VIXtermination Sends Stocks Surging Amid Massive Short-Squeeze

Everything’s going great…

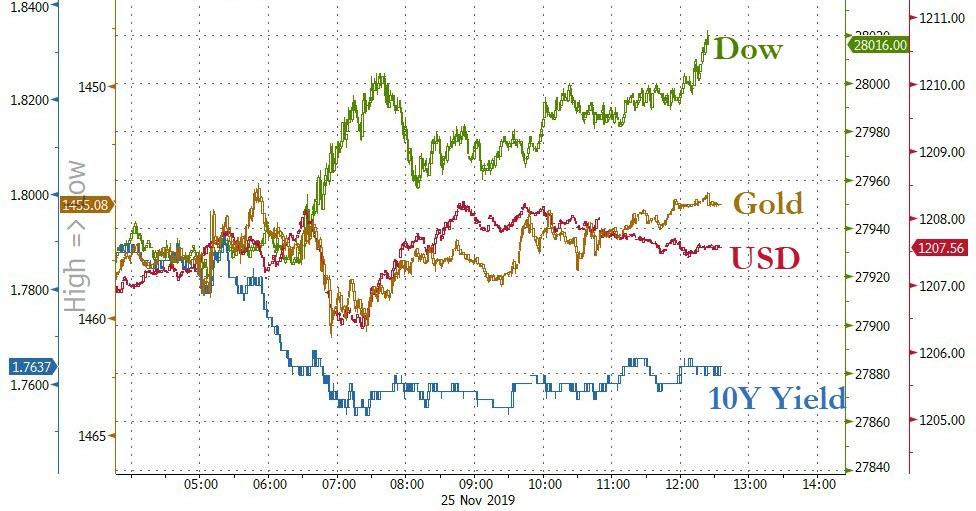

Stocks decoupled from bonds, gold, and the dollar today, melting up aggressively at the US cash market open…

