The Rich Have Assets, The Poor Have Debt

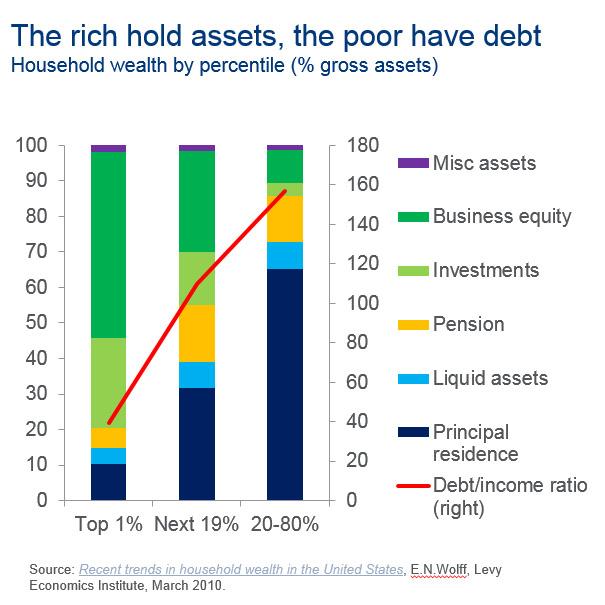

Back in 2013, we first showed with the help of just one chart, why the Fed’s attempts to stimulate the economy by “trickling down” wealth to the wealthy would fail. As a reminder, in 2010 then Fed chair Ben Bernanke published a WaPo op-ed in which he let slip the Fed’s true mandate: in justifying the Fed’s rationale for easier financial conditions as promoting economic growth, Bernanke said “higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending.” Alas, this was a flawed construct from the very beginning for one simple reason: the rich hold assets, the poor have debt, as shown in the following chart.

