Foreign Buyers Surge In Strong 7 Year Auction

Most desks may be quietly emptying ahead of the holiday but there was more than enough traders to gobble up today’s 7Y treasury auction.

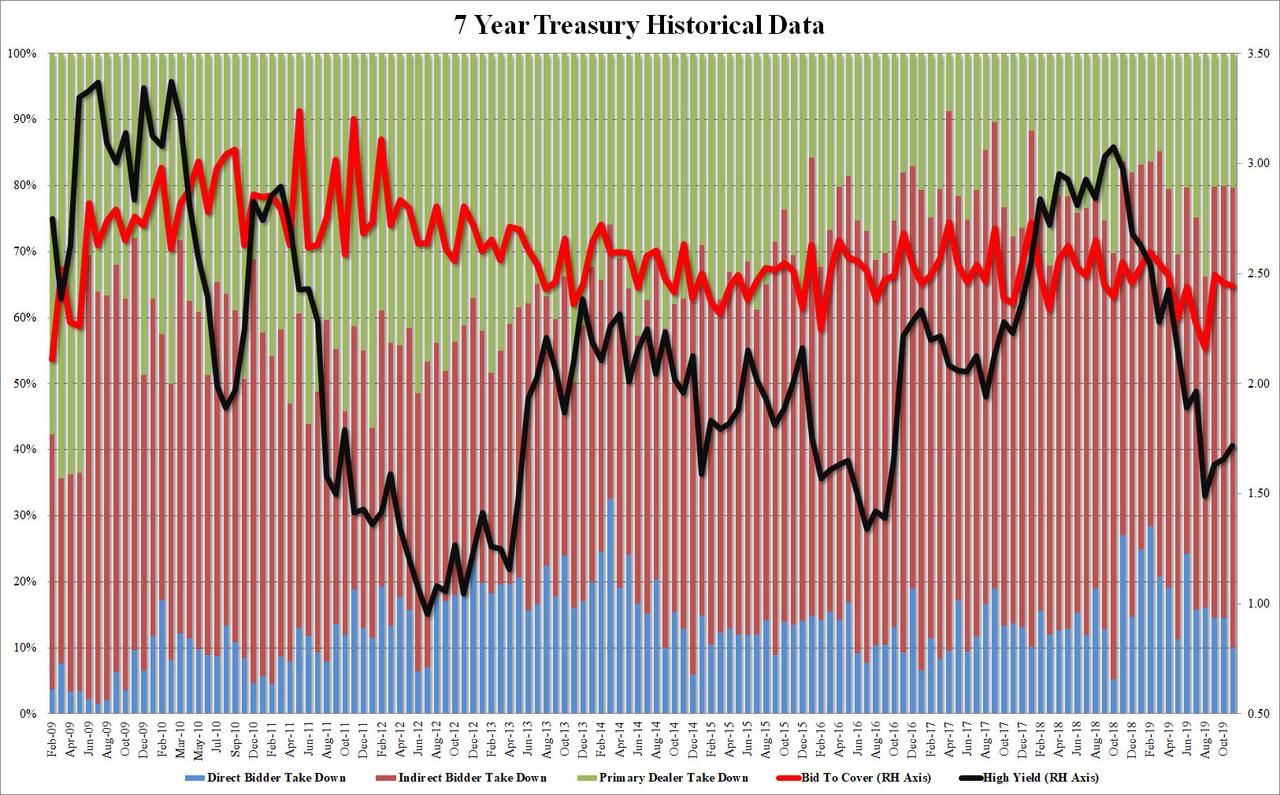

In the week’s last coupon auction which due to a truncated holiday schedule took place one day earlier than normal, the US Treasury sold $32 billion in 7 Year notes, which printed a t a high yield of 1.719%, right on the screws with the When Issued, and up from 1.657% in October. This was also the fourth consecutive month of rising 7Y auctton rates, although as recently as July, the 7Y stopped just shy of 2%.

The Bid to Cover of 2.442 was just above the six auction average of 2.35, and was just below last month’s 2.457.

The internals were most impressive, however, with Dealers taking down 20.3%, in line with last month’s 20.0%, and with Directs taking down just 10.1%, the lowest since October 2018, Indirects were left with 69.6%, the highest since January 2018.

The strong auction came as the 10Y yield jumped as much as 3bps earlier following the stronger than expected Q3 GDP and capital goods data; that said, the morning’s modest concession was enough to build up substantial demand for the paper, and 10Y rates dipped modestly after the impressive auction.

Tyler Durden

Wed, 11/27/2019 – 11:47

via ZeroHedge News https://ift.tt/35x9vNo Tyler Durden