Direct Bidders Soar To 5 Year High In Strong, Stopping-Through 3 Year Auction

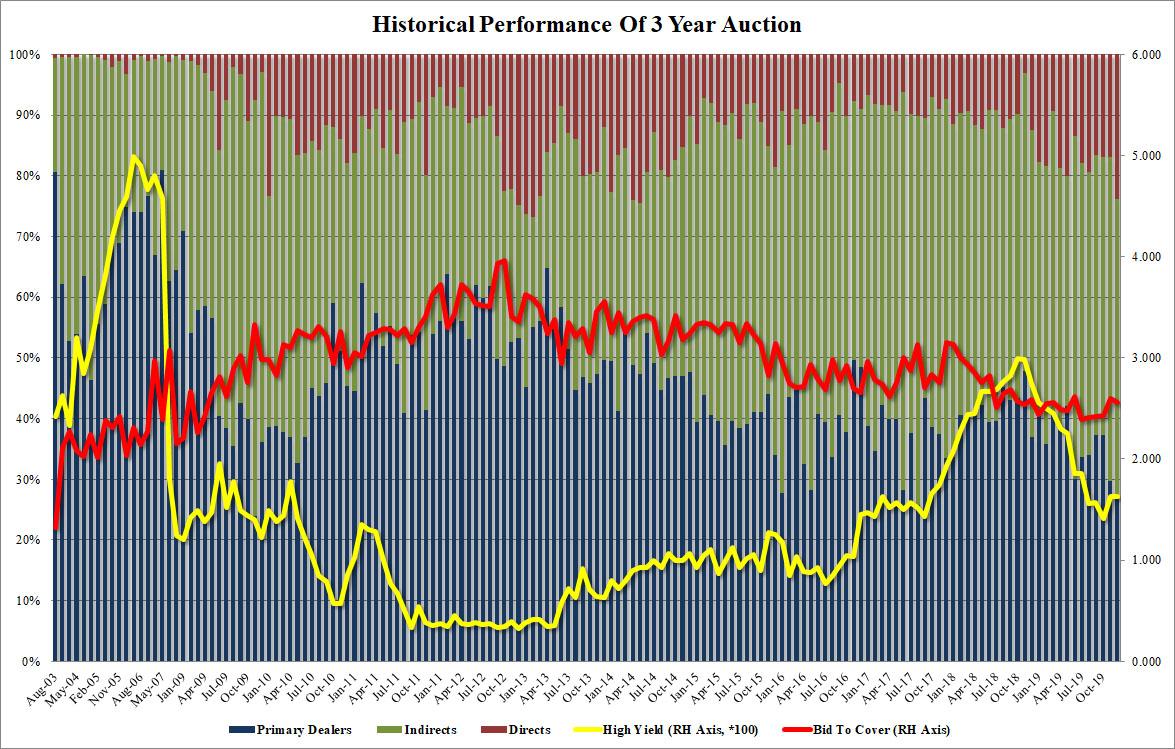

With bond yields spiking last Friday and the yield curve resuming its modest steepening, traders were interested to see if last week’s reflationary impulse would adversely affect today’s coupon auction. It did not, and moments ago the Treasury sold $38 billion in 3Y notes at a high yield of 1.632%, virtually unchanged from last month’s 1.630%, and 0.2bps through the 1.634% When Issued, benefiting from the recent curve cheapening following Friday’s Treasury rout.

The bid to cover was also virtually unchanged from last month, printing at 2.56, down fractionally from 2.60 last month but above the 2.477 six auction average.

The internals were mixed, with Indirects dipping slightly from 53.3% to 49.1%, right on top of the recent average, however more than offset by a surge in Directs orders, who took down 23.8%, up from 16.9% last month and the highest since May 2014. This left Dealers taking down just 27.1%, the lowest since August 2017; with expectations rising that the Fed will expand its T-bill monetization into 2Y and perhaps even 3Y coupons, we expect the Dealer take down to keep rising in coming months.

Overall, this was a solid auction, one which had no impact, either positive or negative on the second market, with the 10Y trading just around 1.825% before and after.

Tyler Durden

Mon, 12/09/2019 – 13:19

via ZeroHedge News https://ift.tt/346ApKI Tyler Durden