Futures Frozen Ahead Of Widely-Anticipated Trump Trade Speech

Overnight markets traded subdued, with US equity futures unchanged after settling in a narrow range, as investors awaited a speech by President Trump at the Economic Club of New York on Tuesday on U.S. trade policy and on news he was likely to delay a decision on European auto tariffs.

Wall Street futures for the S&P 500 inched up 0.1%. Monday’s partial holiday had made for a quiet session after the record highs of last week. The Dow ended up 0.04%, while the S&P 500 lost 0.20% and the Nasdaq 0.13%.

European markets edged higher, set for their first gain in three days, as the Euro Stoxx 600 rose 0.2% back towards 4-year highs helped by upbeat chipmaker shares, with bond yields little changed across most curves, as markets awaited a speech not only Trump but also Fed Vice-Chair Richard Clarida. Major European bourses were buoyed amid expectations that US President Trump will delay the decision to impose tariffs on EU autos by six months, according to Politico citing sources, although upside was hampered amid US-China trade uncertainty and continuing social unrest in Hong Kong with its financial district paralysed with protests. Further upside was also generated after the better than expected German ZEW metrics which showed economic confidence rising to 6 month highs.

Earlier in the session, the MSCI index of Asia-Pacific shares ex-Japan reversed morning losses, climbing 0.5%, following a sharp 1.2% pullback on Monday, as Hong Kong rebounded from a Monday sell-off spurred by violent protests. Most markets in the region rose, with Taiwan leading gains while Australia retreated. Technology and communications were among the biggest gainers. Japan’s Topix index added 0.3% to cap a six-day rising streak, supported by electronic companies. Hong Kong’s Hang Seng Index advanced 0.5% after falling the most in three months on Monday. Shanghai blue chips eased 0.2% after bank lending growth undershot analysts’ estimates, while Australian shares were down, too. A sharp slowdown in credit expansion in October may prompt China’s central bank to step up easing before year-end. India is shut for a holiday.

With earnings season now largely over and major central banks on indefinite hold, investor focus has turned firmly to trade. They appear to be in a cautious mood after hopes for a first-phase deal between the U.S. and China fueled a risk rally and bond sell-off last week, before President Donald Trump’s comments over the weekend cooled some of the optimism. “The markets are already pricing in a lot of trade optimism,” Janet Mui, global economist at Cazenove Capital, told Bloomberg TV. But “the whole situation is very fluid. We still haven’t got a definite answer on where they’re going to potentially sign a deal,” she said.

Trump’s lunchtime address at the Economic Club of New York, which has hosted U.S. presidents including Woodrow Wilson and John F. Kennedy, as well as foreign leaders like former Soviet President Mikhail Gorbachev and Chinese Premier Li Keqiang will be closely watched by investors anxious for any positive news about his administration’s long-running trade war with China.

“You can expect the president to highlight how his policies of lower taxes, deregulation, and fair and reciprocal trade have supported the longest economic recovery in U.S. history with record low unemployment, rising wages, and soaring consumer confidence,” White House spokesman Judd Deere said.

Bond markets also seemed increasingly confident a recession will be avoided as EU officials said Trump was expected to announce this week that he was delaying the tariff decision on EU cars and parts for another six months. The news boosted expectations about Trump’s speech later in the day and for some resolution to his administration’s long-running trade war with China.

Trump wrongfooted markets over the weekend when he said there had been incorrect reporting about U.S. willingness to lift tariffs on China.

Also of note, Fed Vice Chair Richard Clarida will discuss monetary policy in Zurich Tuesday, Patrick Harker and Neel Kashkari follow with speeches later in the day.

Investors were also anxious about the situation in Hong Kong after a violent escalation of protests had knocked 3% off the Hang Seng and nearly 2% off Asia-exposed banks HSBC and StanChart in recent days. Hong Kong’s embattled leader Carrie Lam on Tuesday said protesters who are trying to “paralyze” the city were extremely selfish and hoped all universities and schools would urge students not to participate in violence. Lam was speaking a day after police shot a protester and a man was set on fire in some of the most dramatic scenes to grip the city during the more than five months of civil unrest. The Hang Seng managed to claw back 0.5%.

In rates, a bond holiday in the United States had closed the Treasury market on Monday but there was an early milestone on Tuesday with the gap between 3-month and 10-year yields hitting the widest level of the year so far. 10Y Treasury yields were fractionally higher at 1.9350% having dropping away from last week’s three-month top of 1.97%. European yields were also a touch higher.

