Meet The Old School Fund Manager Who Wants To Be The First To Embrace Quantum Computing

Hedge fund manager Michael Hintze of CQS, based in London, is still a certain type of “old school”.

His firm makes its investment decisions based on daily meetings, where managers pitch their ideas and thoughts about macroeconomic events behind a podium. He also has a “situation room”, where TVs feature news networks like Al Jazeera and China’s CCTV, according to Bloomberg.

But nowadays that is considered archaic and behind the times, especially in the age of algorithms and high frequency trading.

And so Hintze looks as though he may be ready to embrace a switch, saying in a interview that his firm has now turned to “quantum computing” – a superfast technology that is still in labs, where major corporations like Google and IBM are still trying to figure it out.

Hintze said: “We’re trying to get a little bit ahead. You need to be mindful of the tools you have, the ground you’re fighting over, and, thirdly, who you’re fighting against.”

But he also dismissed plans to start a fund run by algorithms. Instead, he says that CQS is working with a startup to develop a quantum chip to help the firm optimize portfolios and execute hedging strategies. CQS recently hired Ahmad Deek, formerly of Oppenheimer, to be the firm’s head of data science.

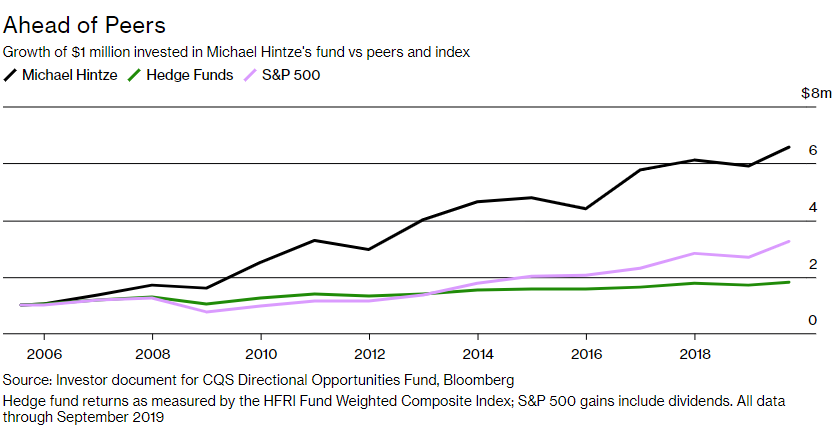

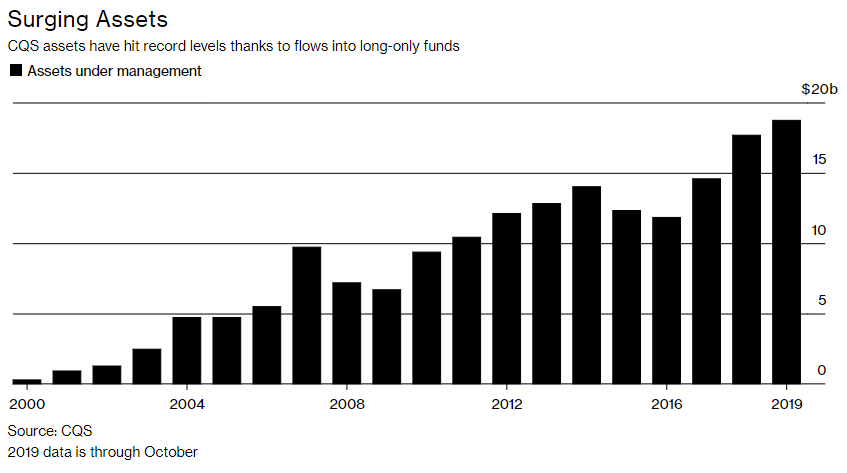

The firm has about $19 billion under management and so far, has done so just using traditional human analysts and managers. The company is one of the largest firms in Europe and its $3.1 billion multi-strategy CQS Directional Opportunities fund is up more than 550% since launching in August 2005. This is double the gain of the S&P 500 over the same time period and about 7x the average hedge fund return.

Hintze knows he faces upcoming challenges, too. Almost half of his firm’s assets are in long-only strategies and he has recently entertained approaches by at least one PE firm about buying a stake in CQS.

He also has to deal with an investor appetite that is stoked primarily for quant funds and low-cost passive funds. He has previously called this a “paradigm shift” that hurts active money managers. Hintze still says that, to get an edge, managers need to add context and deep analysis of world economics and politics.

Hintze said: “The reality is you need to have imagination. It is problem-solving. That’s where it is.”

David Morant, who left CQS in 2015 and was the company’s former head of equities, said he saw this approach first hand. Hintze would think about different ways to make bets, including options, credit bets and CDSs.

Morant said of his old boss: “He makes money in ways that no one else does or can. He effectively thinks in three dimensions.”

Three years ago, the firm brought in Neil Brown as a geopolitical strategist. Brown is a former commodore in the British navy and adviser to the U.K.’s prime minister’s office.

Hintze is focused on surrounding himself with people who make him better at what he does. In 2018, after a slew of executive departures, he brought in Xavier Rolet, the former CEO of London Stock Exchange, to be his CEO. The firm also goes against the herd “often”.

For example, Hintze loaded up on risk in late 2018 and early 2019 when the market dipped, helping contribute to his 10.6% returns so far in 2019, ahead of the 6.8% index average.

While Hintze’s firm waits for the quantum revolution, he seems content continuing his old school approach for the time being. And why not: if it isn’t broke, don’t fix it.

“I still have 20 years left in me,” he concluded.

Tyler Durden

Sun, 12/08/2019 – 13:30

via ZeroHedge News https://ift.tt/2LzjIRS Tyler Durden