Fed’s Balance Sheet Soars Above $4 Trillion: Up $250 Billion Since Repo Crisis

If it seems like it was just over a month ago that the repo market suddenly suffered its biggest cardiac arrest since the financial crisis, when overnight repo rates exploded from 2% to 10% in an instant with no observable news or catalyst on the 11th anniversary of Lehman’s collapse…

… and only immediate Fed intervention prevented a full-blown financial crisis, it’s because it was.

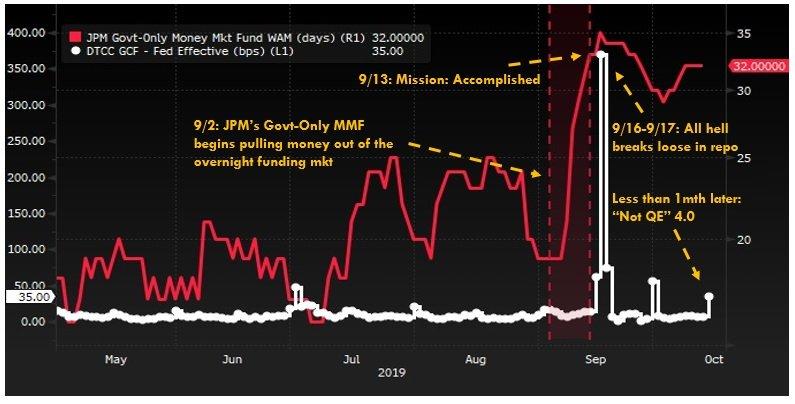

As we have already discussed, we now know that said crisis was precipitated by JPMorgan quietly and steadily withdrawing liquidity from money markets…

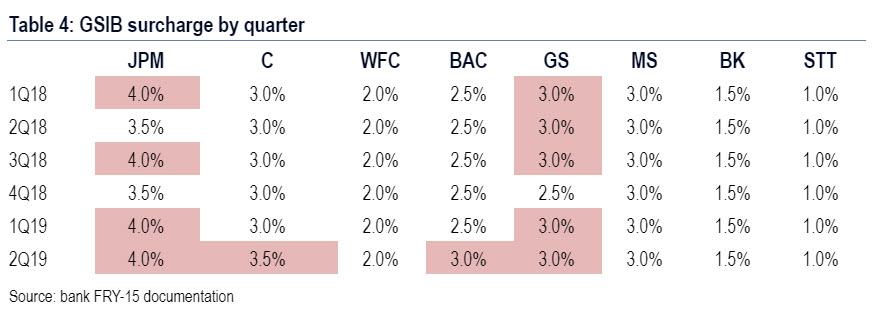

… while at the same time Jamie Dimon’s bank reduced the cash it has on deposit at the Federal Reserve, from which it might have lent to other banks and prevent the repo crisis, by $158 billion in the year through June, a 57% decline, as JPM faced the highest G-SIB surcharges of all US banks due to the specific composition of its balance sheet.

Of course, whether this was indeed the reason behind JPM’s liquidity withdrawal, or if Jamie Dimon strategically shrank the bank’s available liquidity in order to incite a repo market crisis (the same way some speculate Lehman was sacrificed to launch QE1 and the global financial bailout), there is no way of knowing for sure – we can hope that Elizabeth Warren’s questions to Steve Mnuchin will provide some additional insight, although we doubt it – but what we do know is that in response to September’s repocalypse, not only did the NY Fed launch overnight and term repos to inject liquidity into the market, it also started “Not QE”, or “Quasi QE”, which is never ever to be confused with “QE 4” (as that would suggest the US economy is now in a recession and the Fed is panicking to prevent a market crash). Why? Because whereas the narrative never touched on JPM and its explicit liquidity withdrawal, pundits were all too eager to point to the drop in Fed reserves to “only” $1.3 trillion as the culprit behind September’s fireworks.