In FX, the dollar advanced against most Group-of-10 peers Tuesday as a mild risk-on mood in markets weighed on havens such as the yen and Swiss franc. New Zealand’s dollar slid after data showed a drop in inflation expectations, boosting bets for an interest-rate cut this week. The Bloomberg Dollar Spot Index rose while most G-10 currencies traded in a narrow range as investors awaited further developments on trade and also speeches by U.S. President Donald Trump on Tuesday, followed by Federal Reserve Chairman Jerome Powell later this week, while Fed Vice Chair Richard Clarida will discuss monetary policy in Zurich Tuesday.

Elsewhere, EUR/USD was little changed at 1.1027 even as data showed German investor confidence rose to the highest level in six months; Trump’s trade speech could be crucial for the euro, according to some strategists. A postponement of any decision to levy auto tariffs on Europe this week is being regarded as the most likely outcome, said Lee Hardman, a currency strategist at MUFG. “Most of this positivity is already priced into the euro and so we expect limited upside,” he wrote in a note. “There is significantly more downside risk, although we regard this as very unlikely to manifest.”

In the UK, cable declined 0.2% to $1.2833 after Monday’s 0.6% climb; Data released Tuesday show the U.K. economy lost jobs in the third quarter and vacancies posted their largest annual decline since the financial crisis. The yen weakened for the first time in two days — USD/JPY advanced 0.2% to 109.23. Yen was sold against the greenback, with investors using large option strikes at 109.00 as an intraday base, according to Asia-based FX traders.

In geopolitics, Israel announced it struck the house of the leader of Palestinian Islamic Jihad armed wing in Gaza, while a residential building was also said to be hit during Israeli airstrikes in Damascus. In related news, the Palestinian Islamic Jihad vowed a powerful response to Israel’s strike which killed the group’s leader, while reports later noted rocket sirens sounding, multiple explosions and Iron Dome interceptions from a rocket barrage in Israel.

In commodities, WTI gained 28 cents to $57.14 a barrel, while Brent crude futures added 35 cents to $62.53. Gold looked to be heading for a third day of declines, touching its lowest since early August at $1,447.89 per ounce. It was last trading at $1,453.01.

Expected data include NFIB Small Business Optimism. CBS, Linde, and Tyson are among companies reporting earnings

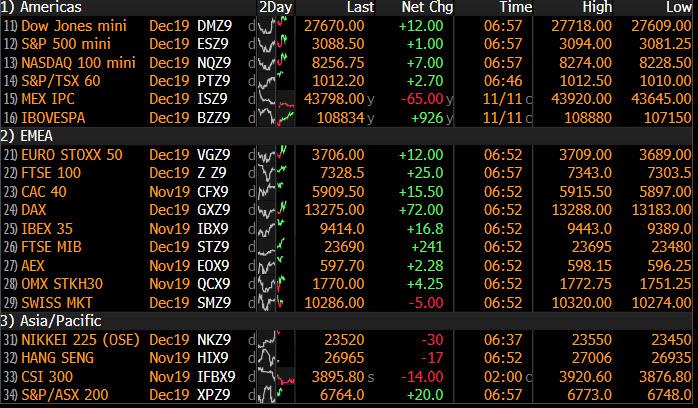

Market Snapshot

- S&P 500 futures little changed at 3,088.25

- STOXX Europe 600 up 0.07% to 405.64

- MXAP up 0.4% to 165.65

- MXAPJ up 0.5% to 530.44

- Nikkei up 0.8% to 23,520.01

- Topix up 0.3% to 1,709.67

- Hang Seng Index up 0.5% to 27,065.28

- Shanghai Composite up 0.2% to 2,914.82

- Sensex up 0.05% to 40,345.08

- Australia S&P/ASX 200 down 0.3% to 6,752.97

- Kospi up 0.8% to 2,140.92

- German 10Y yield rose 1.2 bps to -0.233%

- Euro down 0.02% to $1.1031

- Italian 10Y yield rose 6.7 bps to 0.914%

- Spanish 10Y yield rose 1.9 bps to 0.449%

- Brent futures up 0.5% to $62.48/bbl

- Gold spot little changed at $1,455.03

- U.S. Dollar Index up 0.1% to 98.29

Top Headline News from Bloomberg

- A majority of rich investors expect a significant drop in markets before the end of next year, and 25% of their average assets are currently in cash, according to a survey by UBS Global Wealth Management of more than 3,400 global respondents. The U.S.-China trade conflict is their top geopolitical concern, while the upcoming American presidential election is seen as another significant threat to portfolios

- With their next meeting just weeks away, OPEC and its partners are showing no impetus for stronger action to support oil prices. But without intervention, some influential forecasters say a new supply glut could send the market crashing early next year