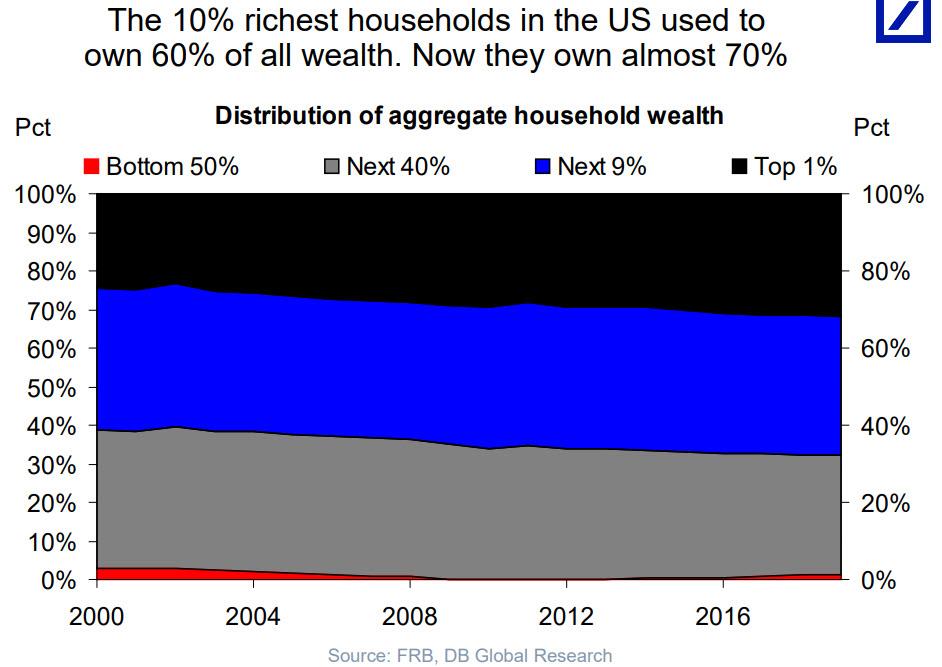

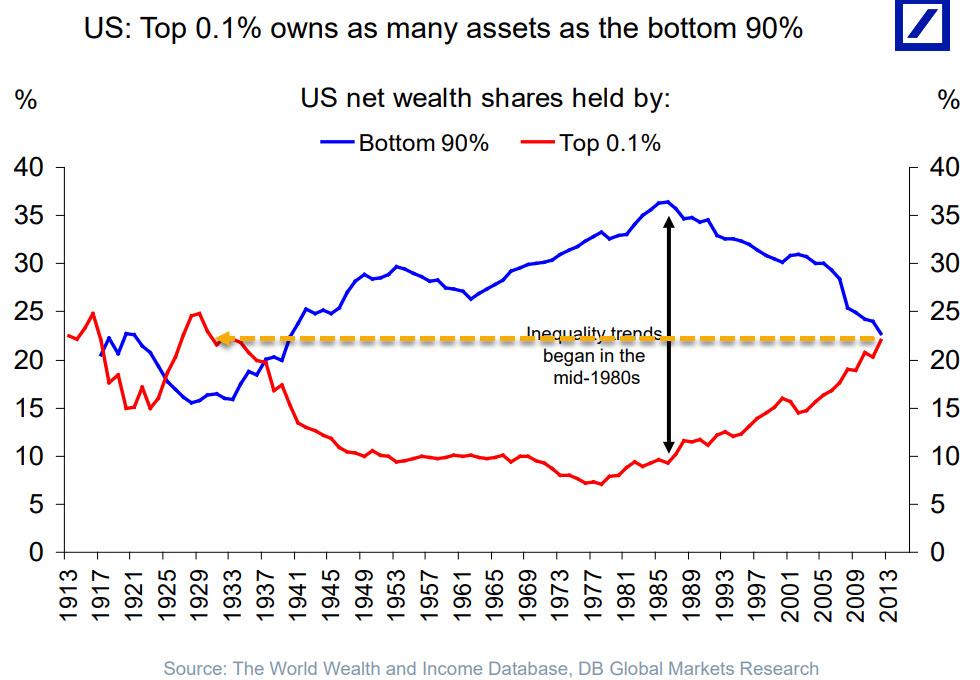

Six years later, one failed attempt at renormalizing interest rates including three recent rates cuts in the past four months and the Fed’s re-launch of “NOT QE”, the US economy is once again slowing despite the Trump administration’s massive fiscal stimulus with Q4 GDP now expected to print at below 0.5%, even as the rich have never been richer and according to the Fed’s own data, America’s richest 1% now own as much wealth as the middle and lower classes combined, and the 10% richest US household now control 70% of all wealth, up from 60% a decade ago.

In other words, Bernanke’s stated intention that somehow higher stock prices would “boost consumer wealth and help increase confidence, and spur spending” failed to materialize. What did happen is that the S&P is at an all time high as of this moment, printing at 3,130, and the rich have indeed never been richer.

