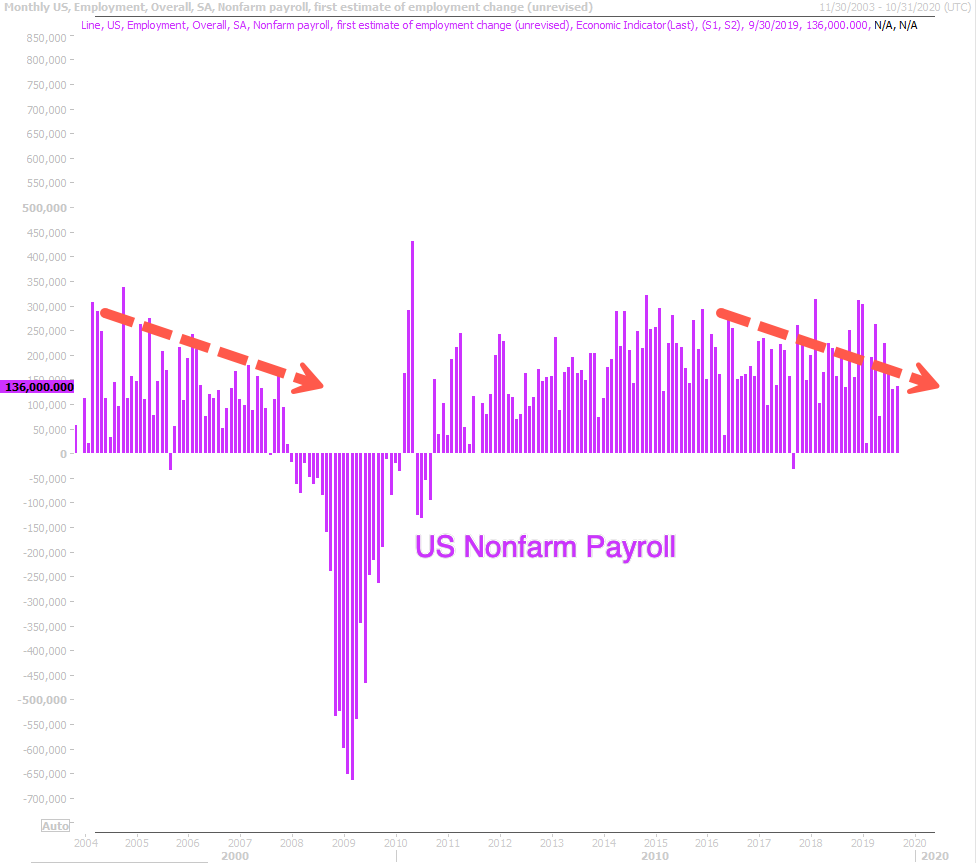

Wall Street has overlooked the cyclical downshift in employment, which started in January 2019, has caught many analysts off guard, despite the stock market hitting new all-time highs thanks to President Trump’s tweeting.

The downshift in employment could spook analysts later this week and through year-end. This alarming trend has forced companies in the last several months to stop hiring and halt wage increases.

What could happen in the next several quarters is a rollover in consumer sentiment, that is what generally happens when the employment cycle moves lower. This will affect retail sales and probably lead to a rather poor holiday season for retailers.

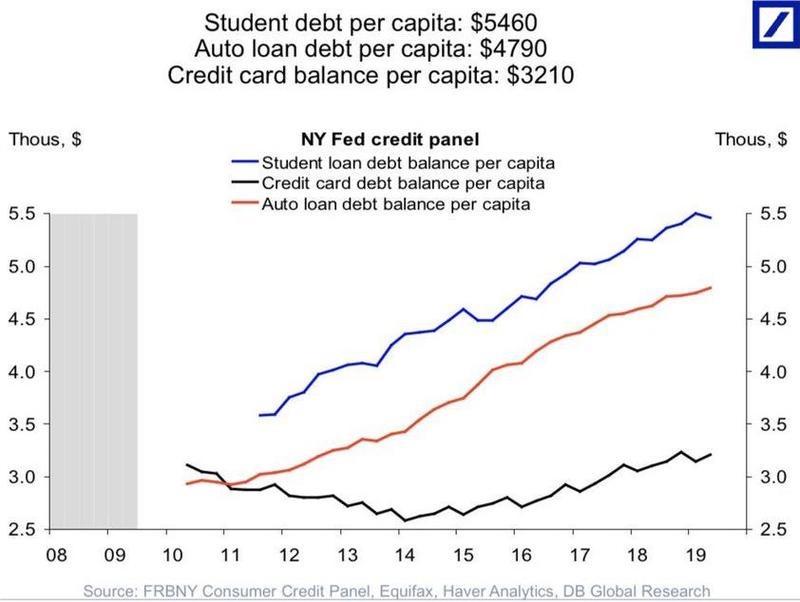

Wall Street’s massive bet on the consumer this late in the cycle is a fool’s errand, that is because the consumer has already cracked, and it’s the recent explosion of serious auto delinquencies has marked the death of the US consumer as the economic downturn is expected to broaden through 2020.

The most troublesome part is that when the consumer disappears, it’ll significantly drag GDP lower.

“We’re in a more fragile situation where consumers are more skittish,” said Diane Swonk, chief economist at Grant Thornton. “They’re more susceptible to negative news shocks even though we’ve got what should be these great underlying fundamentals.”

While JPMorgan CEO Jamie Dimon has been whistling the same tune as President Trump, in calling the economy “quite strong.”

Dimon has been secretly preparing for a consumer bust cycle as the bank increased money for loan losses to $1.3 billion, from $980 million in 2018, reported Bloomberg.

American Express and Discover Financial Services have been setting aside more and more loan loss funds in the last three months as the auto bust continues to gain momentum in 4Q19.

A recent NY Fed report showed for the three months ended in June, auto loans that were +90 days delinquent made up 4.6% of total balances, levels not seen since 2011. In credit card lending, 5.17% of loans became delinquent in the same period, the fastest rate since 2012.

Given the consumer deterioration backdrop, corporate executives in food and services have been warning that consumers pulled back on spending in the last three months.

Gene Lee, CEO of Olive Garden parent Darden Restaurants Inc., warned in a recent investor call that “there’s some uncertainty entering into the consumer” despite a robust economy.

Cracker Barrel Old Country Store Inc.’s CEO Sandra Cochran warned consumers are becoming “more cautious.”

We noted last week that UBS analyst Matthew Mish said 44% of consumers don’t make enough money to cover their expenses.

The big trend to unfold through 2020 is the implosion of the consumer and a broadening economic downturn.

Tyler Durden

Mon, 10/28/2019 – 17:40

via ZeroHedge News https://ift.tt/2Wn3orm Tyler Durden