- Hong Kong protesters gathered in the financial district at lunch time on Tuesday after demonstrators earlier disrupted the morning commute for a second day, blocking subway lines and clashing with police

- Trump administration may punt a decision on whether to slap tariffs on European automobiles as efforts of German car makers to highlight their new investments have helped in the talks, people familiar with White House deliberations said

- Euro’s popularity as a borrowing currency is surging in emerging markets, with annual sales of government bonds crossing the 50 billion mark for the first time ever

- With their next meeting just weeks away, OPEC and its partners are showing no impetus for stronger action to support oil prices. But without intervention, some forecasters say a new supply glut could send the market crashing early next year

- German Chancellor Angela Merkel signaled support for her deputy’s gambit to break an impasse over Europe’s banking integration. Her remarks Monday evening suggest the proposal by Germany’s finance minister reflects a willingness to negotiate on establishing EU-wide bank deposit insurance

- Bolivian lawmakers took a first step toward filling the vacuum of leadership left by the resignation of President Evo Morales, who was granted asylum by Mexico, as clashes continued around the country

- Quantitative hedge funds are being blamed for the worst sell-off in Japanese government bonds since 2013 and the evidence is stacking up against them. Data comprising of open interest positions, fund flow and yields suggest that so-called Commodity Trading Advisors — funds synonymous with trend-following quant strategies — could have been cutting their large long positions in Japanese 10-year bond futures

- The ECB could consider giving non-banks access to its balance sheet to keep control over money-market rates, according to Executive Board member Benoit Coeure

Asian equity markets whipsawed overnight following a similar indecisive lead from Wall St where there was a mild downside bias amid ongoing trade uncertainty, escalating Hong Kong violence and with volumes light due to Veterans Day. ASX 200 (-0.3%) and Nikkei 225 (+0.8%) were mixed with Australia dragged by underperformance in the mining related sectors and with financials subdued after tepid results from the nation’s largest lender CBA, while the Japanese benchmark just about remained afloat with a varied currency the main catalyst for price action. Hang Seng (+0.5%) and Shanghai Comp. (+0.2%) traded choppy after weaker than expected Chinese financing data and with the efforts to recoup the prior day’s hefty losses in Hong Kong, stalling due to resistance around the 27000 level and continued unrest in the city. Finally, 10yr JGBs slipped below the 153.00 level after a lacklustre tone seen in US Treasury futures which was hampered by the US bond market closure for Veteran’s Day, while demand was also restricted by a weak 30yr auction and with the BoJ only in the market today for Treasury Discount Bills.

Top Asian News

- Nissan Cuts Profit Forecast as Post-Ghosn Turnaround Sputters

- Israel Assassinates Gaza Commander, Provoking Rocket Fire

- Bushfires Spread to Sydney as Emergency Crews Save Homes

- Japan’s Biggest CLO Investor Cools on $750 Billion Market

European equities eke modest gains in early trade [Eurostoxx 50 +0.4%] following on from a relatively indecisive APAC session. Major bourses are buoyed amid expectations that US President Trump will delay the decision to impose tariffs on EU autos by six months, according to Politico citing sources, although upside is hampered amid US-China trade uncertainty and continuing social unrest in Hong Kong with its financial district paralysed with protests. Further upside was also generated after the better than expected German ZEW metrics. Sectors are mostly in the green with underperformance seen in Consumer Staples; Tesco (-1.3%) shares weighed on after Kantar showed a decline in the supermarket’s sales for the 12 weeks to November 3rd, whilst sector heavyweight Nestle (-0.2%) is also subdued after Unilever (+0.3%) was chosen by Burger King to supply plant-based burgers, passing over Nestle, Impossible Foods and Beyond Meat. Elsewhere, most European auto names are cushioned on the back of the aforementioned Politico article; Daimler (+1.0%), Fiat Chrysler (+1.5%) and Peugeot (+1.5%) are all in the green, albeit Renault (Unch) fails to benefit after its alliance partner Nissan reported a 70% Q2 profit slump and slashed its FY sales and operating profit due to weaker demand. Tyre names are broadly lower as dismal earnings from Continental (-1.4%) overshadowed the Politico autos story, with Michelin (+0.3%) initially lower in sympathy, whilst Pirelli (+1.0%) awaits its earnings release scheduled for later today. Meanwhile, Airbus (+1.0%) shares seem to be lifted via a Boeing tailwind, whose shares closed higher in excess of 4% after a spokesperson said 737Max deliveries could resume in December; however, FAA approval is not expected until January 2020. Looking at other movers, Illiad (+17.5%) soared to the top of the pan-European index at the open after the Co. announced a EUR 1.4bln share buyback programme at EUR 120/shr, vs. a sub EUR 100/shr Monday close. Finally, Infineon (+7.5%), Dialog Semiconductor (+6.5%) and Deutsche Post (+4.5%) shares remain firm at the top of the Stoxx 600 index post-earnings.