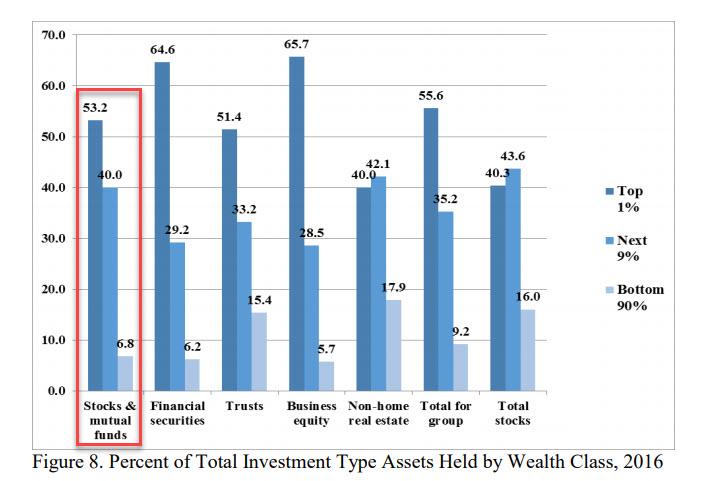

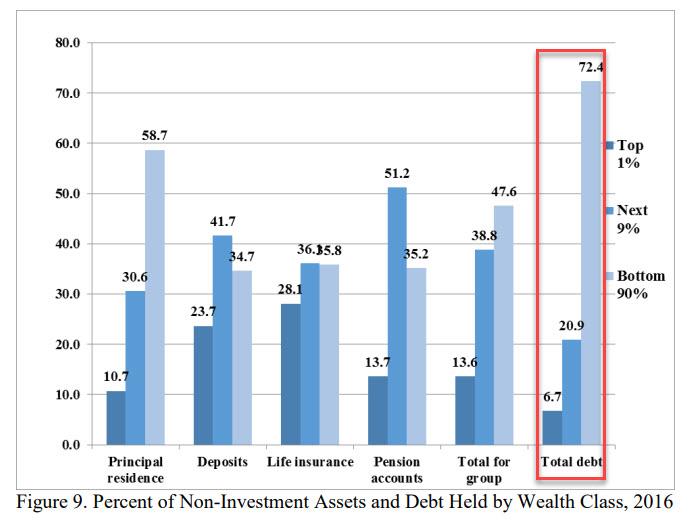

Why did the Fed’s decade-long attempt to trickle down wealth using the “asset price transmission mechanism” fail? The answer is the same as the one we proposed six years ago, and just so the Fed finally understands what is going on, here is the NBER’s explanation stated so simply, even Neel Kashkari can understand it:

THE RICH HAVE ASSETS – The top 10 percent of families as a group directly owned over 93% of all stock and mutual fund ownership…

… AND THE POOR HAVE DEBT – the “bottom 90%”, i.e., 90% of the entire US population, owns the vast majority of debt, some 72.4% of the total pile.

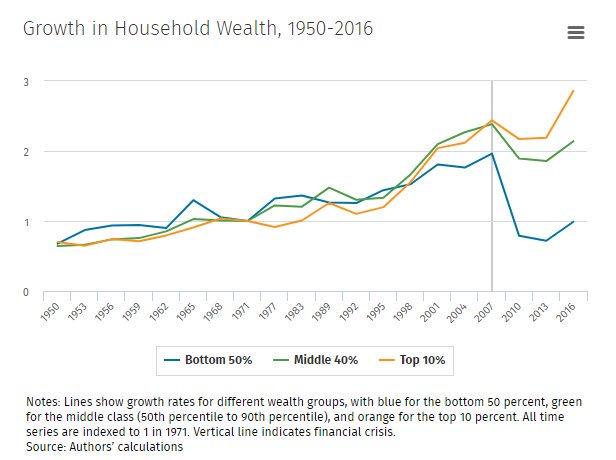

It’s also why as the top 1% have seen their wealth hit all time highs, America’s middle is currently as “rich” as it was at the start of the century, while the “wealth” of the bottom 50% is where it was back in the 1950s!

So the next time Trump delights in tweeting that the stock market has hit another record, as he has been doing in recent weeks, and just did again this morning…

Another new Stock Market Record. Enjoy!

— Donald J. Trump (@realDonaldTrump) November 25, 2019

… he should consider that he is only addressing the tiniest, and wealthiest, sliver of the American population. He should also consider that the last time the top 1% controlled this much wealth, the US was about to slide into the Great Depression, while France has a similar socio-economic distribution just around the time guillotines started being rolled out.

We point all this out because as we first noted last night, and as Rabobank picked up this morning, Fed’s Kashkari is now advocating for the Fed to openly be allowed to redistribute wealth as it sees fit, claiming that “monetary policy can play the kind of redistributing role once thought to be the preserve of elected officials.” Amusingly, as the bank’s Michael Every put it:

“Of course it can, and has: but that redistribution has been from the poor and middle-class to the rich, not the other way round!”

Sadly for the Fed, even the great unwashed masses have started to realize this, and needless to say just a “little more” wealth redistribution” from the poor and middle-class to the rich, and Trump or whoever is president at the time will soon be wondering if tweeting “let them eat cake” as the S&P prints new daily all time highs will help delay the next American revolution.

Tyler Durden

Mon, 11/25/2019 – 15:50

via ZeroHedge News https://ift.tt/37BwA3k Tyler Durden