Source: Bloomberg

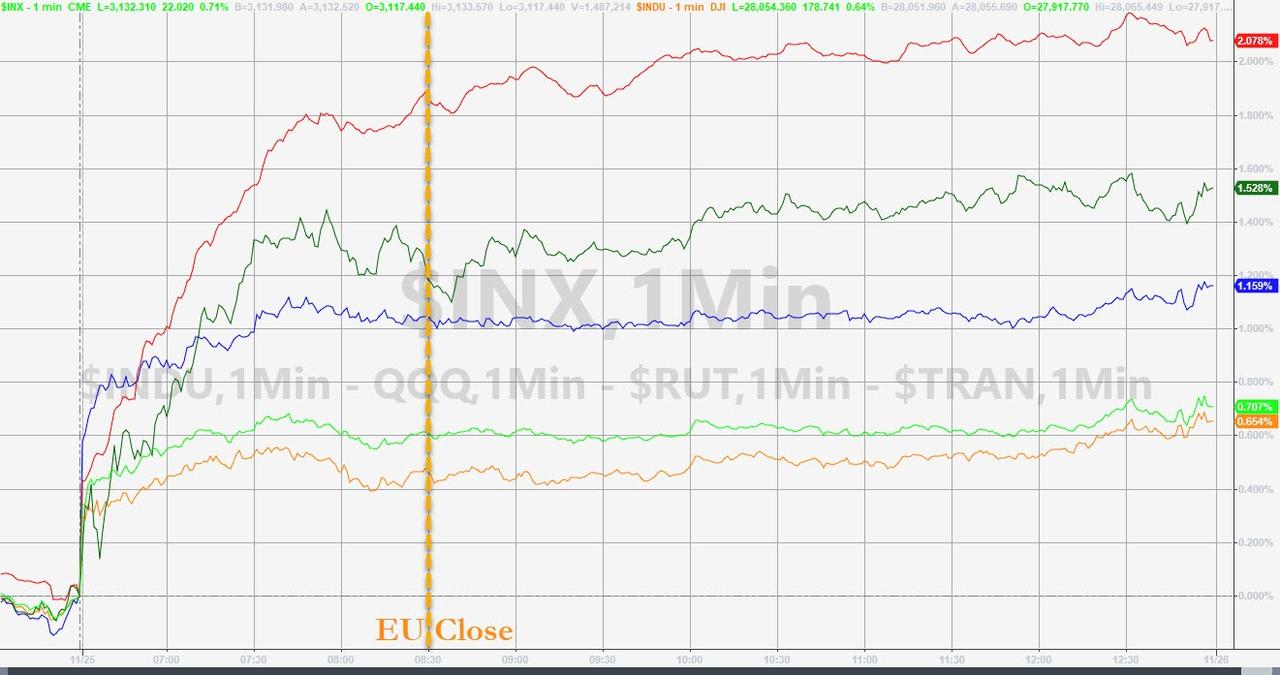

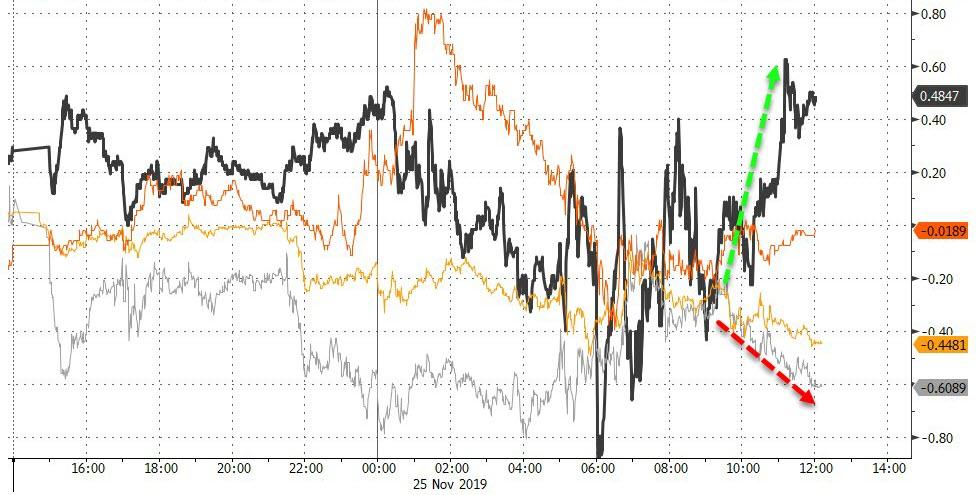

Thanks to the continuation of the biggest short-squeeze since early October…

Source: Bloomberg

Which sent Small Cap stocks exploding higher…NOTE – markets really went nowhere after Europe closed…

Source: Bloomberg

As Morgan Stanley warned – Smaller-capitalization companies could see a second full year of negative EPS growth.

Additionally, the Russell 2000 massively outperformed S&P SmallCap 600 massively today…

Source: Bloomberg

Dow futures algos were entirely focused on 28,000 today…

VIX was clubbed like a baby seal to the lowest since Oct 2018…

Treasury yields tumbled early and held the gains on the day…

Source: Bloomberg

The Dollar extended its rebound today, taking out last week’s highs…

Source: Bloomberg

Cryptos crashed overnight only to see a big bid back to almost even during the day session…

Source: Bloomberg

With Bitcoin battered down to $6500 intraday before a major bounce…

Source: Bloomberg

Commodities were chaotic today with oil higher and PMs lower…

Source: Bloomberg

WTI seems to have found a channel to play in ahead of the Aramco IPO…

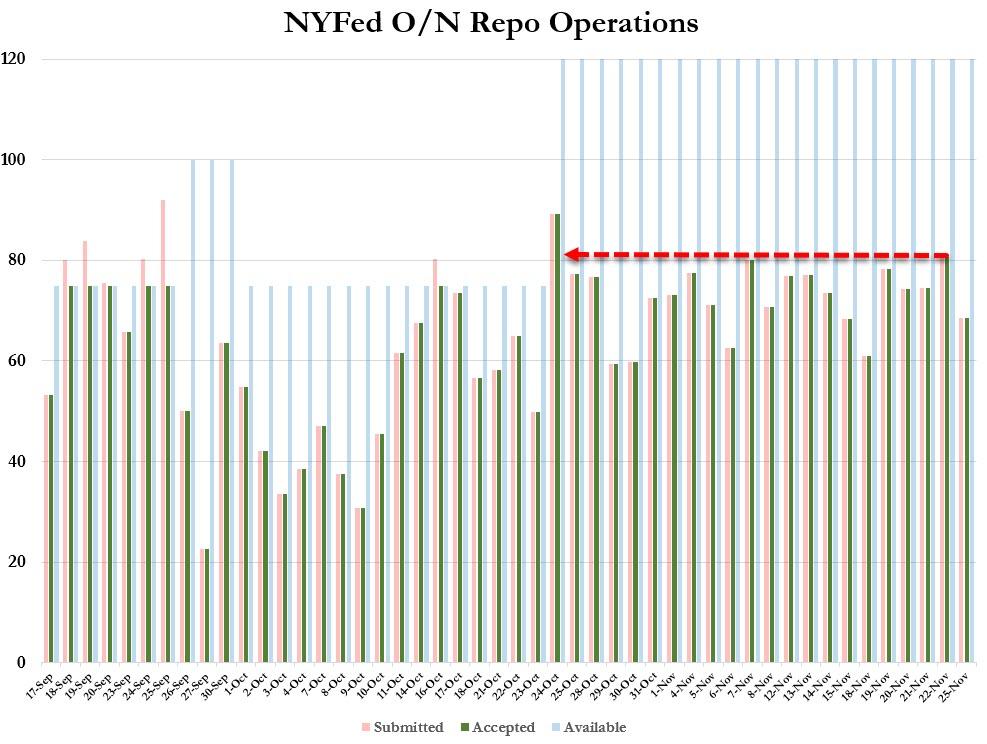

Finally, as Bloomberg reports, market participants submitted $49.05 billion in bids for the Fed’s 42-day term repo operation, which matures Jan. 6, 2020. That was more than the $25 billion on offer. This was the first of three term operations to provide funding past the year-end period. The others will be held in the coming weeks. Meanwhile, overnight repo demands remain anything but transitory…

All of which is a huge deal as global liquidity is starting to decelerate (just as it did in April)…

Source: Bloomberg

Tyler Durden

Mon, 11/25/2019 – 16:00

via ZeroHedge News https://ift.tt/37vm0uy Tyler Durden