Top European News

- Coeure Says ECB Could Work With Non-Banks to Anchor Market Rates

- Xavier Niel Cements Control Over Iliad With $1.5 Billion Buyback

- Osram Throws Support Behind $4.4 Billion AMS Takeover Offer

- Vodafone Jumps as Return to Growth Eases Pressure on CEO

In FX, not quite all change, but a marked turnaround in fortunes and sentiment for the Kiwi following a dip in NZ inflation expectations on the eve of the RBNZ policy meeting that has lifted 25 bp rate cut expectations to just over 80% from around 60% ahead of the survey and prompted Westpac to reinstate its call for an ease this month after the bank switched to unchanged. Nzd/Usd has slipped further below 0.6350 in response and Aud/Nzd is back up near 1.0800 even though the Aussie has fallen in sympathy to fresh 2 week lows vs its US counterpart around 0.6835 amidst expectations that the RBA will implement QE by the end of 2020, per JPM.

- NOK – The Norwegian Krona is marginally underperforming relative to its Scandinavian peer and in Euro cross terms in wake of GDP data showing softer than forecast Q3 growth and consecutive m/m contractions, with Eur/Nok nudging towards 10.1000 vs Eur/Sek holding steady circa 10.7000.

- EUR/JPY/CAD/GBP/CHF – All softer against the Greenback, albeit to varying degrees as the DXY derives some support from steadier UST yields and a broadly unchanged curve in contrast to Monday’s bullish retracement and re-flattening. The index is straddling 98.250, with Eur/Usd, Usd/Jpy, Usd/Cad, Cable and Usd/Chf meandering between 1.1020-38, 109.30-00, 1.3255-25, 1.2866-16 and 0.9953-30 respectively. The single currency appears supported ahead of 1.2 bn option expiries at the 1.1000 strike, but capped well in advance of 1.6 bn that roll off between 1.1075-85, and somewhat strangely unimpressed with significantly better than anticipated ZEW economic sentiment and expectations for Germany and the Eurozone as a whole. Conversely, Sterling did derive a bit of traction from elements of the UK labour report, like a dip in the jobless rate and ‘only’ 58k drop in employment vs -94k or more consensus that compensated for claimant count and wage misses.

- EM – The Rand has rebounded from yesterday’s 14.9600+ lows even though SA’s Eskom is still experiencing problems, but the Lira has not really gleaned much comfort from Turkey’s record current account surplus given ongoing jitters about the outcome of Wednesday’s meeting between US President Trump and Erdogan. Elsewhere, the offshore Yuan is hovering around 7.0000 awaiting Trump’s address on Trade and Economic Policy that may contain something constructive on the status of talks with China (perhaps more on Phase 1?).

In commodities, crude markets are higher on Tuesday morning, as the complex continues to consolidate within recent ranges amid a lack of fresh fundamental drivers. For now, WTI Dec’ 19 and Brent Jan’ 19 futures are rangebound around the USD 57.00/bbl and USD 62.50/bbl marks respectively. Comments yesterday from Oman’s Oil Minister, who said deeper OPEC+ cuts at next month’s meeting are unlikely, served as further evidence that there is a lack of willingness among OPEC+ to take stronger action to support crude prices. Recent reports alleged that the Saudis will push for production cuts, but only via seeking better compliance rather than deeper output cuts. Analysts at Morgan Stanley argue that without firmer intervention, a new supply glut could send the market lower early next year by around 30%, which would see Brent trading at roughly USD 45/bbl. In terms of fresh drivers, the market will be eyeing a US President Trump speech at the Economic Club of New York this afternoon and a slate of Fed/ECB speak throughout the day. Participants will have to wait one day longer than usual for the weekly API Inventory data release and the EIA Short-Term Energy Outlook, which have both been delayed on account of yesterday’s US Veteran’s Day holiday. Similarly, Wednesday’s usual EIA Inventory data release will be pushed back to 16:00 GMT Thursday. In terms of metals; Gold prices are marginally softer and tentative ahead of President Trump’s speech. Elsewhere, Dalian Iron Ore prices were sent higher during overnight trade on the news of an outlook cut from Vale, which implies a decline in sales of at least 14.7% in 2019. Copper, meanwhile, fell as EU players arrived at their desks, breaking through resistance at the USD 2.6500/lbs level to a low of around 2.6425/lb.

