Billionaires Are Licking Their Chops Over Distressed U.S. Oil And Gas Assets

Like the vultures Elizabeth Warren claims they are, billionaires are now circling over the soon-to-be dead corpses of companies in the U.S. oil and gas patch, as they look to pick up assets on the cheap.

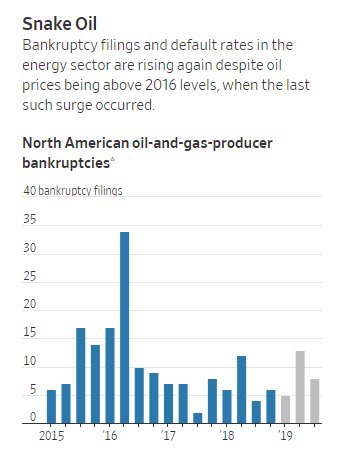

This comes at the same time that the volatility (read: decimation) of the oil and gas industry has scared off many other investors, according to Bloomberg.

Names like Sam Zell, Tom Barrack Jr., and Jerry Jones are all being tossed around as investors who are looking at distressed assets. Zell has teamed up with Barrack Jr. to look at oil assets in California, Colorado and Texas. Jones’ company, Comstock Resources, is looking to acquire natural gas assets from Chesapeake Energy.

Companies are eager to sell at cheap prices to try and get ahead of an upcoming credit crunch.

Zell said on Bloomberg yesterday: “I compared it recently to the real estate industry in the early 1990s, where you had empty buildings all over the place, and nobody had cash to play. That’s very much what we’re seeing today.”

The U.S. has become the world’s largest oil producer due to the shale revolution, but the investors behind that drive have little to show for their efforts. Many companies have plowed through their cash while providing poor returns, as independent oil and gas drillers are down more than 40% since 2014.

Easy money enabled the boom, and we have noted here on Zero Hedge over the last several years how poor resource allocation, crowded wells and overly optimistic estimates have caused a turn for the worse for U.S. oil and gas investors. Now, its time to face the consequences.

With oil prices still low, the number of active drilling rigs in the U.S. has declined and some of the biggest players in the industry have lowered their growth plans.

Chesapeake, for instance, recently warned it may not be able to continue as a “going concern” if low oil prices persist.

This is where names like Zell and Jones come in.

“What we’re seeing are situations where companies are taking steps in anticipation of problems rather than responding to problems,” Zell said. He teamed up with Barrack to create Alpine Energy Capital, LLC and recently closed a $320 million investment with California Resources Corp.

“The seller in that was a big company — not in trouble but not terribly liquid, and therefore looking for ways to, in effect, get somebody else to put up the money to keep the game going,” Zell continued.

Meanwhile Jones’ Comstock is working on a deal to buy Chesapeake assets that could be valued at more than $1 billion. This would give Chesapeake a much needed cash infusion at a time where its debt is its main concern.

Zell has had impeccable timing with markets. In 2007 he unloaded a portfolio of office buildings to Blackstone Group. Now he’s focused on oil instead of natural gas. “The oil situation is in much better shape. And the amount of capital is disappearing,” he commented.

Zell has been called “the grave dancer” for his ability to buy at the bottom of markets. He says that he sees value in assets in an industry that’s in distressed sale mode: it means that the bottom could be in.

Tyler Durden

Tue, 11/19/2019 – 12:38

via ZeroHedge News https://ift.tt/2qj1v3K Tyler Durden