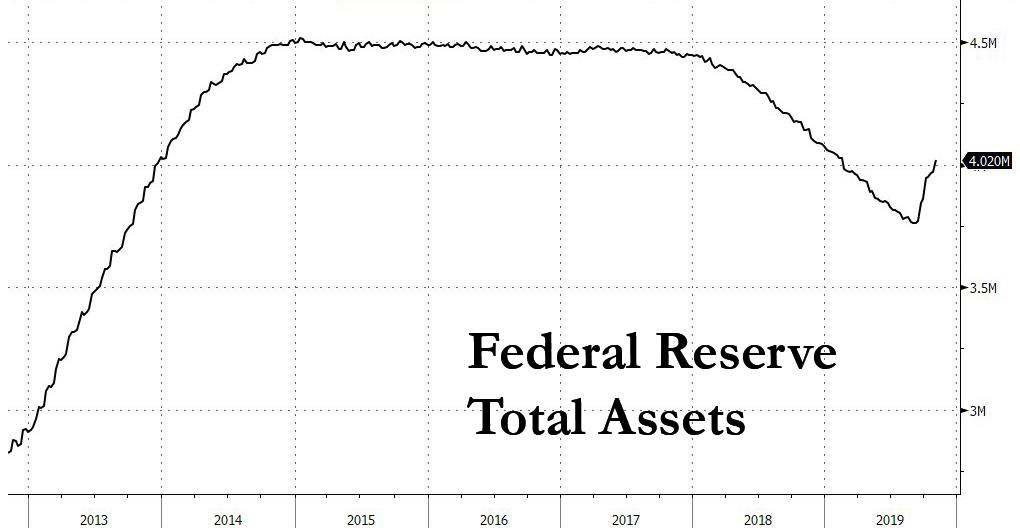

Fast forward to today, when for JPMorgan and all other US commercial banks (which happen to own the Fed), it is mission accomplished: not only did the Fed’s excess reserves spike to $1.5 trillion, a level which the experts say is far more suitable for the US financial system (as a reminder, before the financial crisis the level of excess reserves was precisely $0), but as of last week, the Fed’s balance sheet is now back over $4 trillion (at roughly the same time total US debt hit $23 trillion for the first time), surging over $250 billion since September, and one third of the way to regaining it’s all time highs of $4.5 trillion.

And since the Fed’s POMO will continue well into 2020, expect the previous all time highs in the Fed’s balance sheet to be surpassed soon. Just don’t call it QE.

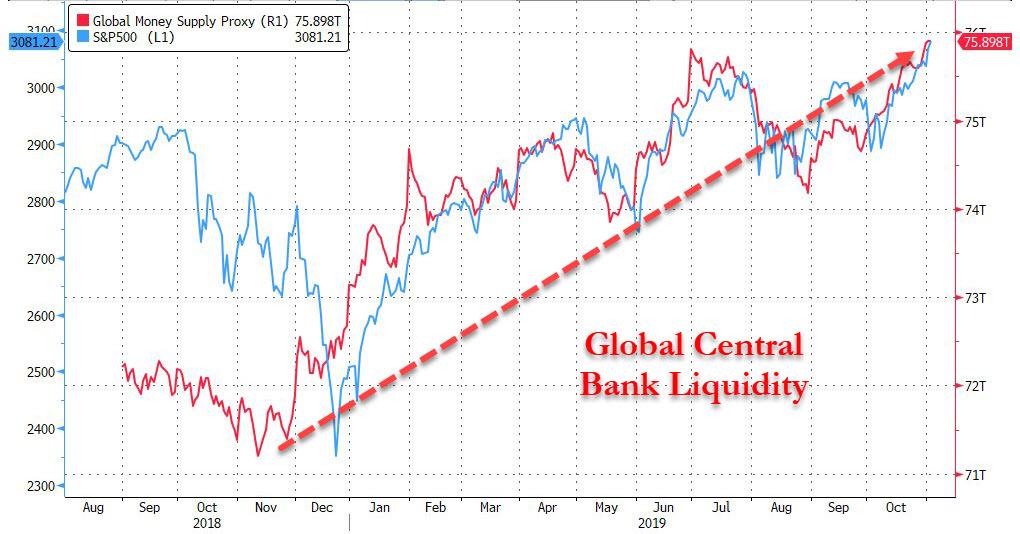

Meanwhile, if one strips away the superficial debate whether the US repo market is fixed or still broken, if interbank plumbing remains clogged up, if JPM caused the September repo crisis (on purpose) or if the dollar funding crisis was due to a drop in bank reserves, and if this is QE or not QE, what is really taking place just behind the scenes is very simple: global central banks, from the ECB, to China, and now to the Fed, are once again flooding the world with liquidity. In fact, the only reason the S&P is up 23% YTD is – drumroll – a $4 trillion surge in the global money supply as shown in the chart below.

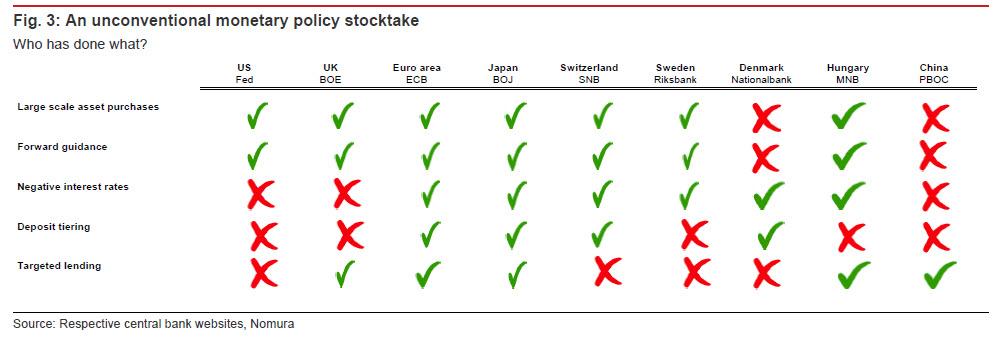

Finally, for those – who like the IMF – say central banks are tapped out, a recent report from Nomura shows that whereas some central banks – such as the ECB and BOJ – have already tried everything, there are those like the Fed and the PBOC which still have some ammo left…

… which means that the can will be kicked at least a little bit longer before central banks use up all their available means to extend and pretend, and the market finally collapses.

Tyler Durden

Mon, 11/04/2019 – 13:30

via ZeroHedge News https://ift.tt/2PMG4lY Tyler Durden