As Ray Dalio Rises To Celebrity Status, Investors Ignore His Sub-Par Returns

Ray Dalio’s popularity is soaring: his most recent book sold over 2 million copies and it seems like nary a day goes by where he is not being talked about, quoted or appearing on television.

But strangely, the height of his popularity is happening at a time when the $40 billion Bridgewater Associates’ Pure Alpha II fund is posting what Bloomberg calls one of its “worst years on record”.

Could “Principles”, his 600 page manifesto that has been praised by celebrities like Bill Gates and Sean “Diddy” Combs, be due for some re-writes?

Or is the book’s PR success acting as cover for the underlying performance at Dalio’s fund?

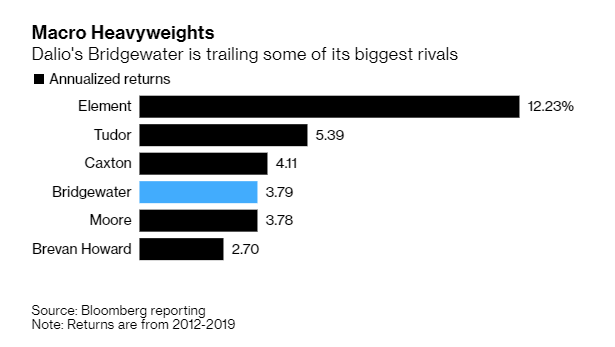

Dalio’s fund had peak returns of 45% in 2010 and 25% in 2011, but has struggled since then. His flagship fund returned an annualized 3.8% since the beginning of 2012, even with last year’s 15% gain. This lags other well known funds like Jeff Talpins’s Element Capital Management and Tudor Investment Corp.

Bridgewater has still racked up 11.4% annualized since its inception, and it is hardly the only fund to struggle with keeping up with the markets over the last decade, as other names have “found it hard to make big profits trading in their usual fare of government bonds, currencies, commodities and stock indexes.”

But the response to Dalio is different than to other funds. Brevan Howard Asset Management, for example, has seen its assets shrink from $40 billion in 2013 to $7.5 billion now.

But Bridgewater remains closed to new capital and actually has a $5 billion waiting list. Dalio’s reputation, the fund’s marketing and its customer service are often cited as reasons for its consistent popularity, despite its returns.

Dalio “has an aura akin to that of Warren Buffett or Bill Gross,” Bloomberg says, adding that his name has been mentioned more than 9,000 times in the media since his book has been published.

In addition to the outsized returns of yesteryear, Bridgewater’s company culture also gives it allure. The company is run from the woods of Connecticut and follows the 200 principles of Dalio’s best-selling book. The most well known of these principles is “radical transparency”, which demands all employees be brutally honest with one another. All of the firms meetings are taped and archived for future study.

John Culbertson, president and chief investment officer of Context Capital Partners, said: “Bridgewater has just become such an institutional name. It’s very hard to get fired for allocating capital to Bridgewater because of who they are and their reputation.”

Bridgewater now boasts $160 billion in assets across classes that include hedge funds and low-fee products. This number has stayed the same for most of the decade.

The company has about 200 people that oversee client relationships, which amounts to one per every 1.7 investors. The company also publishes daily thoughts about the markets or economies that “investment heads say helps them look smart when they appear before their boards.”

But its been this appearance of being smart that is helping the firm retain its clients, despite losses this year from bearish wagers on global interest rates.

And competing firms have posted far better returns this year so far, Bloomberg notes: “Element returned about 8.4% through October and Greg Coffey’s Kirkoswald Global Macro Fund climbed almost 29% in that period. Andrew Law’s Caxton Associates has jumped about 17%.”

That simply doesn’t matter for some people. Michael Rosen, chief investment officer for Angeles Investment Advisors, said: “I think Ray is a genius. What he built is extraordinary and I think his legacy is secure.”

Just this week, Bridgewater announced that Eileen Murray, co-chief executive officer was leaving and would be replaced by David McCormick. Five CEOs have held the position since Dalio ceded it in 2011.

Tyler Durden

Fri, 12/06/2019 – 16:45

via ZeroHedge News https://ift.tt/33Yssax Tyler Durden