US Event Calendar

- 6am: NFIB Small Business Optimism, est. 102, prior 101.8

- 5:30am: Fed’s Clarida Discusses Monetary Policy and Price Stability

- 12:55pm: Fed’s Harker Speaks in New York

- 6pm: Fed’s Kashkari Speaks in Madison, Wisconsin

DB’s Jim Reid concludes the overnight wrap

Markets were a bit slow out of the blocks yesterday, not helped by the US holiday, but how they fare today may well be dictated by President Trump’s speech at the Economic Club of New York. It goes without saying that with the trade war discussions where they are, this speech will be important. However today is also the day before the expiration of the 180-day delay to the results of the Section 232 auto investigation so any discussion on this will be closely watched. The consensus has moved towards the belief that President Trump won’t impose auto tariffs but nevertheless it will be an important deadline to get past for markets with a focus on whether President Trump postpones making a decision or actively decides against action. A report last night from Politico suggested that he will announce a delay to any decision for another six months, which would alleviate the near-term risks but would inject the issue into the heart of next year’s presidential election.

In markets, the S&P 500 dipping yesterday (-0.20%) marked only the second down day in November so far. The only real news markets had to feed off were those comments from President Trump over the weekend about “incorrect” reports concerning the US rolling back tariffs. The NASDAQ (-0.13%) and DOW (+0.04%) were similarly muted, as trading volumes were around 25% below average. It wasn’t much more exciting in Europe where the STOXX 600 (-0.02%) ended little changed. Bond markets were also weaker in Europe – with 10y Spanish bonds +4.3bps following the statement enhancing election with BTPs +6.8bps in sympathy. In credit market Walgreens bonds continued to weaken following further rumblings that KKR is to make an official buyout approach to take the company private in what would potentially be the biggest LBO ever. Walgreens EUR 2026 bonds were another 33bps wider yesterday, which follows a 64bps move last week when the news first came out. It brings back interesting memories from the first half of 2000 when every morning you woke up to news that a large company was at risk of being LBO-ed. There was a point where it felt that no company was immune from the threat. Clearly we are somewhat from that!

This morning Asian markets are largely trading up with the Nikkei (+0.60%), Kospi (+0.58%), Shanghai Comp (+0.09%) and Hang Seng (+0.37%) all higher. The Hang Seng’s advance comes after yesterday’s -2.62% decline. Elsewhere, futures on the S&P 500 are up +0.04% and a big mover in FX this morning has been the New Zealand dollar, which is down -0.40% following a weakening in inflation expectations – 2yr inflation expectation for 4Q came in at 1.80% (vs. 1.86% previously). Meanwhile, yields on 10yr JGBs are up +2.9bps to -0.053% – the highest since May – while those on 10yr USTs are down -1.8bps after the holiday.

Back to yesterday, where the data highlight came in China (during the European session) with the latest credit data much weaker than expected. Indeed, aggregate financing in October totalled 619bn yuan, which compared with expectations for 950bn. However it’s worth caveating that this followed a very strong September (over 2.2tn yuan) so the data should be taken with a bit of a pinch of salt.

Closer to home, there was some disappointment in the preliminary Q3 GDP print for the UK, which showed growth of +0.3% qoq (vs. +0.4% expected). The trade data was particularly volatile while consumption data was broadly in line. That being said with the UK in election purdah it’s hard to see the data as changing the picture for the MPC all that much. Sterling actually strengthened +0.60% following the announcement that the Brexit Party won’t challenge the 317 seats won by the Conservative Party at the 2017 election. In theory that is more positive for the chances of a Conservative Party majority although the estimates I saw yesterday were for it to be positive by maybe up to 10-15 seats. So helpful to the Tories rather than game changing. The Brexit Party have struggled for momentum in this election and the risk to them is that this indirect support for the Tories in nearly half the seats confuses their message in seats they are still fighting in. Their battle for attention and relevance may intensify now the Tory’s have a leave deal to campaign on.

To the day ahead now, which is headlined by the aforementioned speech from President Trump at the Economic Club of New York. As for data, we’ve got the October Bank of France industry sentiment index, September and October employment data in the UK and the November ZEW survey in Germany this morning. In the US, the lone release is the October NFIB small business optimism reading. Meanwhile, it’s the turn of the Fed’s Clarida to speak this morning, while Harker and Kashkari also speak this evening. The ECB’s Coeure and Mersch also speak this morning.

Tyler Durden

Tue, 11/12/2019 – 07:34

via ZeroHedge News https://ift.tt/2QhI85H Tyler Durden